A review of the property-rental companies

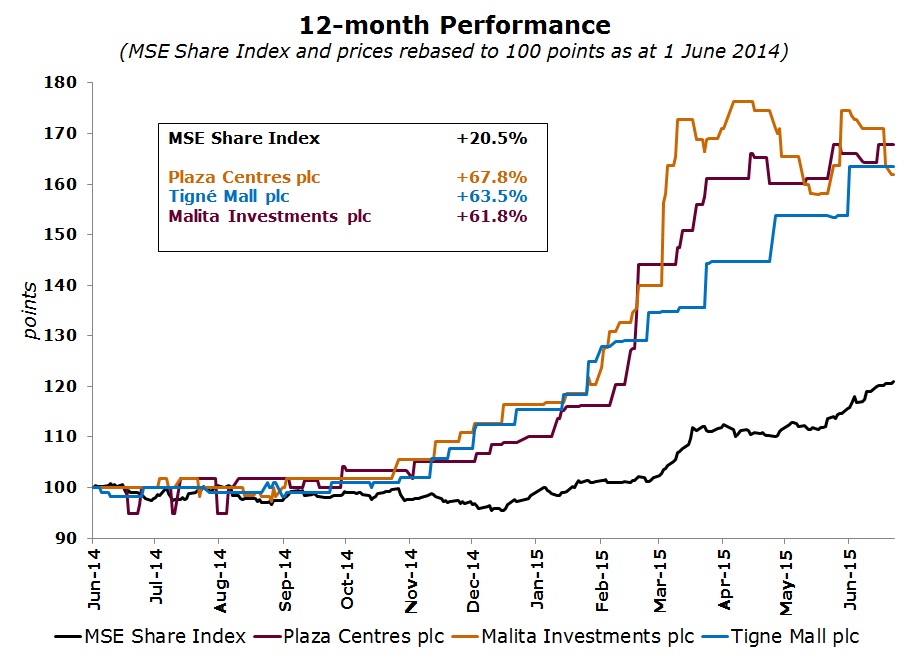

The three property rental companies, namely Malita Investments plc, Tigne Mall plc and Plaza Centres plc, all participated in the rally across local equities over recent months. In fact, a review of the performance of the various local share prices over the past 12 months reveals the strong outperformance of these three equities.

The extent of the gains in these three property rental companies may be surprising to many. The share prices of Plaza, Tigne Mall and Malita surged by 67.8%, 63.5% and 61.8% respectively since June 2014. Due to the inverse relationship between prices and yields, as share prices or bond prices rise, yields decline. As a result, the gross dividend yields of Plaza, Malita and Tigne Mall based on the current market prices and the dividends distributed in respect of the 2014 financial year have now declined to 4.2%, 4.0% and 3.4% respectively. It is worth highlighting that 12 months ago, Plaza’s yield was 6.2%, Malita was 6.4% and that of Tigne Mall was 3.7%. The latter may be misleading because the company’s shares were admitted to the MSE in May 2013 and only the final dividend is reflected for 2013 while Tigne Mall began adopting a semi-annual dividend policy in 2014.

The rally in all these share prices started soon after the European Central Bank reduced eurozone interest rates last summer and as speculation gathered momentum of a possible quantitative easing programme in 2015.

The monetary easing by the ECB caused an immediate upward movement in bond prices and a corresponding decline in yields. Following the significant decline in yields across both the sovereign and corporate bond markets, investors turned their attention to the equity market for a better yield and the spillover of demand from the bond market by investors searching for higher yielding securities sent share prices rallying.

This trend continued during the first few months of 2015 after the launch of the quantitative easing programme by the European Central Bank in March and the continued decline in yields across the bond market to unprecedented levels.

Although these three companies have similar business models that can produce sustainable dividends on an annual basis, they also have very different characteristics.

Plaza Centres is the longest-established of the three companies. Although the shopping centre opened in 1994, Plaza’s shares were admitted to the Malta Stock Exchange in May 2000. The company’s 15-year track record since listing is very positive. Pre-tax profits increased by a combined 99% over the years (from 2001 to 2014) and dividends to shareholders climbed by 66.1% during this period notwithstanding the reduction in the company’s payout ratio from close to 100% in 2001 to 80% in 2014. The growth in profits was possible through regular rental increments stipulated within contracts with tenants and more importantly as the company successfully managed to acquire further properties in the immediate vicinity of the complex and expand its footprint. In fact, the Plaza shopping complex was extended in three phases over the past 15 years. However, going forward, this will be less likely due to the lack of further opportunities in this respect. In fact, Plaza is reportedly seeking to enter into negotiations with the owners of a large site in close proximity to the complex as well as with the authorities with a view to addressing the lack of parking facilities – considered by management to be the largest disadvantage of the complex. Apart from addressing the parking shortage, this possible project could also see the company increase its retail and office spaces in the years ahead once a phased development of the area is undertaken.

Malita Investments was set up on 3 June 2011 by the Government of Malta as an investment holding company and upon inception, the Company acquired the sites of Malta International Airport and the Valletta Cruise Port. On 26 June 2012, the company acquired a 65-year emphyteusis from the Government of Malta over the new Parliament Building and the Open-Air Theatre in Valletta. As such, Malita currently has only 3 tenants, i.e. the Government of Malta as well as MIA and VCP – two national strategic operations. The rental income arising from the ground rents from MIA and VCP as well as the income from the City Gate Project is predominantly fixed in nature with possible future increments over time at pre-agreed terms largely reflecting the rate of inflation. In view of the limited scope of growth from current operations, the Company indicated in recent months that it is seeking to grow by investing in further projects. The Directors are reportedly evaluating a number of potential projects including some involving a mix of public and private participation.

Tigne Mall was set up on 1 December 2004 to manage and operate ‘The Point’ shopping complex and was admitted to the Malta Stock Exchange in May 2013. The Company’s revenues emanate from the leases of the retail outlets which typically have a term of between 15 and 20 years. Tenants pay an annual base rent with rates varying depending on the size and location of the outlet within the shopping mall. Moreover, the large majority of tenants are also charged turnover rents comprising an additional rental fee when a certain level of turnover generated by the respective tenant is exceeded. The base rents are subject to annual review based on the level of inflation and the performance of the previous year.

"Although these three companies have similar business models... they also have very different characteristics."

While all three companies have evident limitations in expanding their footprint organically, Malita and Plaza have more of a challenge to generate significant increases in profits and dividends from their current structure. In fact, both companies have touched upon the requirement to expand inorganically from their present footprint. On the other hand, Tigne Mall has possibly the greatest opportunity of growing profits without further expansion as the complex is expected to benefit from increased footfall following completion of the Tigne Point development by MIDI plc by 2017. Since most tenants within The Point have annual turnover rents apart from base rents, Tigne Mall’s revenue stream should benefit from the eventual increase in footfall and customer spend within the complex. The CEO of Tigne Mall indicated that each time a new block of apartments was completed in the past, the increased footfall and customer spend was immediate. This should likewise take place on completion of the Q1 apartments this year and the Q2 apartments in 2017. Moreover, greater benefits could be derived upon completion of ‘The Centre’ also scheduled for 2017. This is the office block being constructed by MIDI’s subsidiary located between the Q1 and Q2 apartments. Up to 1,000 people could be working within ‘The Centre’ upon full occupancy in the years ahead which shows the extent of the potential positive impact on Tigne Mall’s financial performance.

In the light of the rally in these share prices since last year, investors will be particularly attentive in the weeks ahead once these companies publish their interim financial statements to analyse whether these companies can grow their dividends during the current financial year. In view of the current interest rate environment, company dividend policies will not only be scrutinised in more detail by retail and institutional investors, but any decline in dividends will undoubtedly be viewed negatively with a resultant drop in share prices.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.