How does a rating upgrade impact Malta’s capital markets?

On Friday 14 October, one of the most renowned international credit rating agencies Standard & Poor’s upgraded Malta’s credit rating from ‘BBB+’ to ‘A-‘. This was a very timely announcement since it was in the midst of a €160 million Malta Government Stock issue and a few days before the presentation of the 2017 Budget Speech by the Minister of Finance.

This was the last of the top three credit rating agencies to upgrade Malta’s rating into the ‘A’ category. Fitch Ratings and Moody’s had always rated Malta in the ‘A’ category for the past 20 years. Prior to the adoption of the euro in 2008, Moody’s raised its rating by one notch to ‘A2’ in July 2007 and carried out a further upgrade in January 2008 to ‘A1’ (equivalent to ‘A+‘). However, these upgrades were reversed in September 2011 and February 2012 and Moody’s has since maintained an ‘A3’ (equivalent to ‘A-‘) rating on Malta with a stable outlook.

Fitch also raised Malta’s rating to ‘A+’ in July 2007 prior to Malta’s adoption of the euro but it then downgraded Malta to ‘A’ (with a stable outlook) in September 2013. More recently, on 19 August 2016, Fitch’s credit rating for Malta was maintained at ‘A’ but the outlook was upgraded to positive. Following the S&P upgrade, presumably these two other credit rating agencies may also follow through with a similar upgrade during their next review.

The sudden news from Standard & Poor’s on Friday 14 October may have surprised local financial market observers and economists. However, given Malta’s very positive economic performance in 2015, together with the agency’s positive outlook on Malta with effect from July 2015 as well as the superior ratings by other agencies for several years, it was probably only a question of time before Standard & Poor’s also reflected Malta’s improving economic fundamentals.

In fact, in the document published on 14 October by Standard & Poor’s, it was reported that the rating upgrade reflects Malta’s improved credit metrics with strong real GDP growth that is expected to average 3% per annum between 2016 and 2019 together with a consistent improvement in the Government’s fiscal performance. The Government deficit is projected to decline to below 1% per annum between 2016 and 2019 and the net debt is anticipated to drop to 53% of GDP in 2019 from 58% in 2015.

S&P described Malta as being “in the midst of one of the strongest medium-term economic expansions in the Eurozone”.

The positive remarks on the Maltese economy by Standard & Poor’s is important for the capital market since rating agencies gauge the credit worthiness of a country which ultimately impacts a country’s borrowing costs. An improved or stronger rating should lead to a reduction in borrowing costs. A reduction in borrowing costs is beneficial to the economy and to the Government since it reduces the overall burden on a country’s finances.

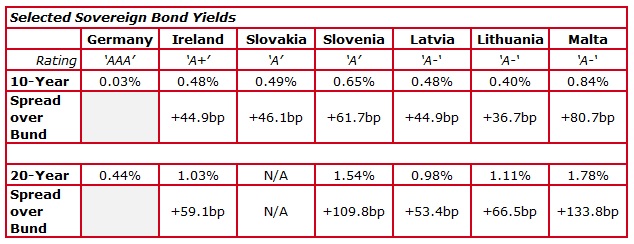

Following this latest upgrade by Standard & Poor’s, it would be interesting to compare Malta to other Eurozone member states. While Germany has the top-most rating at ‘AAA’, Ireland is rated ‘A+’, Slovakia and Slovenia are rated ‘A’ and Latvia and Lithuania have an ‘A-‘ rating similar to Malta’s. Other larger countries now rank inferior to Malta, namely Spain at ‘BBB+’ and Italy is now three notches below Malta at ‘BBB-‘.

Since the primary impact of a credit rating upgrade is on a country’s borrowing costs, a comparison of Malta’s borrowing costs (i.e. the yields on Malta Government Stocks) to other European sovereign yields is warranted.

The table below compares the 10-year and 20-year yields on Malta Government Stock with sovereign yields of other similar rated countries as well as the German Bund yield, which is the benchmark yield across the Eurozone given the ‘AAA’ rating of Germany.

The 10-year German yield started off the year at +0.634% and on 14 June 2016 it dropped into negative territory for the first time ever. The 10-year yield reached a low of -0.204% on 6 July 2016 and has since been range bound between this low and a high of +0.10%. Currently, the 10-year German yield is at +0.03%.

Meanwhile, the 10-year yields in Latvia and Lithuania are hovering between 0.4% and 0.50%. Malta’s 10-year yield has dropped to 0.84% from 1% in mid-August 2016. However, this is still far above the yield of other countries with an ‘A-‘ rating by Standard & Poor’s.

The same can be seen in the 20-year bonds. The benchmark 20-year German bund is currently at 0.44% (after recovering from an all-time low of +0.128% also on 6 July) while the yields on 20-year bonds in Latvia and Lithuania are hovering between 0.95% and 1.10%. Basically, the sovereign yields of these two countries are between 53 basis points and 66 basis points above the benchmark bund. On the other hand, Malta’s 20-year MGS is yielding 1.78%, which represents a premium of almost 134 basis points over the German bund.

Following this analysis, many investors would rightly question whether the additional premium or yield of Malta Government Stocks over other countries also rated ‘A-‘ is justifiable. This could be debated at length. However, one of the main factors that may explain this is the structure of the Maltese sovereign bond market.

Malta’s government bond market is rather unique in that there is only one market maker and this role is played by the Central Bank of Malta. Every morning, the Central Bank publishes an indicative list of prices at which they would be willing to purchase limited quantities of each MGS listed on the Malta Stock Exchange. An indicative price is also quoted for those MGS’s in which the Central Bank is also willing to sell. Unfortunately, the Central Bank is only willing to supply the market in a handful of MGS and over recent months these were restricted to only three longer-dated bonds.

The above arrangement has been in place ever since the commencement of trading on the Malta Stock Exchange 25 years ago. In view of the fact that there is only one market maker, trading activity in almost all Malta Government Stocks takes places only after the publication of the prices by the Central Bank and generally very much in line with the prices indicated by the Central Bank. In recent years, following the increased participation by foreign institutions in the local government bond market, there have been a few instances where prices on the secondary market trade at a premium to those set by the Central Bank. A clear example is the 2.4% MGS 2041 which commenced trading on 23 August 2016. On most days, the price of this bond traded above the indicative bid price quoted by the Central Bank mainly due to the active participation by foreign as well as other local institutional investors who were not able to participate in the primary market since they had been crowded out by retail investors.

A greater number of institutional participants or market makers is likely to result in more competitive pricing across the MGS market. This is one of the factors that could trigger more efficient pricing in line with sovereign bonds of other similar rated countries overseas. The downside to this, however, would be much more volatility than is already evident today. Bond markets have become very volatile from one day to the next and this is likely to continue in the weeks and months ahead. Retail investors need to get accustomed to wider volatility in the MGS market.

While it is evident that the credit rating upgrade given to Malta should translate into lower yields across the various Malta Government Stocks, this should also follow through across the corporate bond market. Most corporate bonds in Malta are generally issued with a 10-year term and many analysts use the 10-year MGS yield as the benchmark rate when reviewing yields of new corporate bonds coming to the market or existing bonds already admitted to the MSE. Generally, many bonds are issued at a premium of between 175 and 400 basis points over the benchmark MGS. This premium should reflect the different characteristics and financial metrics of the issuer in question.

The decline in the 10-year MGS over recent months from 1% to 0.8% should theoretically make corporate bonds more attractive and should also translate into higher prices for corporate bonds unless credit metrics of an individual issuer change. Should yields of Malta Government Stocks decline further to be more comparable to yields of other ‘A-‘ rated countries, corporate bond prices should rise. Lower yields across both the MGS market as well as the corporate bond market are also good news for the new issuers seeking to raise funds via a new bond issue on the Malta Stock Exchange.

Likewise, there should also be a positive impact in the equity market, specifically in respect of the companies offering sustainable and attractive dividends. These equities should become more attractive as a result of lower yields across the bond markets. Moreover, last week’s announcement in the 2017 Budget Speech regarding the changes contemplated next year in the taxation on dividends from companies listed on the Malta Stock Exchange, should help in this respect as it results in a higher effective dividend in the hands of a shareholder.

Against a backdrop of an important credit rating upgrade and the various new initiatives for the capital markets announced by the Minister of Finance, interesting times lie ahead for investors across the Malta Stock Exchange.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.