A debate on the local capital market

Last week, I attended the half-day Capital Markets Conference organized by Camilleri Preziosi Advocates with the support of the Malta Stock Exchange.

One of the key note speeches was delivered by the former Chairman of Bank of Valletta plc Mr Roderick Chalmers who was always regarded as being a fantastic speaker. I am sure many financial analysts, like myself, who had the privilege of attending the presentations when he was chairing BOV, miss his semi-annual ‘lectures’, as I often described them.

His delivery at the Camilleri Preziosi conference was again enlightening, very well researched and provided some important considerations for debate.

Apart from giving a very clear explanation of the recent performance across global and European economies, he also touched upon Malta’s strong economic performance in 2015. Mr Chalmers then moved on to the regulatory environment and its impact on the local capital market.

At the end of 2014, the European Central Bank took over the responsibility for the supervision of 129 systematically important banks across the Eurozone, including Bank of Valletta plc, HSBC Bank Malta plc and Mediterranean Bank plc. Mr Chalmers touched upon three main decisions which he believes will have a direct bearing on the local capital market. I think it is worth highlighting these to the public at large due to the possible important repercussions for retail investors who may not be aware of these facts.

Firstly, Mr Chalmers pointed out that the ECB believes that many banks across the Eurozone remain undercapitalized and therefore it is determined to push banks to increase their Tier 1 capital levels. Many local investors should already be aware of this from comments by the current Chairman of BOV Mr John Cassar White. In their 2015 Annual Report, BOV had publicly stated that the Bank’s first priority is to strengthen its capital bases. Furthermore, in its latest interim results BOV confirmed that the Bank is planning to reduce the dividend payout ratio and raise new equity capital whilst de-risking its business model. Mr Chalmers believes that the ECB’s decision on bank’s capital requirements will also need to be implemented in Malta. The remark by Mr Chalmers could not only imply rights issues or new offerings by some of the banks already listed on the MSE but in my opinion, this could also mean that some of the banks not listed on the MSE may seek the public equity route as a means of increasing their capital base.

Secondly, the ECB wants to severe the link between governments and the banking sector. Mr Chalmers explained the reasoning of the ECB by mentioning the developments over recent years in Greece, Cyprus and Italy (where inappropriate government policies contaminated the banking sector through high holdings of domestic sovereign bonds) and also in the cases of Ireland, Portugal and the UK where trouble in the banking sector affected government finances.

The ECB is insisting that banks gradually reduce their holding of domestic government paper and Mr Chalmers indicated that a number of Eurozone countries are not accepting this proposal. In fact, Malta’s Minister of Finance was recently quoted as having said that: “Malta is completely against this idea of sovereign debt exposure, for the simple reason that Europe is seemingly aiming at creating problems where there have not even been during the worst of the financial crisis, and there aren’t today”.

This is especially important in the case of Malta since the banks are major holders of Malta Government Stocks and Mr Chalmers presented an interesting graph revealing that as a percentage of total assets, the holdings of MGS across the three systemically important banks in Malta (BOV, HSBC and Mediterranean Bank) represent a higher proportion compared to the EU average.

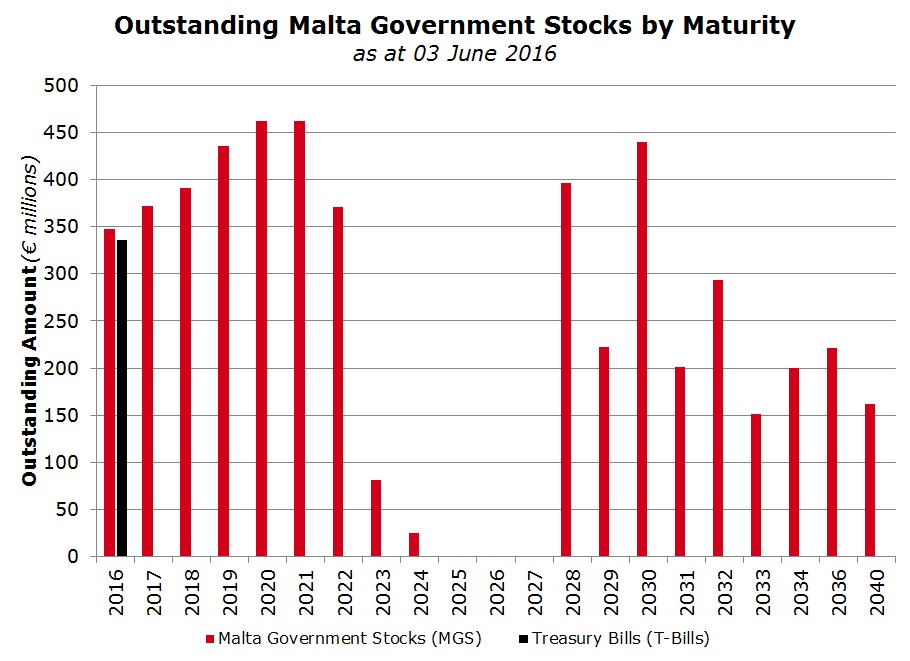

Mr Chalmers then made reference to the dynamics of the local MGS market and the strong level of support shown by retail investors as well as financial institutions to any of the various MGS offerings placed on the market on an annual basis. In my view, he correctly questioned whether demand from retail investors will continue to be sufficiently robust to absorb all the new issuance in the next couple of years if the ECB insists on not allowing banks to subscribe in a material manner. The graph published today shows that over the next 6 years, MGS redemptions will amount to over €2.84 billion. This could be a major challenge for the Treasury of Malta to ensure that new MGS issuance in the future is also met with strong demand. One must also not forget that apart from refinancing the maturing bonds in issue, the Treasury must also finance the budget deficit on an annual basis unless the Government can manage to move into a surplus situation. However, given present circumstances, this can only happen a few years down the road.

Mr Chalmers also debated whether in view of these possible dynamics, the Treasury may, for the first time, consider seeking international investor demand for new MGS issuance. This has been indirectly happening in a small manner in recent years and in fact recent statistics indicate that 8.8% of total MGS is presently held by foreign institutions. The present Governor of the Central Bank of Malta has publicly aired his views on this matter in recent years and was deliberating seeking support from middle eastern sovereign wealth funds. In my view, the fact that retail investors and local financial institutions have been the largest takers of MGS was positive both for the banks and the country in general as this insulated the MGS market from the severe volatility that was experienced by other sovereign bond markets since the international financial crisis. As such, this should only be considered once there is concrete evidence that the local banks will be forced to implement the ECB decision.

The third regulatory decision mentioned by Mr Chalmers relates to lending to the property market where the ECB appears to be insisting that banks reduce their exposure to property development since they believe that this is one of the major factors that caused the most damage to banks internationally during the recent crisis.

Mr Chalmers explained that historically in Malta, the banks have been the main providers of finance to the property sector. He argued that if increased pressure is placed on the banks to limit future financing to property development projects, then such developers will be forced to seek alternative methods of finance also involving the capital markets.

This is where increased vigilance is required in the words of Mr Chalmers. He argued that when developers ask for bank funding, apart from the initial assessment and due-diligence by the banks, annual reviews are also carried out which helps instill a degree of discipline and control on the borrowers. On the other hand, Mr Chalmers said that the bond market is less demanding and “little control or oversight is imposed on the borrower following the initial prospectus”. While I agree with this comparison, it is also fair to say that the recent policies for borrowers to publish a Financial Analysis Summary on an annual basis is a step in the right direction and helps analysts and investors understand a company’s performance from one year to the next as well as their projections for the current financial year.

The concluding remarks on the property sector were also an eye-opener where he referred to the cases where some developers who are unwilling to go to the bond market “are resorting to unorthodox schemes for the raising of finance”.

In the current environment of very low interest rates, which Mr Chalmers also believes will remain so for a while longer, retail investors are invariably taking on greater risk in order to ensure that they obtain a higher rate of interest when compared to traditional bank deposits. While this is a natural development all across the world, this is where in my view, there needs to be greater responsibility on the part of financial services practitioners to try to educate investors on a continuous basis. This is one of my main objectives for my weekly contributions in the press and why I felt it was important to ask the kind permission of Mr Chalmers to replicate the views he presented at last week’s conference for the benefit of the wider investor audience.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.