International equity markets suffer worst quarter since 2011

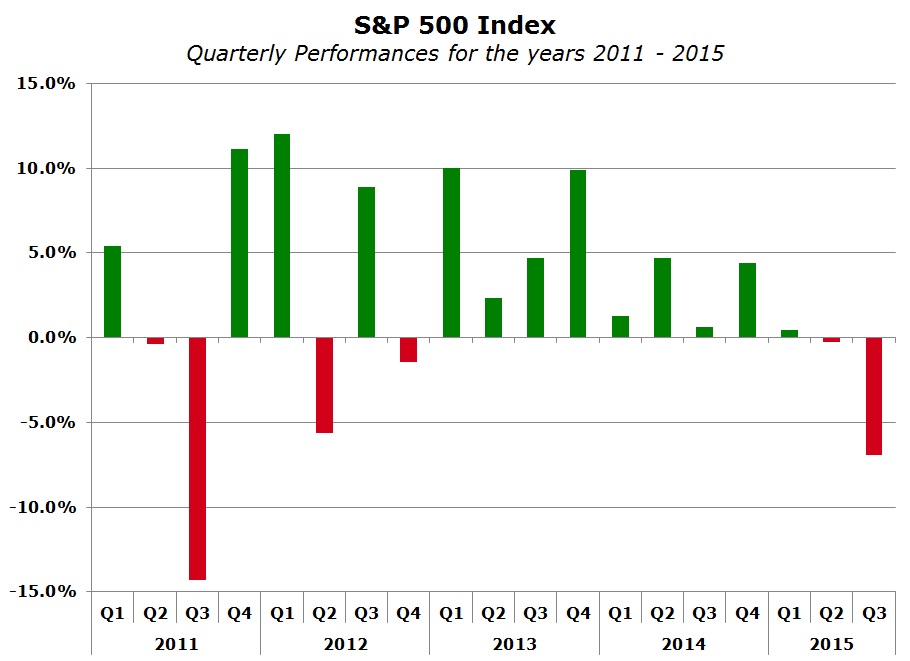

During the third quarter of the year, which came to an end last week, the main global equity markets went through their worst quarterly performance since 2011. The Chinese Shanghai Composite index registered the steepest drop with a decline of 28.6%. Other international indices also posted double-digit losses with Japan’s Nikkei 225 shedding 14.1%, Germany’s DAX 30 down 11.7% and Spain’s IBEX 35 decreasing by 11.2%. All other global equity markets posted sizeable declines with the Dow Jones Industrial Average and the S&P 500 in the US down 7.6% and 7% respectively. The UK’s FTSE 100 and France’s CAC40 also dropped by 7% during the summer months.

The losses suffered during the past three months sent most indices in negative territory on a calendar year to date basis. In fact, all indices are now in the red with the exception of France’s CAC40 which is still up 4.3% and surprisingly the Italian FTSE MIB, which despite the 5.2% loss in Q3, is still showing a 12% gain since the start of the year.

During July, the performance of global equity markets was a positive one across the board with the exception of the Shanghai Composite which lost 14.3%. The positive trend in the US, Europe and the UK was completely reversed in August. One of the major reasons for the heightened volatility and the August sell-off was the most recent news from China. Economic data again clearly indicated that the second largest economy in the world was experiencing growth fatigue after years of buoyant economic performance with double-digit growth rates in gross domestic product (GDP). The surprising manoeuvres by the People’s Bank of China in August to ease investors’ nervousness did not help. On the contrary, markets across the world declined rapidly after the Central Bank devalued the Chinese Yuan on 11 August, interpreting the move as a confirmation of the country’s renewed economic fragility.

The sell-off intensified on Monday 24 August, when the Chinese Shanghai Composite index dropped by 8.5% – the steepest daily decline since 2007. This sent other global equity markets into a tailspin. European indices dropped by around 5% on the day and the Dow Jones Industrial Average in the US declined by 1,000 points in the first few minutes after the market opened. The US equity market partly recovered by the close of Monday’s trading session but still ended the day around 3.6% lower. The market movements on 24 August were widely labelled “The Great Fall of China” or “China’s Black Monday” – a reference to the crash of October 1987.

“…investors must brace themselves for periods of continued volatility…”

Another major factor which impacted investor sentiment during the summer causing uneasiness and volatility across global equity markets was the uncertainty about whether the US Federal Reserve will raise its benchmark interest rate for the first time since June 2006. Following the start of the international financial crisis in late 2007, the Federal Reserve reduced interest rates from 5.25% to virtually zero in a period of only 15 months and then conducted three Quantitative Easing (QE) programmes – unconventional monetary policy measures aimed at increasing the money supply in order to boost consumer spending, reduce borrowing costs and address deflationary pressures. After the end of the QE programmes and positive economic growth as well as employment figures over recent months, many economists widely expected the first rate hike to take place during last month’s monetary policy meeting. However, rates were left unchanged again due to a weak inflation outlook, partly reflecting the declines in energy prices as well as the global economic and financial events which may restrain economic activity. Notwithstanding that the Federal Reserve expects inflation to gradually pick-up towards the 2% level over the medium term, several economists still differ whether the first hike in interest rates will take place in Q4 2015 or whether this will be postponed until 2016.

European equity markets moved in tandem with other global equity markets for most of the summer reflecting the developments across China and the impact on other emerging economies as well as the anticipated decision by the Federal Reserve. However, the Volkswagen scandal in mid-September led to a further downturn in the German DAX30 index which partially also led to a downturn across the other European markets. Germany is Europe’s undisputed export powerhouse and the surprising news tarnished other automakers and suppliers across this important industry. The DAX had been outperforming all major indices for the previous three weeks but then suffered major losses in the aftermath of the VW developments.

The volatility across the equity markets also spilled over into the bond and currency markets. In the midst of the mid-summer sell-off across equity markets and ahead of the decision by the Federal Reserve, bond yield movements across the eurozone were rather erratic from one month to the next. Yields still ended the quarter substantially lower than at the start of the summer leading to a mild recovery following the significant decline during most of Q2.

Across the currency market, the EUR vs USD exchange rate was largely flat over the three month period at USD1.11 but also suffered some wild swings reaching a low of USD1.081 on 20 July (a strengthening USD) and a peak of USD1.171 (a weakening USD and a strengthening of the EUR) on 24 August, ie on China’s Black Monday.

Despite the volatility and sell-off across global equity markets, the Malta Stock Exchange Share Index continued to outperform and advanced by a further 5.9% during the summer months following a strong interim reporting season. Seven equities registered strong double-digit gains led by Medserv plc with an increase of 31.4% and RS2 Software plc with a rise of a further 27.2%. Both equities reacted positively to the surge in profits during the first half of their current financial year and the bullish outlook as both companies aim for further international expansion.

This was the third consecutive positive quarter for the local equity market, culminating into a remarkable year-to-date uplift of 30.1%. Equally noteworthy is the fact that during the course of the summer which is generally a quieter period, €19.7 million worth of equities were traded. This represented a significant 55% increase over the corresponding period last year and the best ever Q3 since 2006. Trading activity across the equity market was particularly strong during July and August – the highest volumes since 2004 and 2006 respectively. On the other hand, only four equities performed negatively. The worst performer was International Hotel Investments plc with a decline of 8.1%, a significant underperformance compared to the rest of the equity market.

On the local front, as always, the final quarter of the year will be characterized by the publication of the annual financial statements of Bank of Valletta plc, the largest company listed on the MSE. BOV’s preliminary full-year results are generally issued by the end of October. Moreover, this year, other interesting developments are likely to materialise with two important Extraordinary General Meetings by Medserv plc and GO plc also during October. Additionally, GO plc should also be obtaining regulatory approval to spin off its property division into a separately listed company on the MSE. The final quarter of the year should also be characterized by higher activity on the primary bond market. Following this week’s €37 million bond issue by Hili Properties plc and the two new Malta Government Stock offerings, Bank of Valletta plc is also likely to tap the bond market by the end of the year following the recent announcement that they are seeking regulatory approval for a €150 million debt issuance programme.

On the international scene, the outlook for the final quarter of the year is dependent on economic data across the major economies with special attention to the slowdown across the Chinese economy. The erratic data emerging from the US in recent weeks is leaving many economists and analysts unsure whether the Federal Reserve will hike interest rates by the end of the year or, like the Bank of England, postpone until 2016. This is a major theme impacting equity, bond as well as currency markets. Following one of the longest bull markets in recent years across the international equity markets, investors must brace themselves for periods of continued volatility similar to that evidenced in recent weeks.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.