The implications of negative interest rates

Last week’s main event across international financial markets was the monetary policy meeting of the European Central Bank (ECB) held on Thursday.

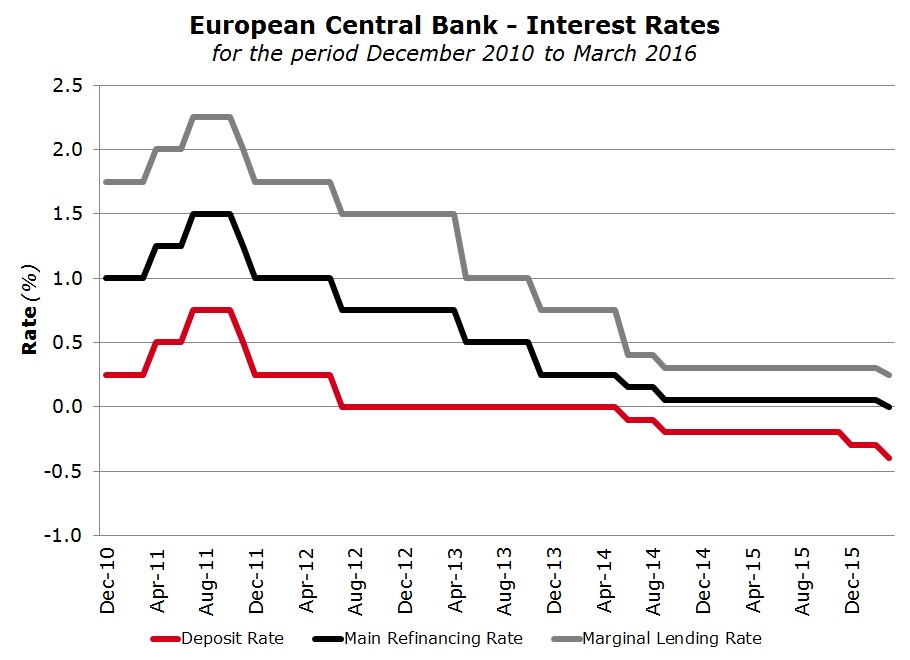

Following the continued evidence of the weak economic data and persistently low inflation, the ECB reduced its deposit rate from -0.3% to -0.4% as was widely anticipated. Moreover, contrary to popular expectations, the ECB also announced a reduction in its refinancing rate (the interest charged on loans to banks) from +0.05% to zero. The other measures introduced by the ECB at the March 10th monetary policy meeting included an increase in the quantitative easing (QE) programme by €20 billion to €80 billion per month as from April 2016 with an extension to investment grade non-financial corporate bonds as well as a series of four targeted longer-term refinancing operations (TLTRO II) starting in June 2016 with a maturity of four years each. The loans to banks under the TLTRO II programme could potentially be provided at rates as low as -0.4%, implying that in effect the ECB would be willing to pay banks to borrow money to issue new loans to individuals and companies thereby supporting the tepid economic recovery.

The anticipated decline of the ECB’s deposit rate further into negative territory was widely covered in the international media over recent weeks as many European bankers voiced their concerns on the dangers of negative interest rates in relation to the profitability of banks as the negative rates are very unlikely to be passed on to ordinary depositors. Analysts at the US investment bank Morgan Stanley predict that a 10 basis point decline in the deposit rate could knock-off 5% of Eurozone bank profits over a 12-month period.

Some senior European bankers were quoted in various media articles explaining that a further cut in the deposit rate “could encourage financial bubbles, hurt economic growth and create social disparity by penalizing savers”. Others mentioned that excessively low rates could prompt banks to take on too many risky loans due to the damaging impact from the deposit base.

The hardest hit banks will be those that earn a high proportion of their overall revenue from net interest income as opposed to non-interest income as well as those banks that have ample levels of liquidity. This is very much the case across the Maltese banking sector. The recent financial statements of the three retail banks listed on the Malta Stock Exchange indicate the low loan to deposit ratio across the sector. Although HSBC Bank Malta plc is ‘best in class’ in this category with a loan to deposit ratio of 66.4%, the senior management team indicated at a recent press conference that the idle liquidity needs to be deployed in a profitable manner. In essence, placements with the Central Bank of Malta or the ECB are surely not profitable given the negative interest rates being charged. The situation at Bank of Valletta plc and Lombard Bank Malta plc is much worse in this respect as both banks have a loan to deposit ratio of below 50% implying exorbitant levels of idle funds seeking positive returns.

With respect to the dependency on net interest income, although during the last financial year, all three local retail banks improved the overall net interest income following a decline in interest expenses paid to depositors, there is a natural floor in this respect. Interest rates on deposits at retail banks cannot be reduced much further and especially as a result of the further decline in the ECB deposit rate, the banks need to resort to growing their loan book in a sizeable manner in order to register higher levels of net interest income.

A media article in the international press last week indicated that Professor Richard Werner from Southampton University, who invented the term QE, argues that the ECB’s policies are likely to lead to severe issues among several of the thousands of German savings and cooperative banks who account for 70% of German deposits and 90% of loans to small and medium sized firms. Prof Werner remarked that these ordinary banks are being punished in favour of banks that make their money from asset bubbles and speculation.

Although a negative interest rate policy is a first for the ECB, other central banks have resorted to these extreme measures over recent years such as the Danish National Bank, the Swedish Riksbank, and the Swiss National Bank. Interest rates in Denmark, for example, first turned negative in 2012 and some banks had to resort to imposing fees on a certain category of depositors (corporate clients as opposed to retail savers).

It is highly debatable whether Maltese banks will also impose similar measures in the future. However, given the ever increasing level of deposits flowing in despite the near zero rates at local banks, if such fees are not imposed on the larger corporate customers as a minimum, the profitability levels of the banks can be negatively hit unless the level of loans increases in a significant manner. The various large scale projects being contemplated across the Maltese islands could be a blessing in disguise and should assist the banks in improving their loan to deposit ratio.

Nonetheless, as recently argued by the CEO of a prominent Danish bank, negative rates could in essence be counter-productive as banks may consider increasing loan rates to compensate for the money they are losing on deposits.

While the negative interest rate environment is particularly worrying for the banking sector, it is equally of concern to the investing community. As I explained in my article “The search for yield continues” published two weeks ago, the options for investors are diminishing as yields have declined substantially over recent years.

Although the low interest rate scenario is here to stay for several more years, investors must also take account of the increased price risk when investing in financial markets especially in the current environment. The wide volatility across most asset classes last Thursday afternoon was a very important eye-opener for investors.

As the ECB announced the new measures being enacted, Eurozone bond yields initially declined rapidly (bond prices improved), the euro weakened to its lowest level since early February and equity markets gained. During the press conference convened after the ECB meeting, the President Mr Mario Draghi explained that while rates would stay low for “an extended period of time”, the ECB did not anticipate taking them deeper into negative territory in the present circumstances, partly because of the impact on banks. Mr Draghi also reiterated his call for governments to act in order to support the actions of the ECB.

Markets immediately reacted in an opposite manner as the ECB chief’s comments were interpreted in a manner that the deposit facility was at a floor of -0.4% and as such the ECB exhausted its policy options which may prove to be problematic against renewed economic shocks or instability across the financial system.

After the euro initially dropped to its lowest level since early February against the US Dollar at USD1.0828, it subsequently climbed by 3.6% to USD1.1217. Likewise, equity markets moved deeply into negative territory for the day reversing the sudden gains in the immediate aftermath of the ECB announcement. However, the most dramatic events took place in the Eurozone bond markets.

The yield on the benchmark 10-year German Bund started off the day at 0.25% and dropped to 0.16% (implying a strong upward movement in bond prices) as the ECB announcement was issued. However, during the press conference by Mr Draghi, yields more than doubled to the 0.33% level in a matter of just two hours resulting in a sharp sell-off across bond markets. The yields in other Eurozone bond markets also moved in a similar spectacular fashion on Thursday afternoon.

Since the Malta Government Stock market mirrors the movements in Eurozone bond markets, investors in Malta’s sovereign debt would have experienced dramatic volatility (initial gains followed by steep reversals) had our market been operative on Thursday afternoon. However, as markets calmed on Friday morning and yields edged back towards the levels of Thursday morning, the Malta sovereign bond market was largely unaffected by the aforementioned events as the MGS prices of the Central Bank of Malta were only marginally lower on Friday.

In any case, the sensitive reaction to monetary expectations which was very much in evidence last Thursday should be an eye-opener for the many retail investors who seem unperturbed by price volatility risks when investing in long-term fixed interest rate securities.

Although low interest rates can be considered a ‘new way of life’, any indication of a slight change in monetary policy may lead to wide movements in bonds, currencies as well as equities. This should be taken into consideration by investors who may be taking excessive risks which do not fit within their risk profile in order to achieve a higher rate of return.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.