Italian Politics and the MGS market

The title of today’s article may confuse several Maltese investors as they would question the reason behind any impact on the prices of Malta Government Stocks from political developments in Italy.

Notwithstanding the various articles published over recent years where I explained that the movement in Malta Government Stock prices is dependent on a number of local and international factors, many investors still seem to fail to appreciate the connection between the MGS market and international developments. Notwithstanding the evident increase in volatility in MGS prices over the past 3 years and the negative performance throughout 2017, a large number of investors continue to believe that MGS prices always continue their almost uninterrupted ascent between 2012 and 2016, thereby resulting in relatively attractive levels of income and continued capital gains.

The developments in recent weeks is another timely reminder of the price risk (as opposed to credit risk) when holding MGS, especially those of a long-term nature.

Since the start of the year, the Italian parliamentary election was widely regarded by international economists as one of the major political risks to market stability in Europe in 2018. This was not only because Italy is the third largest economy in the EU, and therefore has an important weighting on the overall economic performance of the single currency area, but also because in recent years Italy has been the source of significant market turbulence. Many analysts openly expressed their concern about Italy over recent years due to the country’s high levels of public debt and overall weak fiscal position, chronic economic underperformance, elevated unemployment levels as well as a weak banking system with the country’s largest lenders holding a significant stock of non-performing loans (calculated as high as €360 billion some years ago). This also led to the well-documented bailout of the world’s oldest bank – Banca Monte dei Paschi di Siena.

Furthermore, due to its fragmented political system, Italy has also traditionally been associated with successive unstable governments which, in turn, makes the implementation of unpopular reforms more difficult. In fact, it is worth recalling that in the wake of the eurozone sovereign debt crisis, Italy reverted to an ‘emergency’ technocratic government, led by Mario Monti, to win back market credibility and confidence.

In view of the close link in the movements of bond yields across the various euro zone countries, developments in Italy cause major ripple effects across the single currency area, especially in the other ‘peripheral’ economies, namely Portugal, Ireland, Greece and Spain.

Although most of the ‘peripheral’ countries registered significant economic and fiscal progress in recent years (on the back of the improved economic and financial conditions across the world largely as a result of the unprecedented level of monetary stimulus by the world’s most influential central banks), the risks associated with contagion within the eurozone periphery still remained relatively high. This has been evident on various occasions in recent years, where instability in any one country had consequences across other sovereign bond markets.

Against this background, although the Central Bank of Malta never formally disclosed its pricing mechanism for MGS, it is once again very important to highlight the influence that international developments taking place across the euro area, and in particular in Italy and Spain, have on MGS prices.

Although Malta’s credit rating has improved notably in recent years and Malta is today classified as a ‘low debt’ country by the European Central Bank (together with Estonia, Latvia, Lithuania, Luxembourg, the Netherlands, and Slovakia), movements in MGS prices are still largely reflective of developments across several peripheral countries.

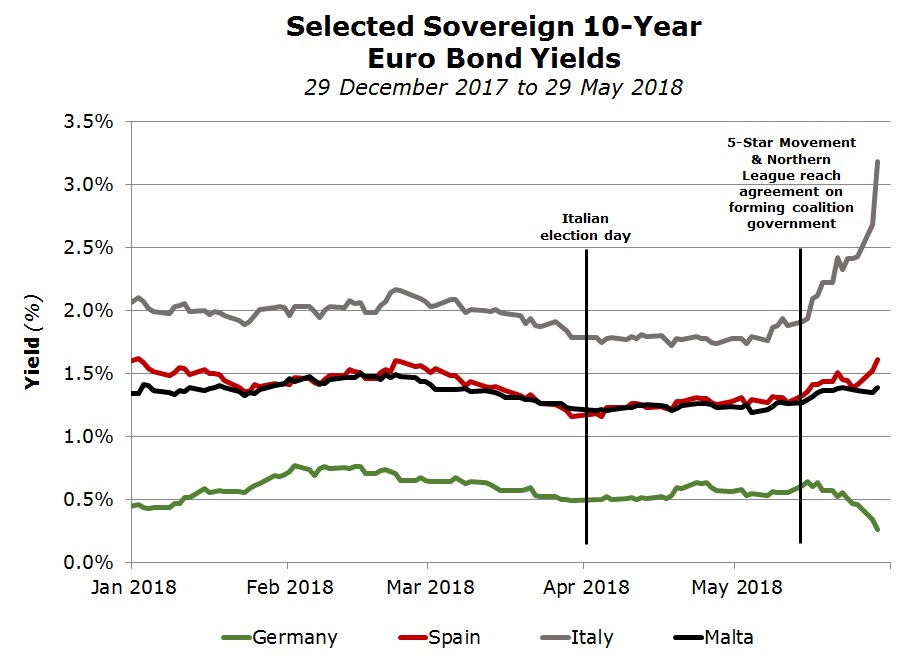

Following the inconclusive election in Italy which took place on 4 March 2018, the Northern League and the Five-Star Movement agreed to join forces and form a new government. The initial reaction in early March to the result of the election was a muted one across international bond markets with the 10-year Italian bond yield largely unchanged around 1.8%. However, over the past two weeks, this ‘alliance of convenience’ rattled bond markets in view of the generous electoral pledges made by these two parties, their high degree of populism, as well as the unclear policies to be adopted for achieving economic regeneration. Several international economists argued that if the various electoral pledges are implemented, it will lead to a further deterioration of Italy’s fiscal position.

The spike in the 10-year Italian yield towards the 3% level (representing a steep decline in bond prices since early March when the yield was 1.8%) intensified as the news emerged over the past two weeks that the Northern League and the Five-Star Movement were contemplating a request to the European Central Bank for a €250 billion write-down of the country’s debt. This is what prompted financial market participants to understand the gravity of the situation unfolding in Italy.

The reaction on the bond markets within a short period of time was notable despite the fact that the final agreement between the Five-Star movement and the Northern League no longer mentions the possibility of debt forgiveness.

The 10-year and 20-year Italian bonds yields surged to their highest levels in several years and the spread over German bonds (the difference in yields between the bonds of these two countries and a widely used measure of the risk investors attach to owning Italian debt) widened substantially as investors fled to the safe-haven German Bund.

As Italian bond yields surged (prices declined), bond yields of other peripheral countries also jumped notably over the past few weeks. Likewise, this negatively impacted MGS prices reflecting once again the underlying pricing mechanism used by the Central Bank of Malta when quoting its indicative bid prices on a daily basis.

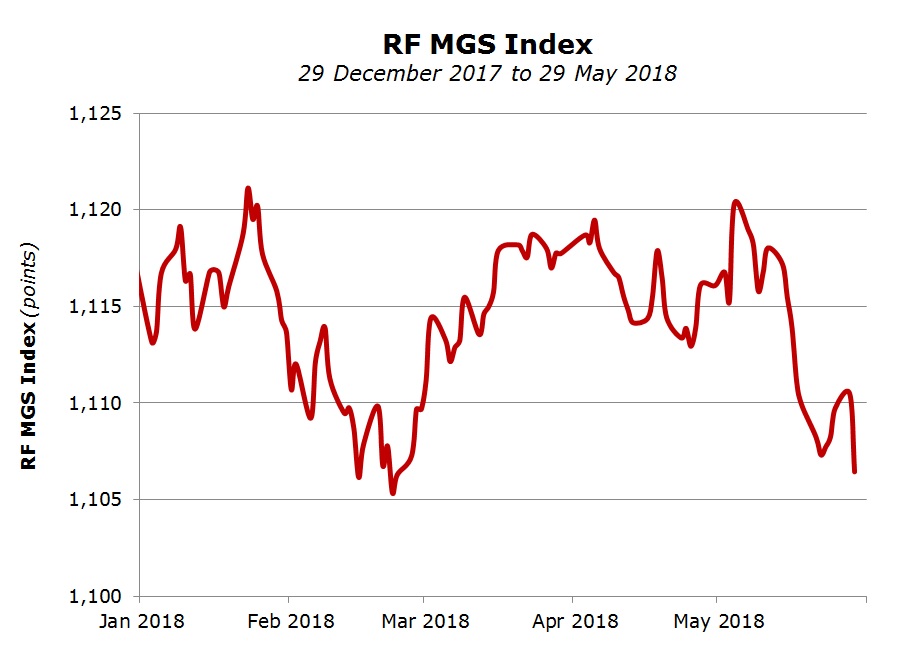

In fact, in a two-week period until 22 May 2018, the RF MGS Index – which gauges the daily movements in the indicative opening MGS bid prices quoted by the Central Bank of Malta – declined by over 1% in the process dropping to a three-month low on 22 May. The price movements of some MGS were notable with 13 individual securities dropping between 100 and 199 basis points each. These losses were even recorded at the shorter end of the yield curve, which is normally associated with a lesser degree of price volatility. By way of example, the shortest-dated MGS issued early 2017 – the 1.4% MGS 2023 – fell 106 basis points to 104.76% from 105.82% just two weeks earlier. Moreover, a further 12 securities each shed more than 200 basis points such as the 5.25% MGS 2030 (-236 basis points) and the 2.4% MGS 2041 (-246 basis points).

Amongst other factors, the political unrest in Italy also impacted the common currency as it dropped to $1.1650 against the US Dollar compared to $1.25 in mid-February – a decline of almost 7% in only 2 months which is a sizeable move for a major currency.

Moreover, to amplify the sudden turn of events across Europe, late last week a Spanish court gave its verdict in a long-running corruption trial involving past officials of the ruling People’s Party and in which the conservative prime minister Mariano Rajoy testified as a witness last summer. The court sentenced the party’s former treasurer to 33 years in jail, but it also found that Mr Rajoy’s party had benefited from kickbacks and the court also cast doubt on the prime minister’s evidence. As the news emerged, one political party demanded an immediate general election and another filed a no-confidence vote against the ruling party led by Mr Rajoy thereby increasing the chances of an early election in Spain.

The impact on the eurozone bond markets must also be viewed in the context that apart from the political unrest in Italy and Spain, recent economic data across the eurozone has pointed towards slowing economic growth. In fact, risk aversion was evident across financial markets as seen by the strong rally in German bond prices which are regarded as a safe haven across Europe. The 10-year Bund yield fell as low as 0.30% earlier this week (a level not seen in several months) compared to a 2018 high of almost 0.81% recorded in early February.

In view of the renewed heightened political uncertainty in Italy and Spain and the continued impact on MGS prices, it is once again important to re-iterate that local investors need to keep abreast of international developments to ensure that their investment portfolios are adequately structured in the light of such developments and always taking into consideration their investment objectives and risk appetite.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.