A trillion-dollar apple

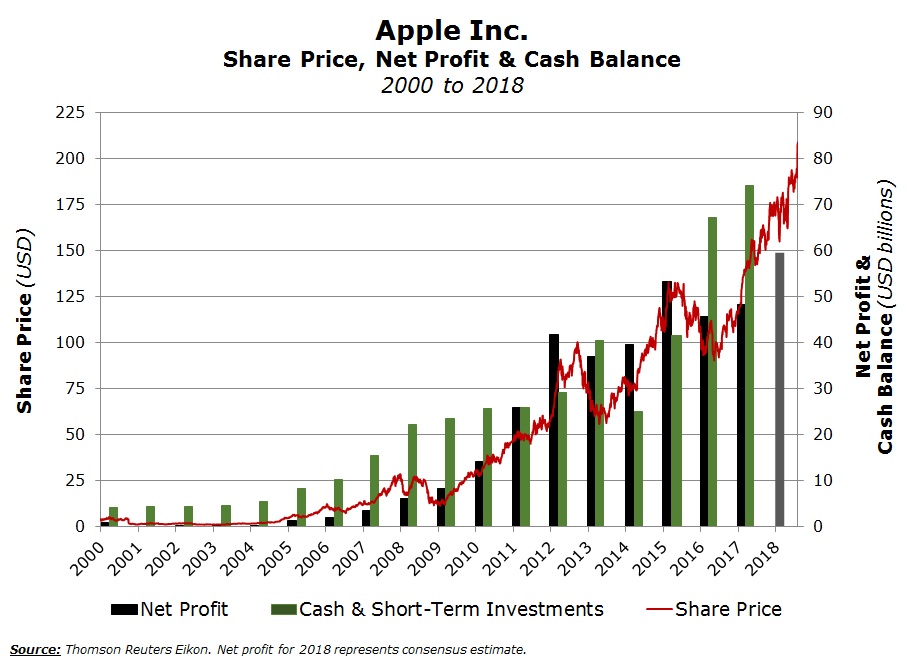

On various occasions in recent weeks, Apple Inc. grabbed the major international headlines across financial markets. On 31 July, it reported strong quarterly revenues and profits that exceeded expectations. On the following day, the company’s share price surged by nearly 6% to close at the USD201.50 level after briefly recording a new all-time high of USD201.76. Then, on 2 August, Apple finally managed to surpass the USD1 trillion in market value – a feat that no other publicly listed company in the world has ever managed to achieve so far. Since then, Apple’s share price continued to advance and in fact on 20 August the equity momentarily traded at a new record high of USD219.18.

Apple’s journey to the USD1 trillion valuation has been nothing short of spectacular. Indeed, it is worth noting that at the start of the current bull market in US equities in March 2009, Apple’s market capitalisation stood at just under USD77 billion. The surge to today’s levels represents a compound annual growth rate of 36%. In comparison, although all three major indices in the US registered remarkable growth over the past nine and a half years, their gains were relatively more modest as both the S&P 500 and the Dow Jones Industrial Average added circa 16% per annum since 9 March 2009 whilst the surge in the tech-heavy Nasdaq 100 translates into an increase of 23% per annum.

Amid this background, however, it is also worth highlighting that as such, a trillion-dollar market valuation may not mean anything to the investment merits of any company. For instance, the potential flotation of Saudi Aramco could well value the Saudi Arabian national petroleum and gas company at over USD1 trillion if this were to happen. Accordingly, although the level of capital growth registered by Apple’s equity in the past few years is indeed extraordinary, what is more important is the identification of the traits that made Apple so unique and valuable today.

When Apple was founded in April 1976, the technology sector already had its undisputed leaders. Just as today we have the group of companies that are collectively referred to by the acronym “FAANG” (namely Facebook, Apple, Amazon, Netflix and Google), at those times Microsoft, IBM, Xerox, Commodore and Atari were regarded as the dominating tech giants. However, Apple’s founders, namely Steve Jobs, Steve Wozniak and Ronald Wayne, believed that they can offer something that is intrinsically different, innovative, creative and desirable but still generating lucrative margins. The “Apple I” and “Apple II” personal computers were introduced within a span of two years between 1976 and 1977, followed by the overpriced and underpowered “Apple Lisa” in early 1983 which although came with floppy drives and a graphical user interface, was not well received by the market.

As the world was embracing itself to the age of “PC Revolution”, Steve Jobs persisted in his belief that despite the disappointing sales of “Apple Lisa”, the company had further inroads to make. For this reason, in April 1983 he engaged PepsiCo President John Sculley as CEO of Apple in order to improve the company’s mass-marketability. Under his reign, Apple went from strength to strength through the rest of the decade. This achievement came on the back of the popularity of the various “Macintosh” products despite an internal rift between Steve Jobs with the rest of the company’s Board of Directors (including the CEO) which ultimately forced Steve Jobs to leave Apple in September 1985.

The 1990’s were particularly challenging for Apple as the competitive landscape became much tougher with Dell, HP and Epson taking on substantial market share on the back of their respective edge on product pricing compared to Apple. Apple launched “PowerBook” in October 1991 which was one of the first portable computers to resemble today’s laptop. Subsequent products however, such as “Newton” (a personal digital assistant) and “Pippin” (a gaming console) simply did not take off. Multiple product offerings had the opposite effect of confusing customers rather than generating profitable sales, triggering the replacement of John Sculley as CEO in June 1993.

As Apple’s profitability continued to suffer, in December 1996 the company decided to acquire NeXT – a company owned by Steve Jobs. This move proved to be decisive for Apple’s future prospects. However, despite having Steve Jobs back within Apple, the company had a more pressing challenge – that of averting bankruptcy which was only prevented through a lifeline investment of USD150 million by Microsoft in Apple which took place in August 1997. As Steve Jobs became CEO in September 1997, he drove the company towards simplifying its product line-up and also rolled out a strategy suitable for the “Internet Age”. The latter also included the sale of Apple products online.

In May 1998, Apple unveiled its first “i” – the “iMac”. This revolutionary internet-connected desktop computer positioned the company as a truly consumer-technology giant, paving the way for the introduction of several other generational “i’s” – namely the “iBook” (July 1999), the “iPod” (October 2001), the “iTunes Music Store” (April 2003), the “iPhone” (January 2007) and the “iPad” (January 2010). In the interim, and despite his various health complications, Steve Jobs strengthened Apple’s status by opening several retail stores across the world (the first one was inaugurated in 2001) and also concluded a number of key acquisitions of software companies.

In June 2011, Steve Jobs made his last product announcement – the “iCloud” – which essentially allows various Apple products to synch with each other. It was the “Internet Age” welcoming the new age of “the Internet of things”, drifting Apple to a more focused shift to technology-related services and artificial intelligence rather than mainly the manufacture of hardware. The company also had to adapt itself to demise of its long-time leader and mentor Steve Jobs on 5 October 2011, as well as repair the severe reputational damage done by the embarrassing launch of “Apple Maps” that forced Apple’s CEO Tim Cook to issue a letter of apology to customers in September 2012.

Apple also faced other considerable challenges in recent years, mainly growing competition from the likes of Samsung, Huawei and HTC in the all-important mobile segment as well as from Google and Amazon in the field of artificial intelligence. Furthermore, on various occasions, Apple had to deal with major supply-chain disruptions (the company assembles most of its products in China), implement an overhaul of its stores globally as well as come out with “post-Jobs” innovations like the “Apple Watch” and “Apple Pay” (September 2014) and “Apple Music” (June 2015).

Although today’s USD1 trillion market valuation is indeed extraordinary, more importantly one has to analyse the valuation multiples. One of the most commonly used valuation multiples in finance is the price to earnings (“p/e”) ratio. This compares a company’s share price with the profitability generated by every share in issue (namely the earnings per share). In this respect, even if Apple’s current p/e ratio of around 19 times is not low, it is on the other hand below that of the Nasdaq 100 at 25 times and of the next three largest US tech giants by market capitalisation – namely Amazon (over 170 times), Alphabet (Google’s parent company with a p/e of 33 times) and Microsoft (28 times).

Apple’s historic achievement is a reflection of its unique characteristics and revolutionary concepts. The company’s profitability is indeed unparalleled (Apple posted a net profit of over USD48 billion in 2017, followed by Berkshire Hathaway Inc. at nearly USD45 billion) and it has an extraordinary cash-rich balance sheet (the company’s cash pile stood at almost USD71 billion as at 30 June 2018). Moreover, the company has a distinctive approach to doing business that is highly disciplined, its blockbuster products and services are upheld by the world’s most recognisable logo whilst its customers are endlessly loyal.

Although nobody can predict what lies ahead for Apple, it is pretty safe to say today that it is likely that the company will continue dominating headlines for years to come. While the USD1 trillion market valuation may be considered to be merely an important milestone, Apple is most importantly an outstanding case study of value creation for all companies to mirror.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.