Mid-summer sell-off across international equity markets

Investors who regularly follow international financial developments or who have exposure to international equities must be well aware of the significant declines across the major equity markets over recent weeks.

The sell-off intensified at the beginning of last week. In fact, on Monday 24 August, the Chinese Shanghai composite index dropped by 8.5% – the steepest daily decline since 2007. This sent other global equity markets into a tailspin. European indices dropped by around 5% on the day and the Dow Jones Industrial Average in the US declined by 1,000 points in the first few minutes after the market opened. The US equity market partly recovered by the close of Monday’s trading session but still ended the day around 3.6% lower. Monday’s events were widely labelled “The Great Fall of China” or “China’s Black Monday” – a reference to the crash of October 1987.

The wild gyrations continued throughout the week, although many European and US indices recovered most of Monday’s losses while the Shanghai composite index ended the week down 11%.

Following the extreme volatility on a daily basis last week amid the steepest stockmarket sell-off in several years, many would rightly question the reason behind the contagion across the globe from China’s stockmarket downturn.

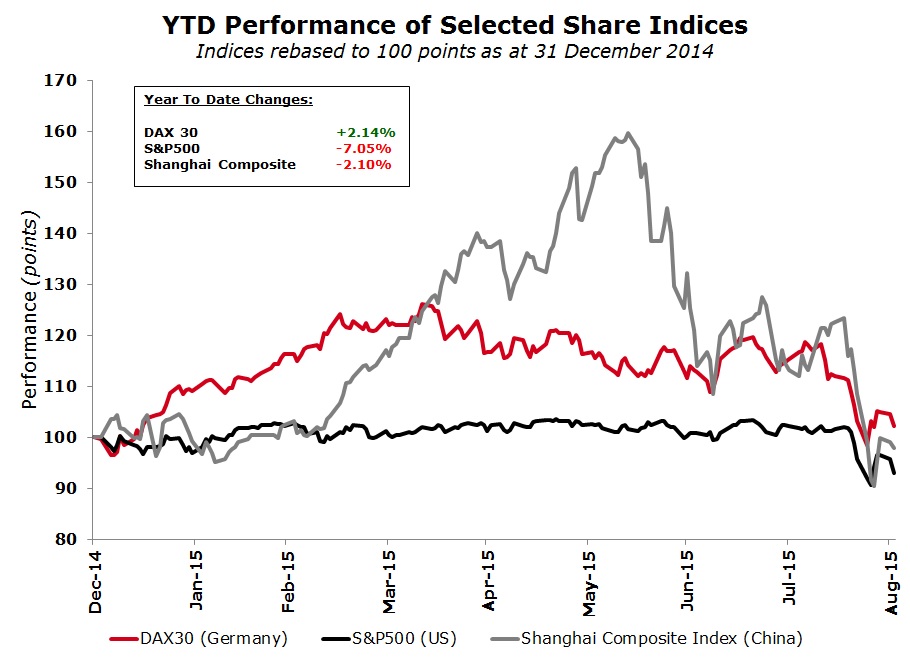

At the outset, it is worth mentioning that the overheating of the Chinese equity market had become rather evident for many months as the Shanghai composite index had climbed by 150% during a 12-month period between June 2014 and mid-June 2015 despite clear indications for quite some time of a slowdown in Chinese economic growth following double-digit growth on an annual basis in earlier years. Statistics indicate that most of the trading activity across the Shanghai equity market was taking place by a growing retail investor base who were borrowing increasing amounts of money to purchase additional shares and grow their investment portfolios.

The Shanghai composite index tumbled by 24% between 15 June 2015 and 11 August 2015 as a series of interest rate cuts by the People’s Bank of China and other intervening measures failed to stem the sudden reversal of the debt-fuelled equity market bubble. These measures included a reduction in the stamp duty on share transactions and liberalizing pension fund rules allowing an allocation of up to 30% in domestic equities.

In recent weeks, although many news channels and internet portals were giving increasing prominence to the developments across China on a more regular basis, the event that possibly prompted the slump was the devaluation of the Yuan on 11 August. The decision by the People’s Bank of China to intervene in the market leading to a 2% devaluation of the Remnimbi (or Yuan) against the USD was another stark warning that the economic slowdown was indeed gathering momentum. In fact, Chinese exports declined by 8.3% in July, their largest drop in 4 months. The Yuan, which until recently was loosely pegged to the US Dollar, had been strengthening against other currencies in line with the US Dollar over recent months thereby resulting in Chinese exports becoming relatively more expensive. The devaluation was intended to increase the attractiveness of exports giving the economy a much needed pick-up. On the other hand, a weaker Yuan makes European and US exports to China more expensive for the Chinese consumer leading to a reduction in demand for US and European products.

Moreover, a few days after the surprise devaluation, data on the manufacturing sector indicated weak growth once again while the market was also disappointed on lack of further measures by the People’s Bank of China over the weekend of 22 to 23 August in response to the weak manufacturing data.

However, the People’s Bank of China did lower interest rates by a further 25 basis points the day after the significant sell-off of last Monday 24 August. Interest rates have now dropped to 4.86% compared to an average of 6.4% between 1996 and 2014. This was the fifth interest rate reduction since November 2014. The reduction in rates in recent months was intended to increase bank lending and curb the decline in share prices which alarmed several investors around the globe. China’s central bank also reduced its reserve requirement ratio by 0.5%, effective from the 6th of September, and injected approximately the equivalent of €19.4 billion into the country’s financial system through a short-term liquidity adjustment operation.

These latest measures, together with the comments from Mr William Dudley, the head of the Federal Reserve Bank of New York, helped stem the decline across European and US equity markets last week although intra-day volatility was significant and widely compared by analysts to the reaction in the stockmarket in the midst of the eurozone crisis in 2011 and in the aftermath of the bankruptcy of Lehman in September 2008.

Mr Dudley dampened expectations of a September interest rate hike by the Federal Reserve as he commented that the case for an increase had become “less compelling”.

Although by the end of last week the major European and US equity markets managed to recover most of the losses sustained during the day on Monday, the sell-off in recent weeks was pretty significant and many markets entered into correction territory after the worst monthly declines for several years. In Europe, the DAX fell by 9.3% during the month of August, the CAC40 shed 8.5% and the UK’s FTSE 100 fell by 6.7%, whereas the S&P 500 in the US fell by 6.3%. Meanwhile, the Shanghai composite index slumped by 12.5% and the near 23% fall in the index during last week is the largest weekly decline since 1996.

Last week’s events not only impacted equity markets but also led to increased levels of volatility across currency markets. Many were probably surprised at the sudden appreciation of the euro against the US Dollar at the start of the week. Normally the US dollar strengthens during periods of risk-aversion. However, the US Dollar weakened significantly against the euro exceeding the rate of USD1.16 as the possibility of a September rate hike initially faded. However, the greenback rebounded to below the USD1.13 level against the euro following the upward revision in the US GDP growth rate to an annualized 3.7% during the second quarter of 2015.

Following the extreme levels of volatility across the equity and currency markets, many investors are questioning whether the developments in China were merely an overdue correction across the market or whether this could represent the start of a more-prolonged downturn. While the growing impact of the Chinese economy cannot be under-estimated, it is very hard to say what the long-term repercussions will be. It is safe to say that the global growth outlook is at a difficult juncture with growth in many regions remaining aneamic despite support from the major central banks over several years. Moreover, with the prospect of an interest rate hike by two of the major central banks (the US Federal Reserve and the Bank of England), the outlook is more challenging. What is probably more certain is the increased volatility with occasional bouts of turbulence based on newsflow from China, the timing and speed of interest rate hikes by the US Federal Reserve and to a lesser extent the Bank of England as well as developments from the Greek political crisis in the run up to the upcoming election. Investors should adequately position themselves for this heightened volatility and to be on the lookout to possibly increase exposures to certain companies that may seem to have been oversold during recent times of panic selling.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.