Consistency in Dividend Distributions

In early May, I published the customary annual dividend league table to assist investors when comparing equities producing the highest dividends. The dividend league table also enables investors to compare these dividend yields to the yields on corporate bonds and Malta Government Stocks, an important comparison especially following the sharp decline in bond yields in recent years.

While the annual dividend league table assists investors to identify those companies generating the highest dividend yields, it is admittedly simply a snapshot of the position of these companies at a particular point in time. The yield is based on the dividends declared or distributed in respect of the previous financial year and the share price at the time of publication of the league table. Both the absolute amount of the dividend distribution as well as the share price can change from one period to the next and this would impact the result of the net yield.

As such, as indicated on more than one occasion in the past, it is equally important to understand the sustainability of a company’s dividend and investigate whether the company may distribute higher dividends to shareholders in the future or may need to cut the dividend due to upcoming investment requirements.

Traditionally, the banking equities were regarded as the most consistent dividend-paying companies. While it is true that both Bank of Valletta plc and HSBC Bank Malta plc regularly paid dividends on a semi-annual basis ever since their shares were listed on the Malta Stock Exchange over 20 years ago, the amount of dividends declared has been rather volatile in recent years as a result of more stringent regulation on the banking industry to retain higher levels of capital. Interestingly, HSBC Malta topped the dividend league table this year due to the payment of a special dividend which as the name implies may not be repeated in future years although the bank retains a capital ratio which is above regulatory requirements.

Malta International Airport plc also paid semi-annual dividends to shareholders ever since its listing on the MSE in 2002. However, in recent years, the dividend has remained unchanged ahead of the sizeable investment programme being undertaken as part of the overall master plan. As such, following the hike in the share price to record levels, the net dividend yield has shrunk towards the 2% level which may not be deemed to be attractive any longer for investors focusing solely on maximizing their annual income from their investment portfolios.

Meanwhile, many of the property companies fit perfectly in the category of ‘dividend plays’. While some property companies are currently primarily focused on development activities such as MIDI plc, Malta Properties Company plc and Trident Estates plc and therefore cannot easily sustain an attractive dividend to shareholders annually, the other property companies generate a regular rental income stream from their commercial properties and can therefore distribute consistent dividends to shareholders. Within this growing category of companies, one finds Plaza Centres plc, Malita Investments plc, Tigne Mall plc and now also Main Street Complex plc.

The business models of these companies are very similar to each other with rental and lease agreements normally contracted for lengthy periods of time enabling the companies to easily project their financial performance and also dividend distributions in advance.

As depicted in the annual dividend league table some weeks ago, the net dividend yields of a number of these companies are superior to yields on several corporate bonds and also Malta Government Stocks.

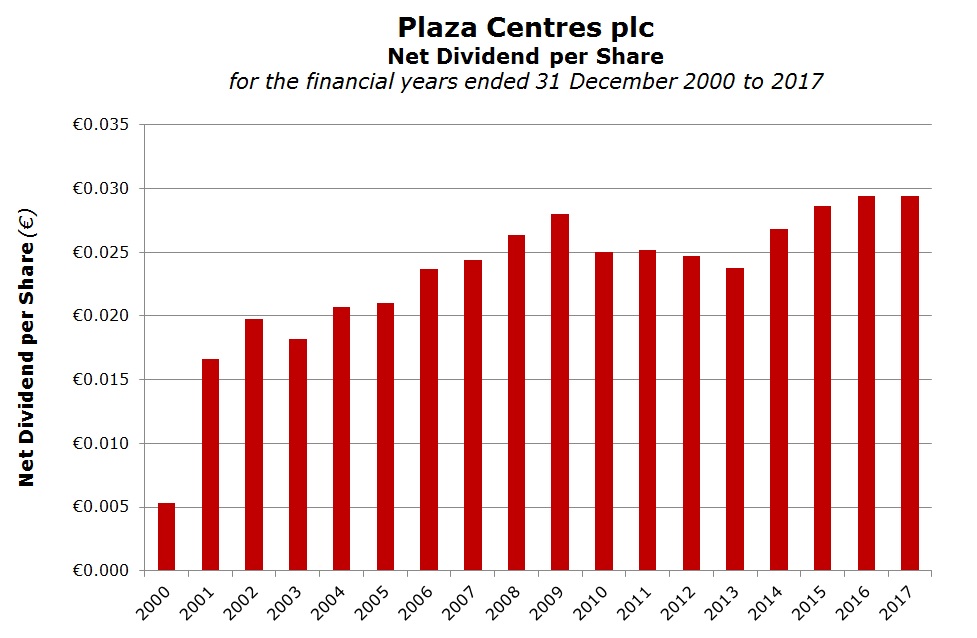

Additionally, the main advantage of these companies is that since most lease agreements cater for an annual increase in rents, this can in turn translate into a gradual rise in dividends to shareholders as opposed to a fixed interest rate on bonds. This can be seen in the rising trend in dividends in the graph of Plaza Centres plc despite the decline in the payout ratio as the company continued to expand its property portfolio.

It is interesting to note that since Plaza’s IPO in May 2000, dividends have risen considerably for the benefit of all shareholders who not only benefited from an attractive dividend but also from an increase in the net asset value per share as a result of the uplift in the value of the property. This graudual capital appreciation may not have been immediately evident to a number of investors in such companies but is nonetheless greatly beneficial to them over the years.

Another example is Tigne Mall plc which was listed on the MSE more recently and also in this case, investors should have noticed the increase in the dividend distributions following the better-than-expected financial performance over recent years as well as the strong growth in the net asset value per share.

A gradual rise in dividends should be an important consideration for investors. It is widely recognised that even income-oriented investors should consider an allocation to equities within their portfolios in order to offset the diminishing returns from bonds as a result of inflation. Therefore, many investors should consider an allocation to such companies to benefit from consistent dividend distributions over the years coupled with an element of capital appreciation.

Another company that is imminently expected to begin delivering consistent returns to shareholders is PG plc. At the time of the Initial Public Offering in the first half of 2017, PG had stipulated that its dividend policy will amount to at least 50% of annual profits after tax. PG distributed its maiden interim dividend of €0.01574 per share in December 2017. The company has a 30 April year-end and its 2017/18 annual financial statements should be published in August 2018. In the prospectus PG had projected that it will generate a profit after tax of €8.4 million and based on the total issued share capital of 108 million shares, this equates to an earnings per share figure of €0.0779. As such, assuming a dividend payout ratio of 50%, the overall net dividend would amount to €0.03895 per share. Following the payment of the interim dividend of €0.01574 per share, the final dividend should amount to at least €0.02321 per share. As such, the total estimated dividend for the 2017/18 financial year equates to a net yield of 2.95% based on the current share price of €1.32 assuming that the profits match expectations and the dividend payout ratio does not exceed 50%.

The equity market needs to attract more companies for investors to have a wider spread of investments in their portfolios. While companies offering sustainable dividend yields may appeal to a certain category of investors, the market also needs other types of companies that have ambitious expansion plans, particularly on an international dimension, in order to also offer other growth-oriented investors with a wider availability of investment options listed on the regulated main market of the Malta Stock Exchange.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.