International equities continue to rally in Q3

Last week’s article dealt with the performance of the local equity market during the summer months. This week’s article reviews the performance of international financial markets and the main developments that took place.

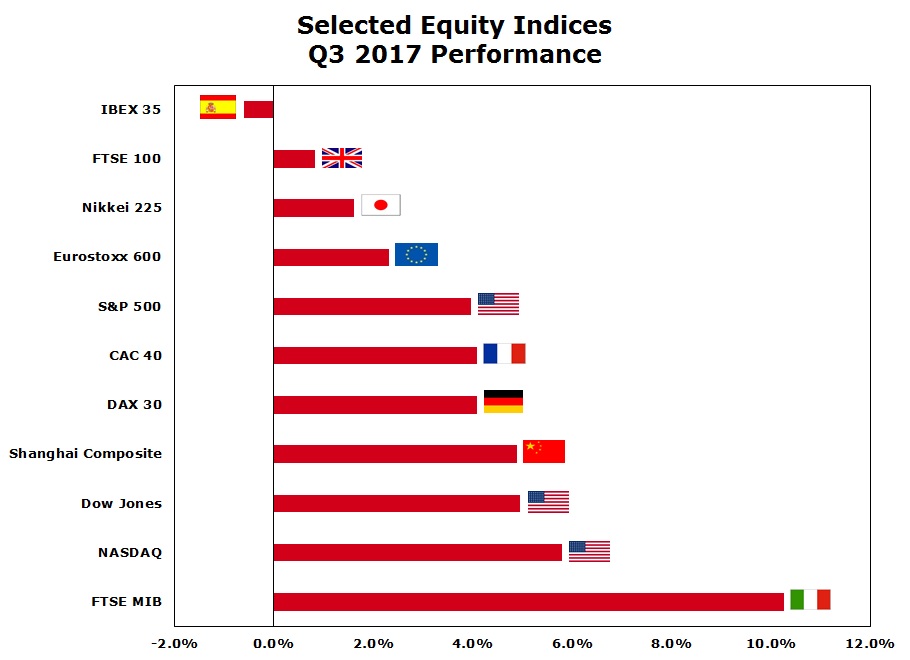

International equity markets continued to advance during the past three months with the Dow Jones Industrial Average in the US posting its eighth consecutive positive quarter – the first time that such a positive trend was registered in the last 20 years. Essentially, the rally across global equity markets that began last November following the US Presidential election continued unabated also during the third quarter of 2017.

Despite the elevated geopolitical tensions following North Korea’s missile tests over Japan, an intense war of words between the US and North Korea as well as nuclear threats which could have ended up in warfare, equity prices advanced mainly on the back of improved corporate earnings growth and other economic data indicating a healthier global economy. In the US, economic growth increased at an annualised rate of 3.1% during the second quarter of the year, whilst the unemployment rate in the UK recorded its lowest level since 1975 and eurozone consumer confidence was at its highest since 2001.

The S&P 500 advanced by 4% during the summer months (its eighth consecutive quarter of gains) to a new record close of 2,519.36 points. Likewise, the Dow Jones Industrial Average advanced by 4.9% – also the eighth consecutive quarter of gains for the first time since 1997. The tech-heavy Nasdaq composite outperformed the other benchmarks in the US with a 5.8% increase. The Nasdaq closed in recorded territory for the 50th time already this year and registered its fifth consecutive positive quarter.

In the Eurozone, the equity performances across the main markets were mixed. While Germany’s DAX 30 and France’s CAC 40 registered almost identical gains of just over 4%, Italy’s FTSE MIB rallied by 10.3% during the summer months while Spain’s IBEX edged 0.6% lower possibly due to the prevailing uncertainty amid attempts by Catalonia to obtain independence from Spain, a move which is being blocked by the Spanish central government.

The UK’s FTSE 100 edged up by only 0.14% – a poor performance compared to other global equity markets. This may be explained by the fact that only a third of the revenue generated by the FTSE 100 companies is generated domestically and as such, the larger capitalised companies tend to lag behind during times when the Pound Sterling is rising, since it reduces the value of sales that are translated back into sterling and also makes the goods and services they sell more expensive internationally. In fact, Sterling strengthened after the Bank of England indicated that it would be considering an interest rate hike possibly by the end of the year as inflation rose to 2.9% in August.

In last week’s article it was noted that the MSE Equity Price Index edged minimally lower during the summer months amid heightened activity in some local equities. The local capital market has therefore continued to underperform all global equity markets also during the third quarter of the year.

As indicated earlier on, the sustained rally across international equity markets was the result of the improvement in economic growth in most of the larger economies around the world, low unemployment levels and also on further confirmation of continued robust growth in company profitability in various sectors. European equities also strengthened following the positive outcome of the French presidential election.

In the latter part of the summer, investor sentiment improved on the expectation of the highly anticipated tax reform plan in the US. The new Republican-backed tax reform plan announced in September proposes the lowering of the US corporate tax rate from its current level of 35% to 20% and other provisions allowing companies to repatriate profits from overseas at a reduced tax rate.

In the currency markets, it was noted earlier on that Sterling strengthened during the month of September after the Bank of England indicated that it would be considering an interest rate hike possibly by the end of the year. Despite the partial recovery last month, Sterling still ended the third quarter of the year weaker compared to the euro. Similarly, the US dollar rallied in September after Congress approved a three-month extension of the debt ceiling deadline while the Federal Reserve signalled the possibility of a third rate rise this year and also said it would begin unwinding its USD4.5 trillion balance sheet in October. The Chairperson of the Federal Reserve Ms Janet Yellen stressed that notwithstanding the weakness of core inflation this year, the Federal Reserve still intended to push ahead with further interest rate rises. The US Dollar had weakened to a level of USD1.2033 against the euro on 8 September before recovering to the USD1.18 level by the end of the month presumably as a result of the German election results where Chancellor Angela Merkel’s party secured a fourth term but lost considerable ground to the far-right movement.

Once again, the euro performed positively against both Sterling and the US Dollar during the third quarter of the year (despite the overall weakness in September) on continued evidence of the improving economic recovery across the euro area. Moreover, the European Central Bank also gave clear indications that despite the continued low level of inflation, it will be discussing some form of reduction to parts of its stimulus measures at the next monetary policy meeting on 26 October.

One of the major highlights during the summer months was the strong recovery of over 20% in the oil price. Brent crude oil hit a 26-month high of just below USD60 per barrel towards the end of September following a faster-than-expected decline in inventories and on increased expectations of an extension to the production cuts by OPEC.

During the next three months (the final quarter of the year), equity, bond and currency markets will all be impacted by monetary policy developments as the three major central banks move towards monetary policy normalisation. The Federal Reserve has already given a strong indication of the possibility of another increase in interest rates in December coupled with measures to reduce the size of its balance sheet and the European Central Bank confirmed that during the next monetary policy meeting it is likely to unveil its plan to begin tapering its quantitative easing programme of €60 billion per month. The Bank of England may also announce an increase in interest rates by the end of the year.

Apart from monetary policy developments, financial markets will also be impacted in the coming months by further news regarding the tax reform in the US as well as political developments in Europe. Following the weaker-than-expected performance of Chancellor Angela Merkel in the German elections, there is still no new German government in place while the situation in Spain is also looking very unstable following the recent vote by the Catalans. Markets must also brace for the upcoming elections in Italy due by May 2018 at the latest.

Finally, it would also be noteworthy to gauge the movements in the markets once an announcement is made on the new Chairperson of the Federal Reserve. US President Donald Trump confirmed that an announcement on who will lead the Federal Reserve in 2018 and beyond could come in the next few weeks. Various sections of the international media reported that the President interviewed former Fed Governor Kevin Warsh and current Governor Jerome Powell in recent days. The current term of Chairperson Janet Yellen will expire in February 2018. During the 2016 presidential campaign, Donald Trump was critical of Janet Yellen and accused her of keeping interest rates too low in order to stimulate economy activity under former President Barack Obama.

International equity markets have continued to perform remarkably well during the summer months culminating in the longest bull market for several years. While some financial commentators continue to claim that a long-overdue correction will take place shortly, other analysts believe that despite the evident monetary policy normalisation due in the months ahead, interest rates will remain much lower than in previous economic cycles.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.