BOV in surprise double-digit profit growth

The interim results of Bank of Valletta plc published after the market close last Thursday ought to have caught many by surprise. Following the weak performances of the other two retail banks with both HSBC Bank Malta plc and Lombard Bank Malta plc suffering from the challenging conditions across the banking industry, analysts and market participants possibly also expected a similar impact on BOV.

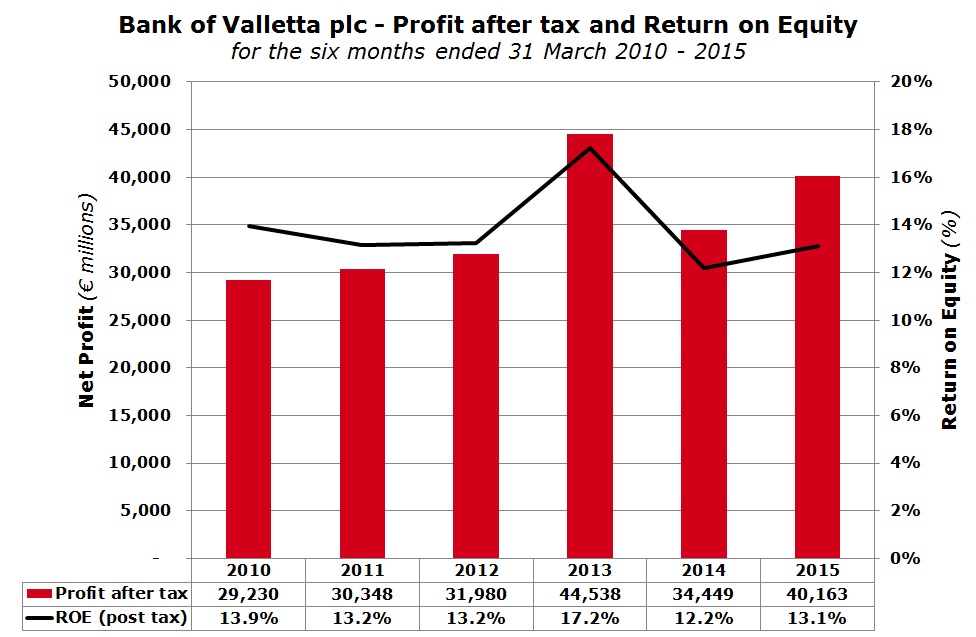

However, the financial statements for the six months ended 31 March 2015 reveal a 15.9% increase in pre-tax profits to €58.8 million. Core profits increased by 6% to €42.9 million on the back of a 15.4% increase in net interest income to €71.1 million (largely due to the decline in interest expense as depositors opted for short-term, low yielding deposits) as well as the double-digit gains in non-interest income with a 20.7% uplift to €48.4 million. BOV reported that all business lines recorded improvements with the most notable being trading profits which surged by 29.6% to €11.35 million on the back of both an increase in volume of transactions as well as a widening of spreads.

Another significant positive contributor to the improved financial performance was the increase in the fair value movement from €4.7 million in the first half of the 2013/14 financial year to €8.1 million during the period under review. Although movements in the Bank’s portfolio of financial assets at fair value through profit or loss still have a material bearing on the Group’s performance, it is important to note that in recent years, the Bank has reduced the amount of such assets to €503.5 million compared to circa €1.3 billion as at 30 September 2014. Moreover, the positive trend across local as well as international financial markets also helped boost the share of profits of BOV’s insurance associate companies by 44.9% to €7.8 million. BOV also recorded a €6.8 million (net of deferred tax) gain on its available for sale portfolio. However, this figure is recognized in shareholders’ funds (through the revaluation reserve) in line with accounting standards.

The interim financial statements also reveal a significant increase in operating expenses (+17.4% to €54.6 million), in the main due to a further substantial rise in regulatory costs which now account for 12% of the Group’s cost base compared to 4% in previous years. During a recent meeting with the financial community, BOV’s Chief Finance Officer Ms Elvia George explained that regulatory costs are expected to remain at such elevated levels going forward.

“Court cases normally take several years to reach a conclusion unless an ‘out-of-court’ settlement is agreed to and this could prove to be a costly exercise for the Bank.”

Additionally, impairment allowances also increased by 40.9% to €13.9 million reflecting the even more conservative approach adopted by the Bank towards provisioning and collateral valuation in line with the recommendations made to the Bank following the Asset Quality Review and stress tests carried out last year by the European Central Bank (ECB). Apart from the Bank’s wish to improve its coverage ratios, the impairment for the period under review also reflect the adverse effect of the instability across North Africa, especially Libya, on certain local businesses.

The Statement of Financial Position once again showed that the growth in the Bank’s deposit base outpaced the net increase in the loan book. During the six months ended 31 March 2015, BOV’s customer deposits grew by 9.2% or €657.7 million. On the other hand, net loans and advances only increased by 3.1% or €121.3 million with the growth largely emanating from home loans. As a result, the Bank’s loan to deposit ratio slipped further lower to 51.2% – the lowest level for several years.

During the analyst meeting convened shortly after the publication of the financial statements, BOV’s Chairman John Cassar White, CEO Charles Borg and other top executives as usual gave a detailed account of the developments over the financial period under review.

However, analysts were probably more interested in an update on developments regarding the Italian court case, which was not included in last week’s company announcement. BOV’s Chairman stated that the Bank was notified about the case in mid-December 2014 and lawyers were called in immediately while the regulators were also notified of the case. The Chairman defended the fact that the company announcement was only made on 2 April since both the lawyers and the auditors required sufficient time to examine the lengthy documents and reach their own conclusions.

However, it is worth pointing out that when BOV issued its customary Interim Directors’ Statement on 6 February 2015 explaining the performance since the start of the new financial year on 1 October 2014, the Directors confirmed that “during the financial period commencing on 1 October 2014 up to the date of this Announcement, no material events and/or transactions have taken place that would have an impact on the financial position of the Bank or the Group, such that they would require specific mention, disclosure or announcement pursuant to the applicable Listing Rule”. Given the magnitude of the claim, market participants would have expected mention of the Italian court case at this stage notwithstanding the fact that the Directors did not yet have feedback from their lawyers and the auditors on whether such a claim ought to have been partly provided for.

Although the Chairman stressed again that BOV have an extremely strong case and that no provisions will be necessary for the time being, the uncertainty over this case could cloud sentiment towards the bank for many more years to come. Court cases normally take several years to reach a conclusion unless an ‘out-of-court’ settlement is agreed to and this could prove to be a costly exercise for the Bank.

During last week’s meeting, BOV’s Chairman also mentioned that a decision had been taken by the Board of Directors earlier that day for the Bank to gradually start to reduce their holdings of Malta Government Stocks via the QE programme currently being conducted by the Central Bank of Malta on behalf of the ECB. Given the size of BOV’s portfolio, even a small reduction in exposure could imply that the Central Bank will start to easily manage to fulfil its €36 million acquisition quota on a monthly basis until September 2016 or earlier if the ECB obtain data on a consistent improvement in inflation readings. In fact, statistics published by the ECB earlier this week indicated that the CBM purchased €58 million worth of MGS during the month of April compared to only €5 million in March.

Mr Cassar White also indicated that the upcoming strategy for BOV entails the introduction of reforms to improve the Bank’s understanding and management of its risks. This comprises substantial investment in the Group’s IT infrastructure (through a 3 to 4 year IT investment programme) as well as the engagement of personnel in this field in order to ensure timely, accurate and high quality reporting in line with more stringent requirements of local and foreign regulators. In the meantime, the Bank will also be required to strengthen its balance sheet by raising capital levels. This could either take the form of additional equity such as a rights issue or via long-term debt funding from the capital market. No further news was provided at this stage. As such in the months ahead, BOV’s stakeholders and all market participants will be keen to understand the nature and timing of this capital raising exercise. Whatever the shape and form of this capital raising exercise, it further vindicates Mr Cassar White’s statement that generally banks are becoming a safer investment but less profitable than in the past reflecting the regulator’s stance of focusing on risk management even at the cost of lower profits.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.