The Hal Mann Vella Bond Issue

Financial market participants had long been aware that the Hal Mann Vella Group was among a number of new issuers seeking to tap the bond market.

On 8 October, the company issued a formal notice confirming the publication of a prospectus for €30 million in secured bonds following approval by the Malta Financial Services Authority two days earlier.

The first thing that one questions when a company offers bonds for subscription is the purpose of the fund raising exercise. In this case, the Hal Mann Vella Group will be (i) refinancing €13.7 million in bank loans; (ii) financing the modernisation of the Hal Mann Vella factory at a cost of €5 million; and (iii) financing the construction of a mixed-use development earmarked for lease to third parties which is expected to cost €7 million. The remaining balance of €3.6 million will be used for general corporate funding purposes.

The origins of the Hal Mann Vella Group date back to 1954 when brothers Vincent and Nazzareno Vella started producing Terazzo tiles. Over the years, the Group expanded its operations and has established itself as one of the leading family run tile manufacturers in Malta. The Issuer is the parent company of a Group which is still predominantly involved in the manufacturing of tiles and pre-cast elements, importation of marble, granite and natural stone as well as tendering for real-estate related projects both in Malta and internationally. After the two founders split up in 2004, Vincent Vella and his children (who together are the owners of the Hal Mann Vella Group in its present form) began to diversify and today the Group is involved in ‘Property Development & Letting’, ‘Fashion Retail’ and ‘Hospitality’.

“In view of the timing of the contributions from the new investments, management ought to have published projections beyond the required minimum established by the Listing Policies to validate their claims. “

Although the Group’s operations are split into four main divisions, the Hal Mann Vella Group is still predominantly involved in the manufacturing of tiles and general contracting services. This division generates 80% of overall Group revenues and is strongly linked with the level of activity in the local construction industry and dependent on the number of contracts completed during the year. Unfortunately, the Prospectus and the Financial Analysis Summary do not provide the profit contributions of each of the divisions. Management claims that the profit contribution from the core business was significantly stronger prior to 2008 when construction in Malta was at a peak and the Group was actively engaged in a number of overseas projects. Given the weak financial performance with Group EBITDA only ranging between €1 million and €1.3 million, one would have expected that the documents published by the company included historical financial statements for a longer number of years to gauge the higher profitability at times of improved economic conditions. In the recent bond issue of Mariner Finance plc, the Financial Analysis Summary included the 10-year track record of the Baltic terminal which helped analysts gauge the limited impact from the financial crisis and the strong rate of profitability growth over the years. The Hal Mann Vella Group ought to have published similar statistics on the performance of their core division to prove to the market the Group’s ability to generate higher profits.

One of the reasons for the bond issue is to finance the €5 million investment in the modernisation of the factory in Lija to increase capacity and achieve cost efficiencies in order to spearhead the Group’s future growth. The Directors claim that the renovated factory will lead to improved margins and enable the Group to once again venture into overseas markets. Although historically the Group successfully secured and completed some projects in the UK, on the basis of the information made available we are unable to gauge the number of projects required in order to have an optimum utilisation rate of its newly refurbished factory as well as assess the Group’s ability to compete for such projects on an international scale.

This modernisation project is expected to be completed in the fourth quarter of 2015 and as such the impact is not visible in the projections for 2015 as presented in the Financial Analysis Summary annexed to the Prospectus. However, management have clarified that they are anticipating additional revenue of €400,000 per annum shortly after completion (and rising during the lifetime of the bond) and cost savings of over €100,000 per annum. The various large property projects being planned locally should be a natural target market for the Group although from the financial statements of the last three years, some of the projects completed did not seem to lead to attractive profit margins. Once again additional information and forward guidance would have helped to gauge the merits of such assumptions.

The future profitability growth of the Hal Mann Vella Group is also centred around the planned mixed-use property development project situated in Lija. The development, comprising office space, warehouse facilities and parking, is expected to start generating income from 2017 when the initial leasing contracts are projected to come into effect. The Issuer expects to generate €0.9 million in annual rental income at full occupancy in the years ahead although the Financial Analysis Summary does not indicate the profit contribution from this investment. The development comprises 9,300 square metres of office space and the company’s projections are based on a considerably lower rental rate per square metre compared to other developments in Sliema, St Julian’s as well as the SkyParks Business Centre.This seems to be justifiable given that the location is not as sought-after as those indicated. Although the demand for quality office space in Malta is currently strong and is expected to be sustained given the evolving nature of the local economy, the Hal Mann Vella Group will be competing against a number of upcoming developments mostly in more desirable locations. Also worth taking into consideration is the planned construction of a large shopping village across the road by another investor (PG Holdings Limited which is independent of the Issuer) and the impact this may have on the new development of Hal Mann Vella. The shopping village is said to eventually host retail outlets and from media reports it transpires that it will not have any area dedicated to office facilities. As such, while the new development of Hal Mann Vella will compete with the shopping village for the small retail space available for rent, it will not be in competition for office rental and actually the transformation of the area from such a development is likely to complement the Hal Mann Vella development and attract potential tenants to this part of the island.

The Hal Mann Vella Group is also active in the fashion retail industry (via three GUESS outlets and one outlet of Brooks Brothers) as well as in the hospitality sector with two properties in Bugibba. The contribution from both divisions to the overall Group performance is still a minor one and is likely to remain immaterial over the coming years.

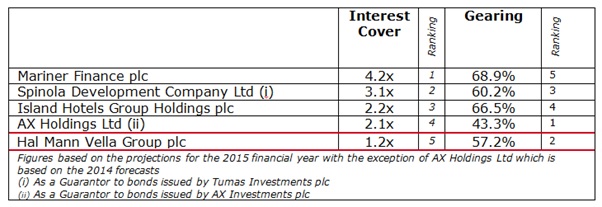

Based on the financial projections published in the Prospectus, the Group is expected to have an interest cover of only 1.2 times in 2015 which is the weakest compared to a number of the recent bond issuers on the local market. Meanwhile, the gearing ratio is expected to rise to above 55% by 2015 as a result of the additional borrowings. However, it is worth pointing out that the gearing ratio of Hal Mann Vella is more favourable than that of a number of companies such as Island Hotels Group Holdings plc, Mariner Finance plc and Tumas Investments plc which all have higher levels of leverage. Although the ratios of Hal Mann Vella might strengthen beyond 2015 in line with the Directors’ expectations of improved revenue and earnings mainly from the core business and the new commercial property development, we are unable to gauge the extent of this anticipated improvement given that the contributions from these investments commence as from 2016 and the forward guidance provided by the Group in the Prospectus covers only until 2015 in line with the Listing Policies. In view of the timing of the contributions from the new investments, management ought to have published projections beyond the required minimum established by the Listing Policies to validate their claims.

Notwithstanding the limited financial projections available to calculate the interest cover during normalised operations, investors may be comforted by the security granted to bondholders. The Group is granting a first-ranking special hypothec on a number of properties owned by the Group and one of the subsidiaries Sudvel Ltd (as guarantor to the bond issue) as well as a first-ranking general hypothec over all other assets of the Group.

Following this bond issue, a further two new issuers are expected to tap the bond market next month. Unfortunately, retail investors will not be able to participate in the next MGS issues taking place next week since the Treasury has structured these in the form of an auction with a minimum tender of €250,000.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.