A co-ordinated strategy for Malta’s capital markets

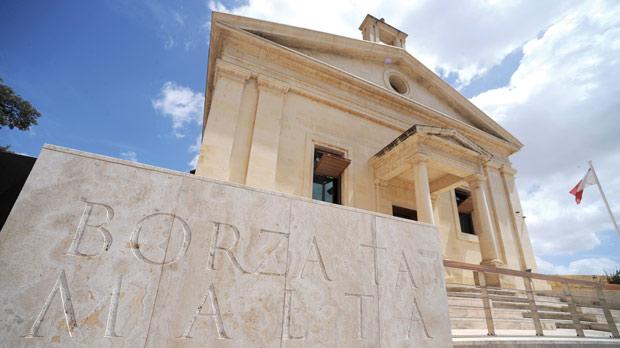

On 27 October, the Chairman of the Malta Stock Exchange Mr Joseph Portelli launched the National Capital Markets Strategic Plan. The MSE is proposing a number of initiatives as part of its overall long-term strategy to develop a liquid and efficient securities market for the benefit of issuers as well as investors.

The various stakeholders invited to the launch, namely member stockbrokers of the MSE, accountants, lawyers, fund services providers and other professionals, are being requested to provide feedback by mid-December. The final strategic plan being formulated by the MSE will be formally launched by mid-January 2017.

A few days before the launch of the Strategic Plan, the Minister of Finance presented a number of fiscal initiatives in the 2017 Budget Speech.

In my view, one of the most important initiatives which will likely be very effective in attracting companies to list their equity on the Official List is the re-introduction of the tax exemption on capital gains upon the sale of shares to the public through a listing on the Malta Stock Exchange. Under current regulations, such a gain would presently be taxable at the rate of 15%. This change in legislation makes it more attractive for shareholders of existing companies to list their companies via the issue and/or sale of equity on the market since they will now pay no capital gains tax on their shareholding sale as at the point of admission. This measure could prove to be a major attraction for many family-run businesses to conduct an Initial Public Offering for succession planning purposes.

A similar capital gains tax exemption will also be introduced in respect of the sale of shares to the public through a listing on an alternative trading platform, such as Prospects. However, in this case, the extent of the exemption will depend on the amount of shares offered to the public.

Another important initiative is the treatment of dividend income from companies listed on the Malta Stock Exchange. Upon a dividend distribution, a shareholder holding not more than 0.5% of the capital of a company listed on the Malta Stock Exchange, may claim a refund on the tax deducted at source on such dividend. The tax refund amount would depend on the effective tax rate applicable to the shareholder. This will be applicable with respect to dividend distributions made out of profits derived after 1 January 2017.

The Minister also announced the setting up of a Risk Investment Scheme such that an annual tax credit of up to €250,000, shall be available to persons who invest in Small or Medium Enterprises (‘SMEs’) that are listed on an alternative trading platform, such as Prospects or in funds that invest in a number of SMEs.

Additionally, in his recent Budget Speech, the Minister of Finance announced plans to introduce Government Savings Bonds for pensioners as well as the issuance of solar bonds via Malita Investments plc. These are interesting and innovative ideas although details on such investments have yet to be announced.

The measures announced by the Minister of Finance in his Budget Speech will provide the necessary support for the other initiatives in the National Capital Markets Strategic Plan.

It is not my intention to delve into each of the 19 key action points included in the proposed plan. In my view, the most important ones include: (i) increasing liquidity by revamping market-making rules; (ii) the extension of trading hours; (iii) the listing of Exchange Traded Funds and REITS and (iv) promoting Malta and Maltese companies to international institutional investors.

Another commendable initiative within the plan is the investor educational campaign via the new MSE Institute offering courses to enhance financial education in Malta.

The MSE is also doing its part in encouraging further companies to list by offering rebates on listing fees. Although this is commendible, the major driver to increase listings will be the exemption of capital gains tax introduced by the Minister of Finance.

Although the co-ordinated strategy by the Ministry of Finance and the MSE is a most welcome development, in my view, in addition to the various action points and fiscal incentives being mentioned, other regulatory changes need to take place to make it possible for some other companies to list on the MSE.

I have written about this on various occasions in the past and also mentioned it in various fora including at the launch of the National Capital Markets Strategic Plan. In my view, the required minimum of 25% of the issued share capital of a company to be held in public hands (i.e. the free float) should be amended to take into account the small size of Malta’s market. It is good that the MSE are offering a 50% rebate on listing fees for 2 years for companies having a market capitalization of at least €300 million and a 75% rebate on listing fees for 2 years for larger companies having a market capitalization of at least €500 million. However, if you apply the 25% free float rule to these benchmarks, such rebates would only apply for those companies conducting an IPO of at least €75 million and €125 million. These benchmarks should be lower, firstly because only a few companies would qualify and more importantly, since it would seem premature for subscriptions to equity offerings from the investing public reaching such amounts.

Although there are sizeable amounts of investible funds looking for various investment opportunities, I am quite sure that most would agree that it would be very hard indeed for a single equity offering to attract €75 million or €125 million in subscriptions from local retail and institutional investors. This reveals the limitations with the current regulation in place. It is therefore almost impossible for the large family companies to list their overall Group structure. The listing requirements should therefore be amended to take into consideration the size of prospective issuers compared to the investment profiles of local investors.

For example, the 25% threshold should be maintained for companies of a market cap of up to say €100 million but this should decrease to say 20% for companies with a market cap of above €150 million and 15% for companies with a market cap of above €200 million.

Although this free float restriction can remain problematic to attract some new entrants, it is indeed welcoming that the Ministry of Finance have given so much importance to the enhancement of Malta’s capital markets development in the 2017 Budget speech.

Hopefully, these initiatives will herald a new era for the faster development of the MSE since it is now becoming a more attractive venue both for investors as well as for companies seeking to raise funding. The Chairman of the MSE Mr Joseph Portelli claimed that the joint strategy could be ‘a milestone in the history of the financial services sector in Malta’ while on his part Prime Minister Joseph Muscat stated that the capital markets ‘could be the next big thing for Malta’.

Although a few of these measures had long been on the drawing board, the current low interest rate environment which is instigating investors to urgently seek alternative investment propositions would seem to present the ideal backdrop for the plan to succeed.

However, as Mr Roderick Chalmers stated earlier this year in a conference on Malta’s capital markets, maximum vigilance is required to ensure that a certain standard is maintained for the benefit of investors and all other stakeholders. The MSE should not focus solely on growing the issuer base at all costs but the quality of the issuers, governance procedures and transparency with the market remains of paramount importance.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.