Expansion plans for Portomaso after record financial year

Tumas Investments plc and some other bond issuers are obliged to publish an updated Financial Summary every year within two months from the publication of their annual financial statements. The publication of a Financial Analysis Summary is a relatively new requirement under the Listing Policies of 5 March 2013. The updated Financial Analysis Summary of Tumas Investments plc was published on 30 June and provides a detailed insight into the different business units of Spinola Development Company Limited (SDC), the company that owns the Portomaso complex which is the guarantor of the bonds issued by Tumas Investments.

Since Tumas Investments is merely a finance vehicle for SDC, the financials of the guarantor are the ones that ought to be analysed by investors and market participants. SDC’s main business activities over the years have been the development and management of the Portomaso complex which comprises a mix of residential apartments, the 410-room 5-star Hilton Malta hotel as well as commercial and office space complemented by various amenities including an underground car park of around 1,200 spaces and a 130-berth yacht marina.

2014 was a record financial year for SDC and the performance also exceeded the projections made this time last year when the last Tumas bond was issued. Total revenue climbed by 13% to €43.3 million, with earnings before interest, tax, depreciation and amortisation (EBITDA) surging 32% higher to €15.4 million. Likewise, pre-tax profits of the company which owns the Portomaso complex rallied by over 190% from €2.2 million in 2013 to €6.3 million in 2014. More importantly for bondholders is that the interest cover improved to 3.8 times during 2014.

“2014 was a record financial year for SDC…”

The rationale behind the record financial results and the substantial improvements over the projections published mid-way through 2014, was the larger number of apartment sales than anticipated also at higher sale values, as well as a better-than-expected improvement in the hotel’s performance.

In fact, most of the improvement in EBITDA came from the property development unit as SDC concluded the sale of 7 apartments during 2014. SDC reported that out of the current remaining stock of only 10 apartments from the overall development of 445 residential units, it entered into a further 5 promise of sale agreements during the first half of 2015. This reflects the renewed strength of the property market which experienced a visible increase in prices across all categories during 2014 largely as a result of the Individual Investor Programme as well as the record low interest rate environment.

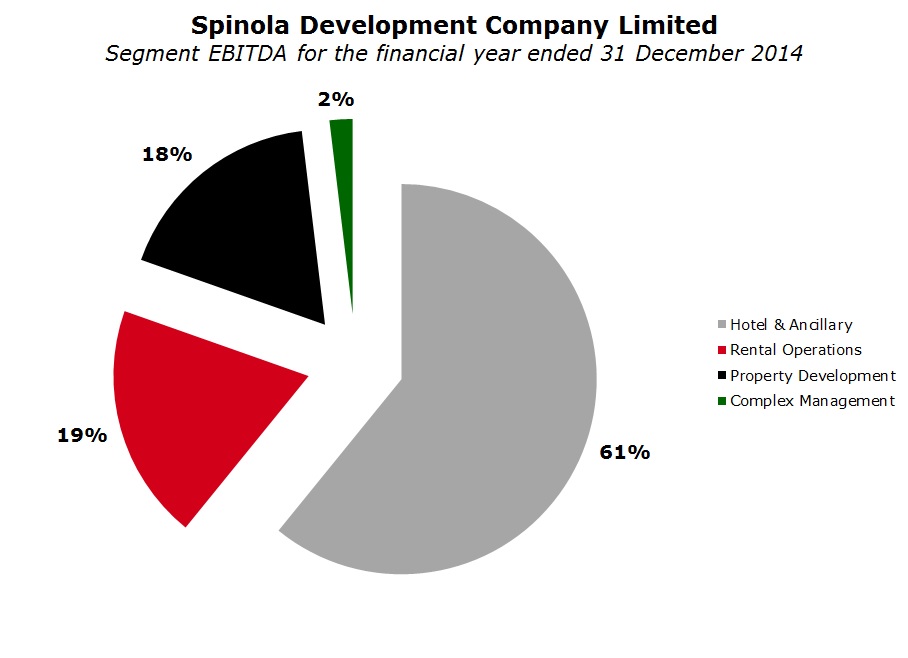

Although the bulk of the improvement came from property development, the overall contribution to SDC’s total EBITDA was still under 20%. Moreover, investors should note that the performance of the property development business unit is volatile in nature given its dependency on the number of apartments available for sale, the timing of new developments and moreover the timing of the final contracts since the revenue and profits can only be booked in the income statement once the final deed of sale is entered into. The volatile nature of property development companies was very evident also in the financial performance of MIDI plc over recent years.

The Tumas Group has very few apartments left for sale within the Portomaso complex and in fact construction works have already commenced on the next extension. The Laguna Apartment Project comprises a total of 44 units on an area of 8,500 sqm located near the marina. Although the company has already started entering into promise of sale agreements, the contribution to the financial performance of SDC will only be evident in 2018 when the first units are expected to be delivered to the buyers.

The hotel and its ancillary operations remains the largest financial contributor to SDC. The EBITDA of the Hilton Malta hotel together with the conference centre, the car park, the marina and the Twenty-Two lounge in the business tower amounted to €9.4 million in 2014, representing just over 60% of SDC’s overall EBITDA in 2014. The reason for the continued growth in EBITDA which also exceeded the projections for 2014 by 4.3% was a result of improved occupancy and higher room rates reflecting the continued strong performance of the tourism industry both as a result of the increased airline capacity as well as the importance of Malta’s growing services industry.

The other main business unit of SDC is the rental income stream from the leases of the units within the business tower amounting to around 3,300 sqm and other commercial and office spaces around the complex totaling around 11,000 sqm. All units are fully occupied resulting in total rental income of €3.2 million and an EBITDA contribution of €3 million. Due to the continued strong demand for premium office space as a result of Malta’s success in attracting foreign companies operating from the island mainly in the areas of financial services, gaming and IT, SDC intends to expand its commercial offering. An application was filed with the Malta Environment and Planning Authority for the construction of a 9-storey building on top of the cafeteria adjacent to the business. This will increase the rentable area by around 4,000 sqm.

In addition to the detailed analysis of the 2014 financial performance, the Financial Analysis Summary also provided an update to the forecasts for 2015. Although the revised projections depict an improved level of revenue and EBITDA compared to the previous forecasts for 2015 published at the time of last year’s bond issue, SDC is expecting a slight decline in revenue to €42.7 million from the actual results of 2014 and a 9% drop in EBITDA to €14 million largely due to the expected decline in the performance of the hotel arising from the extensive refurbishment works taking place. These are expected to negatively impact occupancy levels and lower contributions from the property development unit.

"The Financial Analysis Summary has proven to be a good tool for investors and analysts..."

Apart from the interest cover, another financial ratio that bondholders ought to monitor on a regular basis is the gearing ratio. This measures the level of indebtedness of the company compared to the level of shareholders’ funds. Net borrowings of SDC declined from €51 million in 2013 to €44.6 million in 2014 helping the gearing ratio improve to 47%. This is expected to continue to improve marginally again in 2015. The Financial Analysis Summary also indicates that the financial statements of SDC include the value of investment property, namely some of the floors within the business tower as well as the commercial and office outlets in others areas of the complex, at cost. However, if the market value of these properties are taken into consideration, the gearing ratio would improve substantially to just over 40%.

The Financial Analysis Summary has proven to be a good tool for investors and analysts interested in following company-specific developments closely. While this is obligatory for some bond issuers only (although not all issuers have so far published their updated FAS within the 2-month statutory period), forecasts should be more useful for equity investors. Those companies having their equity listed on the Malta Stock Exchange should also consider issuing projections in a similar manner. This is customary practice overseas and this procedure should also be followed in Malta too. The publication of financial projections is especially important given the growing number of investors getting exposed to equity instruments more so as a result of the significant rally in shares prices which led to valuations far above historic averages in some cases. Management executives and Directors of companies having equities listed on the MSE should feel obliged to publish increased information to the market at large. Foreign research specialist firms could also be engaged to perform this task on behalf of the companies in question. This would be an important development for the local equity market.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.