ECB announcement rattles financial markets

In the midst of the annual reporting season in Malta when many Maltese investors would have been focused on the publication of the annual financial statements by various companies, another very important development took place last week. On Thursday afternoon, the European Central Bank (ECB) announced a new series of targeted longer-term refinancing operations (which are loans to banks dubbed as TLTRO-III), that will begin in September 2019 and run until March 2021.

In recent months, the world’s major central banks were all heading for gradual monetary policy normalisation after a long period of monetary stimulus policies to combat the side effects of the 2008 international financial crisis. However, in a matter of weeks, the shift in monetary policy action was remarkable as the Federal Reserve first put its strategy of gradual interest rate hikes on hold and other leading central banks also followed this dovish stance. Last week’s unexpectedly fast decision by the European Central Bank to make a new offer of cheap loans to eurozone banks, and signal that interest rates would stay at record lows for longer, completed the remarkable U-turn by the major central banks.

The ECB slashed its economic growth and inflation forecasts. Economic growth across the eurozone is now expected to be 1.1% in 2019 – a far cry from the projections only last December of a much more positive growth of 1.7%. This represents the weakest outlook for the eurozone economy since 2013. The inflation forecast for 2019 is now 1.2%, down from an expected rate of 1.6% in December 2018.

The slowdown in economic growth is not only limited to the eurozone area. Last week, the Organisation for Economic Co-operation and Development (OECD) cut its growth forecasts for almost every large economy, warning that the global expansion was losing steam as a result of China’s slowdown, policy uncertainty in Europe and the risk of further trade conflicts. Moreover, last Friday, data in the US revealed that jobs growth almost stalled in February, fuelling fears that recent signs of weakness in the world’s largest economy might turn into a more persistent slowdown. Chinese data for the same month showed a steep decline in trade, with both exports and imports contracting, whilst the Chinese Prime Minister announced that his country would aim for a GDP growth of between 6% and 6.5% this year, down from the 6.6% recorded in 2018 and the slowest rate in nearly three decades.

The President of the ECB Mario Draghi also introduced a new phrase at last week’s press conference that will long be remembered within financial circles similar to some of his previous statements that marked important monetary policy decisions. Many will recall the statement in July 2012 when Mr Draghi said he was “ready to do whatever it takes” to save the euro.

Last week, the ECB President spoke of “pervasive uncertainty” as he stated that “we are in a period of continued weakness and pervasive uncertainty”, possibly referring to the central bank’s inability to take any further action in the light of geopolitical risks related to trade conflicts and a disruptive Brexit, as well as the uncertainties of Italian politics, which were weighing down on business investment. Mr Draghi basically echoed the remarks made at the start of the year by the Chairman of the Federal Reserve Jerome Powell who had warned about the weakening global environment and the various ongoing political risks which, in turn, also forced the Federal Reserve to change course.

Although the possibility of a new series of loans to banks by the ECB in order to stimulate lending into the eurozone economy had been rumoured for a while across international financial markets, the very swift action by the ECB rattled market observers since it clearly suggested that policymakers were worried about the serious economic headwinds in the months ahead. In fact, the euro dropped to below USD1.12 – a level last seen in June 2017.

Across the equity markets, European bank shares tumbled as the ECB delayed even further the prospect of higher interest rates which is an evident threat for bank profitability. In fact, in recent years, banks have been appealing for higher interest rates to help the sector’s profitability.

Given the ECB’s policy statement last week affirming the market’s view that monetary policy tightening is no longer on the agenda for 2019, noting “key ECB interest rates to remain at their present levels at least through the end of 2019”, European bond yields declined rapidly once again with the German 10-year Bund yield approaching 0.05%, its lowest level since October 2016.

Since data suggests that almost 55% of the previous targeted longer-term refinancing operations which were launched in mid-2016 went to Italian and Spanish banks, many market observers believe that Italian banks in particular were likely to benefit from the ECB’s new lending programme. This may have been the reason for the stronger rally in Italian bond prices compared to those of other eurozone countries. Despite the political uncertainty in Italy, the 10-year Italian government bond yield dropped to its lowest level since July 2018 of 2.49%.

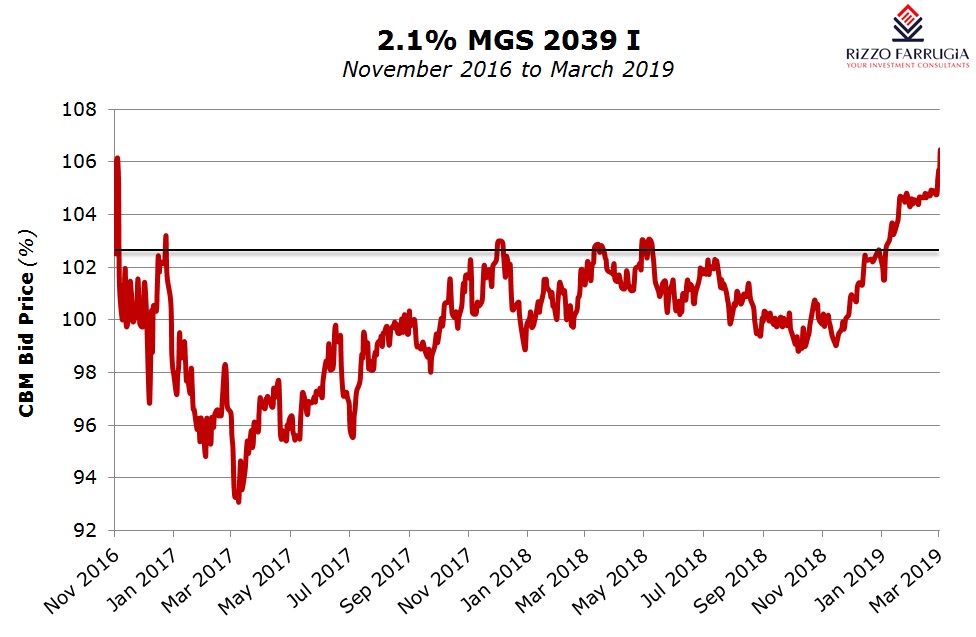

The movements in eurozone bond yields also left an impact on Malta Government Stocks. MGS prices soared and a few securities even reached new record highs thereby surpassing the previous record in October and November 2016. As an example, the indicative bid price quoted by the Central Bank of Malta for the 2.1% MGS 2039 was of 106.42% last Friday compared to the previous all-time high of 106.15% in November 2016.

Few Maltese investors may be closely following the sharp movements in the MGS market. The recent upward movement should be welcomed by the thousands of investors who had enthusiastically subscribed for the Malta Treasury offering in October 2016 when it had launched the 2.1% MGS 2039 at a price of 102.50% but after a very brief upturn in the first week of November 2016 shortly after the bond commenced trading, a sudden change in circumstances across global financial markets led the price of this MGS to drop below the par value. The price of the 2.1% MGS 2039 had slid to a low of 93.08% in mid-March 2017 and only started trading close to the par value of 100% in October 2017.

These latest developments are another sign to investors of the unpredictability of events across international financial markets which evidently impact all asset classes, be they equities, bonds or currencies.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.