Understanding movements in MGS prices

Almost a year ago, on 14 May 2015, I had published an article entitled “Why have MGS prices suddenly dropped?”, to explain to retail investors the rationale for the sharp drop in Malta Government Stock (MGS) prices between the first half of April 2015 and mid-May 2015.

During that 3 to 4-week period, medium and long-term MGS prices had suffered steep declines of between 600 basis points and 800 basis points following the extraordinary rise over the previous 16 months to record levels between 9 April and 16 April 2015.

In the article of 14 May 2015, I had mentioned that prices and yields of MGS mirror movements in the benchmark German bund and those of other periphery countries with similar ratings to those of Malta (BBB+). Our assumption remains that MGS prices are based on a basket composed of German Bunds and periphery bonds. One of the major credit rating agencies, Standard & Poors, classifies three Eurozone countries within the ‘BBB’ ratings category, namely, Malta (BBB+ Positive); Spain (BBB+ Stable); and Italy (BBB- Stable). As such, our view is that the basket used by the Central Bank of Malta to determine MGS prices on a daily basis is indeed composed of the German bund and the sovereign bonds of Spain and Italy.

This may be compared to the basket of currencies that used to make up the value of the Malta Lira. Prior to the pegging of the Malta Lira to the euro as from May 2005 ahead of the adoption of the euro in 2008, the daily value of the Malta Lira was composed of the EURO (70%), GBP (20%) and USD (10%).

As such, movements in prices and yields of government bonds of Germany, Spain and Italy determine the changes in MGS prices on a daily basis. Hence, movements in bond prices and corresponding yields may be very erratic from one day to the next.

Generally, movements in bond markets follow from statements and decisions by the major central banks (especially the ECB in the case of the Eurozone including Malta) and the publication of economic data including inflation readings. The data on inflation has become particularly important over recent months since this determines the likelihood of the ECB introducing additional stimulus measures or otherwise.

The primary objective of the ECB’s monetary policy is to maintain price stability. The ECB aims at inflation rates of below, but close to, 2% over the medium term.

Investors must accept the fact that since Malta joined the euro, our sovereign bond market is more aligned to the dynamics of the eurozone markets. Bond markets may indeed fluctuate rapidly from one period to the next and this was especially evident during the course of 2015 and the first few months of this year. In view of the extreme monetary stimulus measures being adopted by the European Central Bank, there is an increased degree of daily volatility in European bond markets including for Malta Government Stocks.

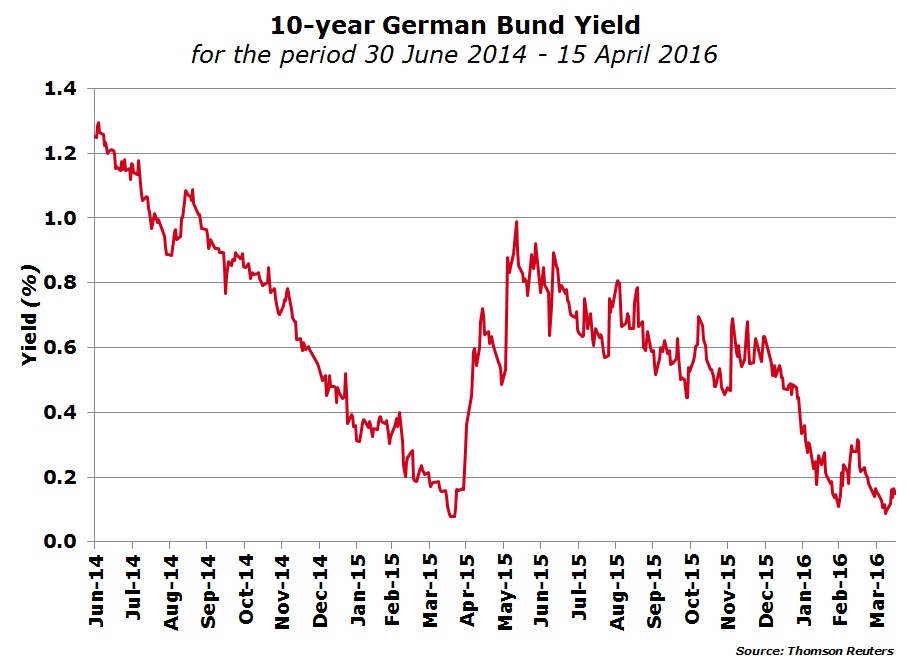

In fact, in recent weeks, the 10-year German bund yield dropped below a level of 0.10% or 10 basis points for the first time since the first half of 2015. The 10-year German bund yield had reached a low of 0.05% on 17 April 2015 but rallied strongly to almost 1% in June 2015 before subsequently retreating to end 2015 at around the 0.55% level.

Yields continued to decline at the start of 2016 on increased speculation of extended easing measures by the ECB. On 10th March 2016, the ECB announced various measures to combat continued weak economic data and low inflation. The deposit rate was reduced from -0.3% to -0.4% and contrary to popular expectations, the ECB also announced a reduction in its refinancing rate from +0.05% to zero. The other measures introduced by the ECB included an increase in the quantitative easing (QE) programme by €20 billion to €80 billion per month as from April 2016 coupled with an extension to investment grade non-financial corporate bonds as well as a series of four targeted longer-term refinancing operations (TLTRO II) starting in June 2016 with a maturity of four years each.

These various measures coupled with a downward revision in euro GDP growth and continued deflationary concerns saw yields drop to 0.088% on 7th April 2016.

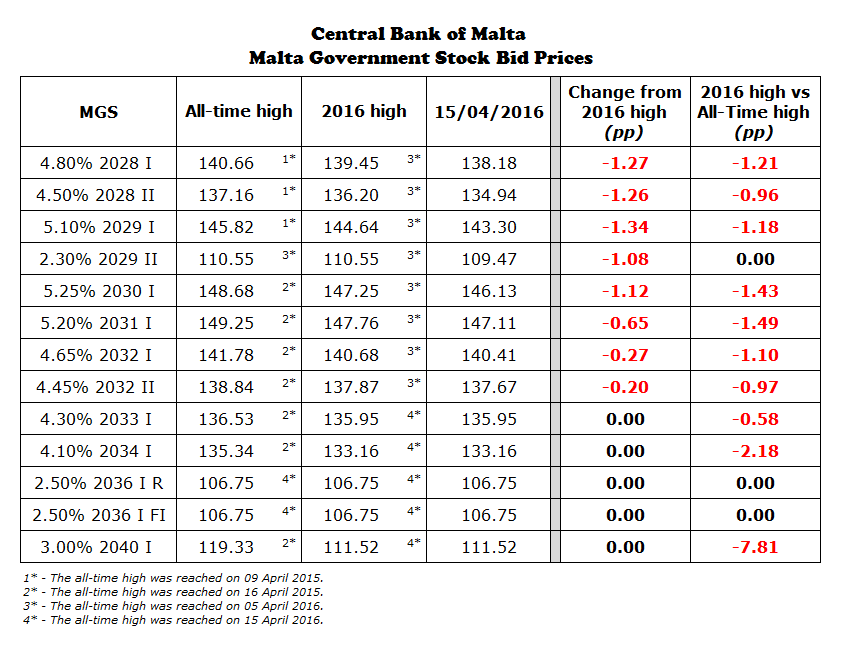

Following the decline in yields, some retail investors have questioned why the prices of some of the MGS’s that had already been in issue last year are still below the record prices registered last year.

The table shows a comparison of the record prices reached last year to those seen in recent weeks. As an example, the 3% MGS 2040 had traded up to a high of 119.33% in April 2015 and dropped to 103.34% in early July 2015 before rising back to over 111% last week. Despite the sharp upturn over recent months, the price of the 3% MGS 2040 is still 781 basis points below last year’s high. This is one of the examples that is confusing quite a number of local investors.

The pricing differences for some of the other medium and long-term bonds is not as large. For example, the 4.65% MGS 2032 had traded up to a high of 141.78% and after dropping to 127.77% by 13 July 2015, it recovered to 140%.

Since many retail investors have large exposures to MGS and the market mainly revolves around the indicative bid prices quoted by the Central Bank of Malta on a daily basis, investors need to understand the main criteria that determine MGS prices. As such, it would be helpful if the Central Bank provides additional information on the methodology used for the determinantion of prices on a daily basis.

Does the Central Bank follow a basket similar to what had been the case at the time of the Malta Lira? Has the composition of the basket changed over recent months? In other words, has an increased weighting been attributed to the periphery nations or vice versa?

The movements in Eurozone yields and MGS prices last week again may have confused many of the retail investors who try to understand such changes on a daily basis. Despite the upturn in Eurozone bond yields to a high of 0.18% for the 10-year German Bund (representing a doubling of the yield over the previous week), the prices of many of the longer-term MGS’s climbed to fresh 2016 highs on Thursday 14 April.

The recovery in yields was possibly due to upbeat German inflationary data. In fact, fresh data showed that German consumer prices rose by 0.8% in March from the previous month and by 0.1% over the corresponding period last year. Inflationary data for the eurozone was revised upwards, taking the single currency out of deflation territory for March 2016 following a decline of 0.2% in February. In fact, consumer prices were confirmed to be unchanged in March on a year-on-year basis, compared to the initial estimate of -0.1%.

Due to the inverse relationship between yields and bond prices, one would have expected MGS prices to also move in tandem with Eurozone bonds and decline as a result of the rally in yields. On the other hand, however, MGS prices edged higher at a time of rising yields across the Eurozone.

Some important lessons should be learnt from the volatility in the bond markets since the start of 2015. Nothwithstanding that recent statements from the European Central Bank clearly indicate that official interest rates will not be rising in the foreseeable future, yields across the eurozone bond markets change rapidly from one day to the next. As such, bond prices are determined by yields (which in turn reflect inflationary expectations, etc) and not by movements in official interest rates. In other words, investors need to understand that it does not necessarly follow that MGS prices will retain these record levels until the QE programme comes to an end and eventually official interest rates also start to edge higher in the years ahead. As was evident in recent months, yields may rise (bond prices may drop) well in advance of an upward movement in official interest rates.

Further clarity from the Central Bank of Malta in respect of the criteria behind the calculation of MGS prices would be welcome to ensure that market operators can provide proper explanations to retail investors. A more educated investor base is especially important to deal with the situation when yields again start to rise from these exceptionally low levels ahead of the end of the QE programme in the coming years and local investors will then be faced with the first real bear market for bonds too.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.