Is MaltaPost in need of additional capital resources?

On 9 December, MaltaPost plc published its financial statements for the year ended 30 September 2014 and the Directors recommended that during the forthcoming Annual General Meeting being held on 16 January 2015, shareholders approve an unchanged net dividend of €0.04 per share. Moreover, similar to previous years, shareholders will have the option to receive the dividend either in cash or by the issue of new shares at the attribution price of €1.16 per share.

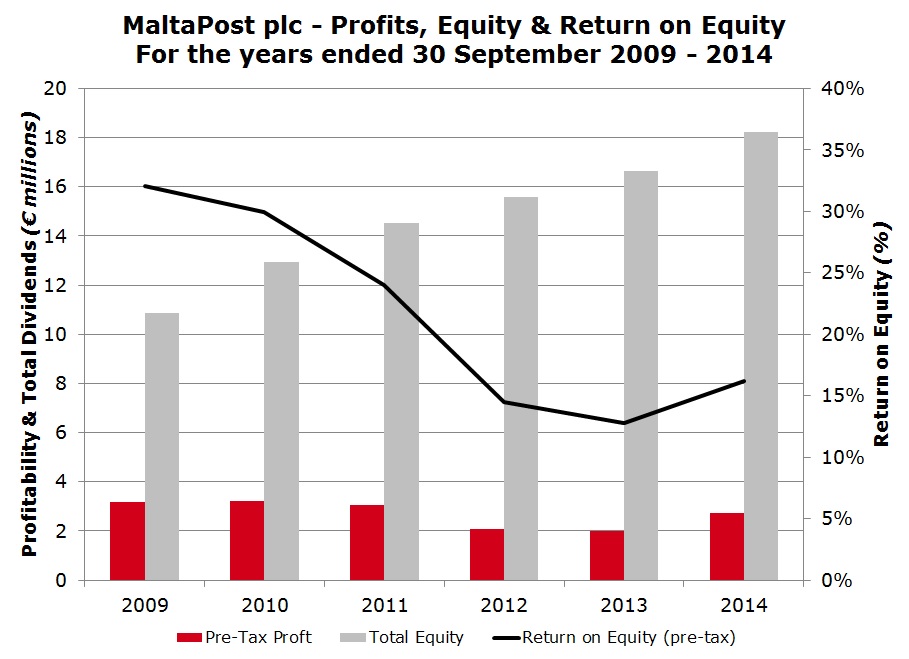

In previous years, there was a very high take-up of new shares as opposed to a cash dividend, primarily due to the shareholding structure of MaltaPost with Lombard Bank owning a stake in excess of 65%. This implies that the company actually only paid a very low cash dividend on a yearly basis and retained further capital resources. In fact, despite a high dividend payout ratio assuming a cash dividend to all shareholders, total shareholder funds of MaltaPost grew from €10.9 million in September 2009 to €18.2 million in September 2014.

Scrip dividends are normally used by companies which require additional capital resources to fund ongoing investment programmes. Moreover, some of the most common users of scrip dividends are banks that are typically in constant need of additional capital to sustain a growing loan book and also in view of changing regulatory requirements.

The balance sheet of MaltaPost is rather ‘peculiar’ with no bank borrowings or debt financing, and with high levels of cash (although some are held on behalf of third parties such as the utility companies on whose behalf money is collected from customers) as well as available-for-sale financial assets totaling €3.3 million. Given this balance sheet structure, the need for a continued scrip dividend by the company is questionable. From the communications by MaltaPost via the customary company announcements, the market is not aware of any immediate capital expenditure requirements by the company. Moreover, if the company aims to purchase certain property assets, wouldn’t it be more advantageous for shareholders that MaltaPost slightly leverages its strong balance sheet and takes on some bank borrowings to fund such an acquisition given the current low interest rate environment?

“Given this balance sheet structure, the need for a continued scrip dividend by the company is questionable.”

Some years ago MaltaPost had actually borrowed €4 million to partly fund the acquisition of certain key properties and this borrowing had been repaid by the company within a short period of time given its positive cash flow generation.

The cash flow statement for the last financial year shows that MaltaPost acquired €1.9 million in property, plant and equipment and purchased financial assets for a value of €0.6 million during the year. Given the decision by the Directors to opt for another scrip dividend, at the next Annual General Meeting shareholders would be pleased to learn about the company’s capital expenditure requirements and why debt financing is not being considered as a financing option.

The take-up of shares as opposed to a cash dividend on an annual basis by Lombard Bank, as the majority shareholder, with some of the other investors opting for a cash dividend implies that Lombard’s stake is gradually increasing over the years once the new shares are allotted. MaltaPost had announced on 25 October 2012 that its largest shareholder, Redbox Limited (a fully owned subsidiary of Lombard Bank) intended to increase its stake in the postal operator from the level of 67.72% at the time to not more than 74.5%. The announcement failed to disclose the way in which the majority shareholder intends to increase its shareholding, i.e. via purchases of shares on the secondary market or via the periodical scrip dividend allotments. The shareholding has only increased to 69.2% by November 2013 (the latest information available). This indicates how difficult it has been to achieve its objective through the acquisition of shares from current shareholders via the Malta Stock Exchange. In fact, due to the company’s shareholding structure with over 2,000 shareholders having very small stakes, it has not been easy for Lombard to increase its equity stake. The scrip dividend method could therefore be considered as the most viable solution to achieve Lombard’s objective which was officially announced more than two years ago.

The scrip dividend decision should also be analysed in the light of its impact on the company’s financial ratios, most notably the return on equity which is a widely used indicator by financial analysts worldwide to gauge a company’s performance. Although the post-tax return on equity improved to 10.6% during the last financial year to 30 September 2014 compared to 8.3% the previous year, this must be viewed over a longer-term period. In fact, the post-tax return on equity in 2009 and 2010 was just below the 20% level which is a very attractive return for the company’s shareholders. The reason for the decline in the ratio was twofold, namely a decline in profits from circa €2.0 million in 2009 and 2010 to €1.8 million in 2014 coupled with an increase in the company’s equity base from €13 million in 2010 to €18.2 million in 2014. This ratio shows that the company did not manage to employ the extra capital in a similarly profitable way for the benefit of all shareholders.

The 2014 financial statements published last week show a rebound in profits following two disappointing years when profits had dropped following the adverse impact arising from the higher regulatory-induced costs related to cross border mail which were not recovered from higher postage rates. The increase in certain postage tariffs which came into force in November 2012 followed by other changes in April 2013 and again in January 2014 are now having a positive impact although profits are still below the record levels achieved in 2009 and 2010. In this respect, MaltaPost warned that “the high fixed cost base of the Universal Service Obligation needs to be re-evaluated so as to ensure its long-term sustainability”. In December 2013, the Malta Communications Authority had concluded that no further changes in universal service tariffs would be required before financial year 2016. Given this recent statement by the Directors, investors should be informed whether MaltaPost is making any representations to bring forward any further hikes in postage rates in order to mitigate the higher costs being incurred.

In last week’s announcement, MaltaPost also confirmed that its strategy “remains focused on securing a reasonable share of the growing parcels market, while enhancing and consolidating a diversified portfolio of services to counter the irreversible decline in letter mail volumes”. The Company’s portfolio of services expanded in recent years with the introduction of document management, invoice processing and printing, the mail forwarding service which offers delivery from the UK to Malta branded ‘Send On’ and other ancillary services. In the financial services sphere, on 30 September 2014 MaltaPost launched the ‘Posta Pay & Save’ in conjunction with Lombard Bank. This is an interest-bearing account with a passbook allowing customers to receive funds and deposit cheques as well as to make payments or withdraw money. Customers can visit a post office and pay bills (such as water and electricity, telephony, internet and TV) and also purchase stamps and merchandise without the need of carrying any cash. During the Annual General Meeting MaltaPost shareholders would also be pleased to hear whether this long-awaited product was well received by the market and how positively this is likely to impact the company’s financial performance in the coming years.

"The Company’s portfolio of services expanded in recent years..."

MaltaPost had also intended to enter the insurance sector but in December 2013, the company very unexpectedly announced that its aim of securing an agreement for its new subsidiary to act as an insurance agent of Middlesea Insurance plc will no longer be pursued any further. Despite this setback, MaltaPost claimed at the time that it still intends to provide insurance-related services and the company stated that further announcements will be made at the appropriate time. However, over the past 12 months, no further mention was made of any developments in this respect. The shareholders of MaltaPost ought to be adequately informed of whether the company still intends to pursue its plans or whether these have been abandoned altogether.

MaltaPost’s Annual General Meeting being held on 16 January provides the right forum for the Company’s executives to provide shareholders with details on any capital expenditure plans, the funding options being considered and the strategic initiatives being taken by the Company to help profits recover back to their record levels of some years ago.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.