MIA’s share price rallies as dividend surges

Last week, Malta International Airport plc published its 2014 financial statements and while the double-digit growth in pre-tax profits was expected given the news earlier this year that passenger figures increased by 6.4%, the extent of the increase in the final dividend at +77% was very much unpredicted.

The airport operator has a straight-forward business model with good visibility of future income streams. The number of passenger movements remains the most important determinant for the Company’s operations and the monthly passenger traffic announcement provides the market with valuable information which can be used to gauge the Company’s ongoing financial performance. Over recent years although passenger movements climbed from one record to the next almost on a monthly basis, non-aviation income activities also became a serious contributor to overall revenue. In fact, income from non-aviation activities accounted for almost 30% of overall revenue during 2014 notwithstanding the 8.1% growth in aviation income.

Revenue from the ‘Retail and Property’ segment, also referred to as non-aviation income, improved by 11.8% to €19.1 million during 2014. The SkyParks Business Centre was among the main contributors to the increase in income from the retail and property segment in the last few years. In 2014, MIA reported that rental income from SkyParks exceeded expectations and amounted to €2.6 million. However, the largest contributor to non-aviation income is the revenue from the concessionaires within the air terminal while fees earned from the car parking facilities and the use of the VIP lounge are other important sources.

“…the extent of the increase in the final dividend at +77% was very much unpredicted.”

Market observers and financial analysts also ought to have taken note of some other strong financial indicators that emerge from the financial statements of MIA. Earnings before interest, tax, depreciation and amortisation (EBITDA) improved by 13.2% to €33.8 million with the EBITDA margin climbing to 52.6%. The progress achieved by the company in the past few years is evident from the strong increase in EBITDA as this surged by 63.4% between 2009 and 2014, equivalent to an increase of 12.7% per annum.

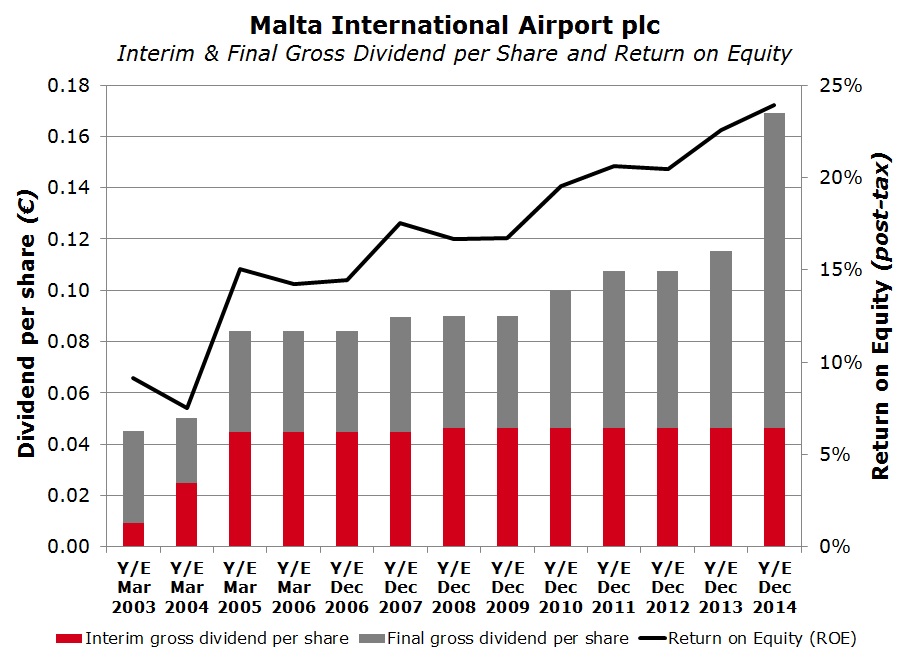

The return on equity (ROE) is among the most common used ratios by financial analysts worldwide to gauge a company’s performance. This profitability ratio is calculated by dividing profits after tax with shareholders’ funds and measures the amount of profit a company generates with the money shareholders have invested. Essentially, it shows whether management is growing the company’s value at an acceptable rate of return. MIA has consistently registered double-digits returns on equity for the past eleven years and this increased to just below 24% during 2014 – an impressive figure which is not matched by any of the other companies listed on the Malta Stock Exchange and also ranks well amongst other international airport operators. Although it is not appropriate to compare such ratios across different industries, market observers should take note of the trends across specific sectors. As an example, the ROE’s across the banking sector are in decline both as a result of the challenging environment which is resulting in weaker profitability as well as due to the regulatory requirements to maintain increased levels of capital. HSBC Bank Malta plc published its financial statements last week and this showed that the ROE dropped to 7.8% in 2014 from over 22% in 2008.

While the improving trend in MIA’s financial performance and profitability ratios has been steady over recent years, the real surprise last week was the extent of the increase in dividends. MIA reported that its Board of Directors recommended the payment of a final gross dividend of €0.1231 per share (net dividend of €0.08 per share) representing a 77.8% increase over the final gross dividend paid out in respect of the previous financial year. Shareholders as at close of trading on 16 April 2015 will be eligible to receive this dividend which will be paid by not later than 8 June 2015 subject to shareholder approval at the upcoming Annual General Meeting taking place on 20 May 2015. MIA distributes a semi-annual dividend to its shareholders and in September 2014, the company paid a gross dividend of €0.0462 per share. The interim dividend has been unchanged for several years and the final dividend is normally amended to at least partly reflect the financial performance of the Company during the entire financial year. Following the strong upturn in profits, the final dividend has almost tripled since 2009 from €0.0438 to €0.1231 per share.

The total dividend in respect of 2014 of €0.1693 per share (+46.6%) represents a dividend payout ratio of 88.5%. While this may be surprising to many following the more conservative distribution in 2011, 2012 and 2013, such a decision is comprehensible given the Company’s balance sheet structure and current market circumstances. As at 31 December 2014, MIA’s cash balance amounted to €30.7 million and while the final dividend payment in June will represent a cash outflow of €16.7 million, the cash flow generation is strong and amounted to almost €20 million in 2014 so a large part of this cash buffer will be replaced in the months ahead. Moreover, the gearing level has also improved substantially during the years as net debt dropped to €28.8 million in 2014 from over €51 million in 2009 while shareholders’ funds strengthened to €73 million. The conservative leverage ratio provides the company with the ability to take on additional debt should the remaining cash buffer after the dividend payment prove to be insufficient to fund the next major development, possibly the long-awaited property investment often referred to as SkyParks 2.

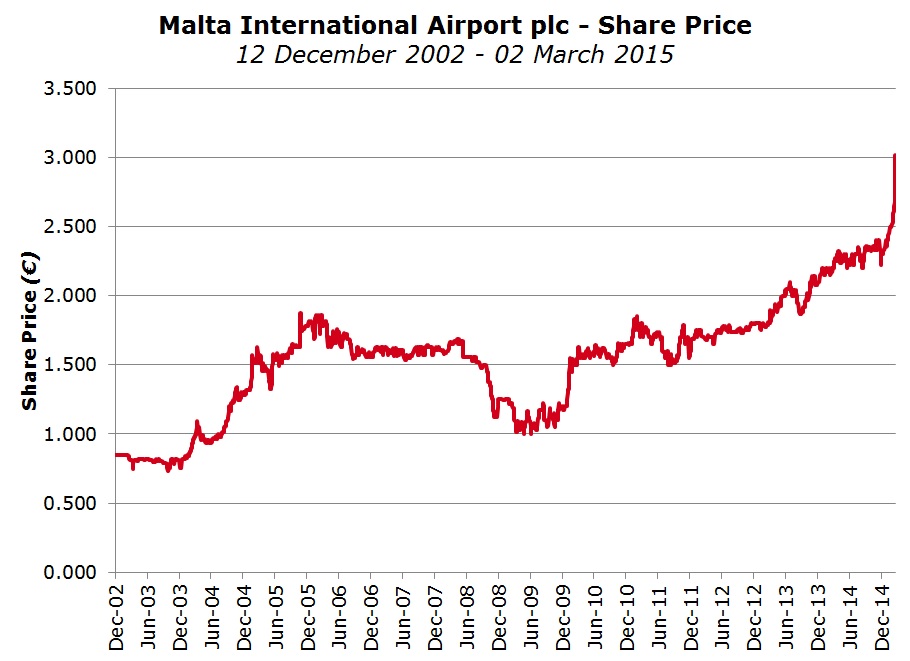

The local equity market has clearly become more responsive to company announcements and overall market circumstances, especially news related to dividend distributions. In fact, the reaction in the market to the dividend announcement of MIA was immediate and very strong. The equity climbed by 16.1% over the past week on strong volumes to €3.05 with the share price reaching new record levels almost on a daily basis. This upturn spearheaded MIA to a year-to-date increase of 29.8%, the second best performer this year. MIA is the only company on the MSE with three different classes of shares. Although only the ‘A’ shares are listed (the ‘B’ shares representing 40% of the issued share capital held by the Malta Mediterranean Link Consortium were not listed at the time of the Initial Public Offering in October 2002 and there are only ten ‘C’ shares held by the Government of Malta), the market capitalization should be taken calculated using all the shares in issue amounting to 135.3 million. Based on the total issued number of shares, the market capitalization of the airport operator, of just over €412 million, places MIA as the third largest company on the MSE.

Company executives on the one hand ought to remain firmly focused of growing their business activities while at the same time adjust their funding strategy based on changing market dynamics. Given the current interest rate environment and expectations that eurozone interest rates will remain at such low levels for a few more years before possibly edging up slightly in the latter part of this decade, companies should take advantage of this situation and seek debt funding to partly fund large investments and not resort solely to internally generated funds in order to retain an optimal capital structure with an appropriate mix of equity and debt funding. In the current circumstances, companies could lock in an attractive interest rate on new borrowings for the coming years while also meeting shareholder expectations through regular and growing dividend payments.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.