Hal Mann Vella maintains 2015 profit forecast despite underperformance in 2014

Hal Mann Vella Group plc was one of the companies that published its updated Financial Analysis Summary later than the deadline stipulated in the Listing Policies of the Malta Financial Services Authority dated 5 March 2013. After the publication of the initial Financial Analysis Summary (FAS) which is appended to the Prospectus at the time of the launch of a bond issue, an issuer must publish an updated report annually by “not later than two months after the publication of the annual accounts”.

As such, bond issuers having a December year-end should publish their annual financial statements by 30 April and the updated FAS by 30 June. The report by Hal Mann Vella Group plc was published on 28 July and other bond issuers published their updated FAS even later with one particular issuer recently announcing that it will publish its updated FAS by not later than 31 August.

The aim of the Financial Analysis Summary is to assist retail investors to obtain a better understanding of the financial soundness of the issuer. The initial report as well as the annual update also greatly assists financial analysts to monitor the performance of the issuer and verify whether the company managed to achieve its revenue and profitability targets across the various business divisions.

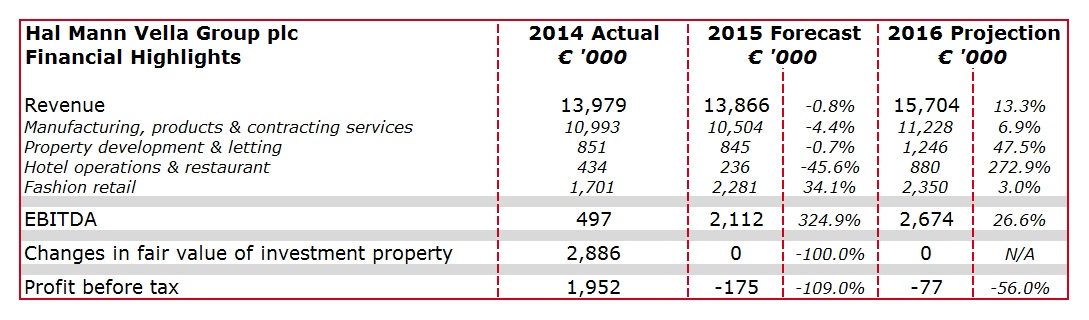

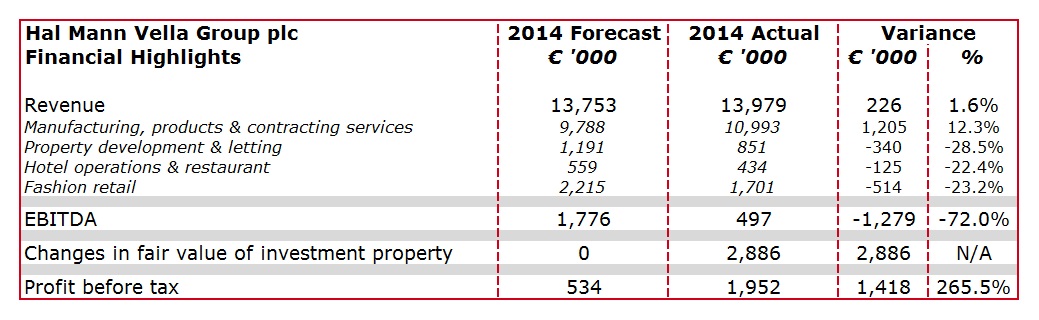

The original FAS of Hal Mann Vella appended to the Prospectus dated 6 October 2014 included the forecast for 2014 and the projections for 2015. Since the document was published during the fourth quarter of 2014, one would have expected the actual figures to be very much in line with the forecasts. While the actual overall Group revenue of €13.9 million came in slightly higher than the forecast of €13.7 million, analysing the variances across the four main business divisions throws up some interesting observations.

In fact, while revenue from the core business unit “manufacturing, products and contracting services” was significantly higher than projected, the other three business units all underperformed. Nonetheless, the updated FAS does not provide any reason for this shortfall across all three business units.

Net operating costs of €13.5 million were also much higher than the forecast of €11.9 million with the result that the actual earnings before interest, tax, depreciation and amortisation (EBITDA) of €0.5 million was significantly below the forecast EBITDA of €1.8 million. After accounting for depreciation of €0.6 million, the Hal Mann Vella Group incurred an operating loss of €71,000.

Although in Hal Mann’s Company Announcement of 30 April 2015 in which it published its 2014 financial statements, the Group argued that “the operational loss was offset by profits made on the revaluation of assets which resulted in an overall profit before tax for the Group of €1,951,746 compared to €534,000 projected in the prospectus, a positive variance of € 1,417,746”, this is little consolation for bondholders as a revaluation is purely an accounting entry and is not a cash item.

For bondholders the EBITDA figure is the main item to look out for since it reveals whether the company is generating sufficient cash to honour its ongoing interest obligations. In fact, one of the more relevant financial indicators for bondholders is the interest cover, which shows the number of times operating profits cover finance costs. During 2014, the interest cover of Hal Mann Vella Group, at 0.46 times compared to the forecasted ratio of 1.6 times, indicates that it did not generate sufficient cash during the financial year to cover its interest costs.

The Group explained in its Company Announcement of 30 April 2015 that during 2014 it “sustained a higher than expected squeeze on operational margins, driven by higher than anticipated operational and manufacturing costs, whilst in the context of market conditions, such higher costs could not be reflected in corresponding price increases”.

Moreover, it argued that “the upgrading and modernisation of the manufacturing plant targeted for the end of 2015 is intended to address these issues by enhancing efficiency levels and increasing operational margins”. A similar explanation was included in the updated FAS. The report also indicated that the Directors of Hal Mann “anticipate that the full benefits of the new factory layout and modern machinery will be reflected in the income statement (through growth in revenue coupled with a decline in operating costs) as of FY2016”.

However, despite the significant underperformance in EBITDA during 2014 and the expectation that the efficiencies of the new factory will only lead to an improvement during the 2016 financial year, the forecasts for 2015 originally published in October 2014 were maintained at the same level in the updated FAS!

In essence, the Hal Mann Vella Group expect overall revenue to decrease marginally during 2015 to just under €13.9 million, but EBITDA to climb from €0.5 million in 2014 to €2.1 million in 2015 as a result of a decrease in net operating costs. Should this be achieved, the interest cover would improve to 1.19 times in 2015. Bondholders and financial analysts would have found it useful if the FAS provided further insight on the measures being taken during the current financial year to achieve such a strong improvement in performance.

Since the updated FAS was published after 1 July 2015, Hal Mann Vella Group was also required to include its projections for 2016. The Group expects to generate revenue of €15.7 million in 2016 and EBITDA is anticipated to rise to €2.7 million giving an interest cover of 1.4 times in 2016. Although this is above the minimum acceptable level of 1, it would still rank amongst the weaker ratios across the local market.

The FAS provides a breakdown of the expected revenue across the four business units in 2015 and also 2016. The highest sales growth in 2016 is expected from (i) ‘hotel operations and restaurant’ (+273% to €0.88 million) and (ii) ‘property development and letting’ (+47.5% to €1.2 million).

Hal Mann expect a significant decline in revenue from ‘hotel operations and restaurant’ in 2015 to €0.2 million due to the closure of the Mavina hotel in December 2014 for renovation. The anticipated strong improvement in revenue in 2016 (+273%) is therefore as a result of the re-opening of this small hotel during the second half of 2016 and from the expected increase in inventory and room rates following the refurbishment. With respect to the ‘property development and letting’ unit, revenue is expected to remain practically unchanged in 2015 at €0.8 million but it is then anticipated to rise by 47.5% to €1.2 million in 2016 as the Group expects to sell the remaining properties within the Madliena Ridge complex (in which Hal Mann Vella owns 50%) by the end of 2016.

Unfortunately, the FAS did not provide an update on the planned development of the mixed-use commercial centre. An amount of €7 million of last year’s bond issue was earmarked for the development of this 5,200 sqm parcel of land into a commercial centre comprising office space, warehouse facilities and parking. The total rentable area is expected to amount to 14,000 sqm and last year Hal Mann had indicated that it expected to start generating income from this development as from 2017. In the October 2014 Prospectus, it was reported that the Group had submitted an application for the proposed development to the Malta Environment and Planning Authority. However, in view of the lack of any progress being reported in this respect, the completion of this project would seem to be heading for a delay since the Group anticipated that it requires 21 months to complete the building from receipt of the necessary permits.

The main contributor to overall Group revenue will continue to be the “manufacturing, products and contracting services” arm. Income from this segment is expected to decline slightly in 2015 to €10.5 million but it is then anticipated to grow by 6.9% in 2016 to €11.2 million – accounting for 71.5% of the Group’s forecasted revenue of €15.7 million. The FAS also reveals that the Group is in the final stages of leasing a factory in Hal Far measuring 14,000 sqm from Malta Enterprise for a period of 65 years. The FAS explains that the objective of this acquisition is to ease the operational flow at the Lija factory and to have sufficient capacity to consider new projects. Moreover given the close proximity of this factory to the Malta Freeport, the Group plans to carry out the initial processes of materials (marble, granite and natural stones) at Hal Far, and subsequent stages of manufacture will take place at the Lija factory. This seems to be an important development that had not been contemplated in the Prospectus in October 2014 and once again the updated FAS fails to explain the reason for this change in strategy coupled with the respective impact on the Group’s financials.

The FAS also reveals that within the ‘fashion retail’ arm, as part of its expansion programme, the Group acquired a few months ago the ‘7 Camicie’ franchise. This franchise is presently distributed in two stores across Malta. Moreover, the Hal Mann Vella Group leased another store which it is currently operating as a warehouse clearance store. Revenue from the ‘fashion retail’ unit is expected to amount to €2.3 million in 2015 (from €1.7 million in 2014) and the Directors project this to rise by 3% in 2016 to €2.4 million.

Given the significant underperformance by the Hal Mann Vella Group in 2014 despite the publication of forecasts in the fourth quarter of the financial year, market participants ae likely to remain very attentive to the publication of the interim financial statements to verify whether the Group is indeed in line to achieve its 2015 forecasts and achieve an interest cover of above 1. Bondholders should also expect Hal Mann and other bond issuers to provide more regular updates on progress or otherwise in their business objectives to assist them in monitoring the trends across investment exposures within their portfolios.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.