Client Newsletter – January 2015

As we end 2014 and look forward to 2015, the below is a rundown of events and news that shaped 2014. We also highlight our expectations for the year ahead.

International market developments

2014 can best be described as the year of volatility driven principally by geopolitical events in various corners of the world and actions by major central banks. Furthermore, mixed data on the state of the global economy combined with the spectacular collapse in the price of oil in the latter part of the year exacerbated the market volatility that hallmarks 2014. Indeed, at the half way point last year, we had commented that market volatility was expected to pick up as valuations in some instances in both equity and especially bond markets were high. However, notwithstanding the increased volatility that we witnessed, valuations, especially in bond markets, continued to build up and bond market performance has been nothing short of exceptional.

Apart from the US, most equity markets worldwide experienced negative to low single digit positive performances. In Europe, the UK FTSE100 declined by 2.7% during 2014, the French CAC40 shed 0.5% while Germany’s DAX30 gained 2.7%. On Wall Street, the Dow Jones Industrial Average and the S&P500 gained a much more respectable 7.5% and 11.4% respectively as US economic growth powered ahead relative to most European economies while the tech-heavy Nasdaq index achieved 13.4% growth.

On the bond side, the 10-year benchmark Eurozone yields slumped to all-time lows by the end of the year largely reflecting expectations that the European Central Bank would introduce a full blown quantitative easing programme to combat the weak economic performance across the Eurozone and the increasing threat of deflation. Although the ECB held back from launching such a programme in 2014, investors now feel that the ECB can no longer postpone this decision. This led to a substantial increase in bond prices which was also reflected across local fixed-income securities.

On the currency front, the Euro depreciated significantly against the US Dollar reflecting the outperformance of the North American economy as the aggressive monetary stimulus of the US Federal Reserve had the desired effect of bolstering economic activity. Similarly, the European economy was also lagging behind that of the UK with its central bank also pondering the start of an interest rate hike during 2015. As a result, the Euro ended 2014 12% lower against the US Dollar at fresh four and a half year lows of around USD1.21 and registered a 6.5% drop against the British Pound to two and a half year lows of circa GBP0.77,5.

Local market developments

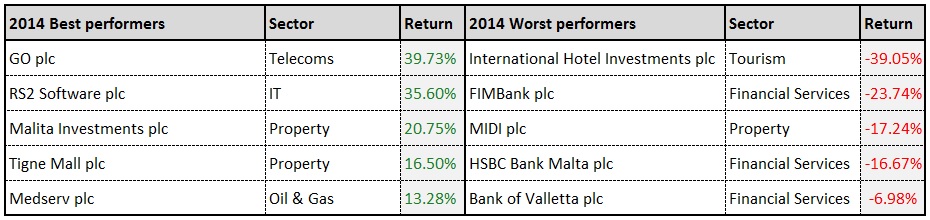

The domestic stock market performance as measured by the MSE Share Index was largely impacted by the negative performances of the large caps, primarily Bank of Valletta plc, HSBC Bank Malta plc and International Hotel Investments plc. The Index shed 9.6% during 2014 as these three companies accounting for 53.3% of the overall equity benchmark were among the worst performing shares during the year. In comparison, 15 companies out of the 22 listed entities comprising the Index, generated positive share price performances. However, given their relatively smaller size as measured by market capitalization compared to the banks and IHI, the impact on the Index was smaller and not sufficient to offset the heavyweights.

GO plc and RS2 Software plc led the list of best performers during 2014. GO plc shares gained an encouraging 39.7%, while RS2 Software plc shares rose 35.6% after a hugely impressive 2013 in which this company also ranked best performer. While the gains in GO plc were possibly fuelled to a certain extent by speculation of the company’s sale of its shareholding in the Greek company Forthnet SA to Vodafone and Wind Hellas as well as the realization of some of its property assets, RS2’s gains were principally derived from excellent operational performance and most importantly, a very healthy outlook. The attractive dividend payout to shareholders by Malita Investments plc and Tigne Mall plc pushed the respective equities up by 20.8% and 16.5% respectively – another very good return from companies which are principally regarded as dividend plays in view of the prevailing low interest rate environment. Oil and gas services operator Medserv plc followed in fifth place, gaining an overall 13.3% during 2014 also as its operational performance improved but principally on a strong outlook following the award of some very lucrative contracts.

Meanwhile, International Hotel Investments plc was the worst performer in 2014 as the share price declined by 39.1% largely as a result of political developments in Libya and Russia which are undoubtedly expected to impact the company’s operations in these countries. As a result of this share price drop, IHI lost its ranking as Malta’s third largest equity by market capitalisation to Malta International Airport plc – a steady performer in another excellent year for tourism.

Bank shares had a disappointing year, with the share prices of three banks featuring in the worst performers list. Banks are facing challenging conditions given the low interest rate environment coupled with a strong increase in deposits and low demand for loans. Moreover, regulatory challenges are also taking their toll with higher costs to comply with additional reporting obligations and pressure to increase impairment provisions. Moreover, a recent banking rule requires banks to reduce dividend payments to shareholders thereby retaining additional capital resources. This is resulting in lower returns on equity for banks with a corresponding drop in shareholder returns by way of dividends.

Despite the fact that the value of equity trades that took place during 2014 at €50.76 million was 4.4% lower than that in 2013, the market was still relatively liquid at the retail level. However, the shift to bond trading was clearly evident and activity in the corporate bond market increased by 29.4% to €43.2 million while trading in Malta Government Stocks increased by 23.2% to €836.4 million. The bond price increases of almost all corporate bonds and Malta Government Stocks were remarkable but reflective of international trends.

Outlook

We expected 2014 to be a more ‘normal’ year compared to 2013 and indeed, apart from the volatility which underscored most of the second half of the year, equity returns in 2014 were far more subdued. While our view last year remained a positive one for equities, we cannot avoid highlighting the exceptional performance of the bond markets and the strong returns generated by fixed income as an asset class. 2015 kicked off along the same lines and initial views for the coming year indicate that, at least for the first half of the year, this trend in the bond market is set to continue. However, investors should bear in mind that they ought to remain vigilant and not expect a repeat performance. 2014 is clearly an outlier in terms of bond market performance and there is a limit to how large an impact quantitative easing by the European Central Bank (i.e. injecting cash into the economy by buying government bonds) and lower interest rates will have on bond markets in 2015 although some international analysts have speculated on a further sharp decline in benchmark eurozone yields similar to what happened in Japan some years ago. However, a prolonged low interest rate environment is to be expected given very recent economic developments. Indeed, market observers are not forecasting European interest rate increases in the coming years while a leading UK bank indicated that rates will only start to rise in 2020.

From an equity perspective, share price movements will again be driven by company earnings and outlook. We expect some encouraging full year results being published by April 2015. However, some companies will announce earnings drops in view of amply documented challenges and circumstances that should not come as a surprise. Companies within the banking sector fall in this category. On the whole, we do not believe that the local equity market is overvalued and pockets of value indeed exist for the longer term, growth-oriented investors as well as for income-oriented investors seeking sustainable and relatively attractive dividend income. Since trading activity in some local equities is not always frequent, investors must be prepared to hold on to shares that ought to be re-rated at some point if the company delivers from an earnings perspective or other corporate actions materialise. Indeed, the most recent surprise announcement of International Hotel Investments plc agreeing to acquire Island Hotels Group Holdings plc led to a sudden rebound in the share price of Island Hotels to levels last seen very briefly in 2013. This development coupled with the voluntary bid for the entire issued share capital of Crimsonwing plc may indeed trigger a number of other similar actions in view of certain large shareholding patterns that are likely to change. Nonetheless, earnings remain the key driver of share price movements although we cannot exclude that the direction of share prices will also be impacted by such corporate actions or indeed other one-off announcements. Overall, we would still choose selected local equities over bonds both for income as well as for long-term capital growth potential.

In terms of new issues, we expect an interesting number of new corporate bonds in Malta very much in line with what was seen in 2014. Demand for fixed income remains very strong and well-priced bonds are expected to be met by strong support. From a Malta Government Stock perspective, although new issuance is expected to reach a total of €500 million spread over three or four issues throughout the year, retail investors ought to bear in mind that this amount is €150 million below the new issuance in each of the previous two years. The new MGS issuance for 2015 is therefore not high especially when one also takes into consideration the increasing demand for such securities from retail investors as well as from institutional investors. We therefore cannot exclude a scenario where retail investor allocation in Malta Government Stock will also start to suffer similar to what has now become customary in new corporate bonds.

Another potential interesting development hitting the headlines recently is the upcoming launch by the Malta Stock Exchange of PROSPECTS – a new market aimed at small and medium sized enterprises to gain access to alternative sources of financing. This development, although in its infancy, could eventually lead to a new domestic market for various bond and equity issues. It is indeed an interesting development that is set to continue helping the domestic capital market to grow further and provide added opportunities for investors.

Rizzo, Farrugia & Co. (Stockbrokers) Limited

20 January 2015

This document was prepared by Vincent E Rizzo, Director, Rizzo, Farrugia & Co. (Stockbrokers) Ltd (RFC), members of the Malta Stock Exchange and licensed to conduct Investment Services business by the Malta Financial Services Authority. This document has been prepared in accordance with legal requirements. It is intended solely for distribution to its clients. Any information in this document is based on data obtained from sources considered to be reliable, but no representations or guarantees are made by RFC with regard to the accuracy of the data. The opinions (if any) contained herein constitute our best judgement at this date and time and are subject to change without notice. This document is for information purposes only. It is not intended to be and should not be construed as an offer or solicitation to acquire or dispose of any of the securities or issues mentioned herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this document without first obtaining investment advice. The author and other relevant persons may not trade in the securities to which this report relates (other than executing unsolicited client orders) until such time as the recipients of this document have had a reasonable opportunity to act thereon. RFC accepts no responsibility or liability whatsoever for any expense, loss or damages arising out of, or in any way connected with, the use of all or any part of this document. RFC may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies therein mentioned. Past performance is not necessarily a guide to future returns. The value of investments and the income derived therefrom may fall as well as rise and investors may not get back the amount originally invested. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. No part of this document may be reproduced at any time without the prior consent of RFC. All intellectual property and other rights reserved.