Missing great expectations

At the European Central Bank meeting held in Malta on 22 October, President Mario Draghi had signaled additional monetary stimulus at its next meeting in December in order to tackle deflationary pressures.

Mr Draghi had mentioned a possible extension to the asset purchase programme and hinted at the possibility of a further cut in the deposit rate from the level at the time of -0.2% in a further bid to counter downside risks in both inflation and economic growth projections.

Ever since the Malta meeting, various speeches by the ECB President and other executive members of the ECB had indicated that more stimulus was urgently needed since they spoke about their growing concern about the low rate of inflation across the Eurozone and risks to the economic recovery. In a speech on 20 November, Mr Draghi had said that the ECB would do what is necessary “to raise inflation as quickly as possible”. As such, market expectations had becoming increasingly pointing towards an increase in the Quantitative Easing programme.

Some international economists and financial analysts had mentioned the possibility that the Quantitative Easing programme will increase from the current level of €60 billion per month to between €75 billion and €80 billion per month coupled with a 20 basis point cut in the central bank’s deposit rate to -0.4%.

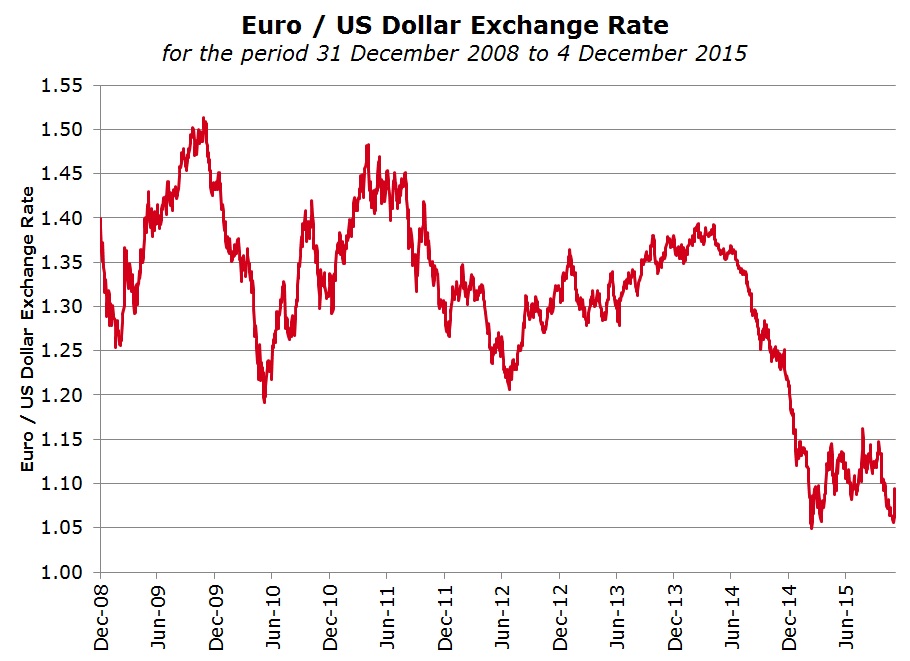

This led many investment banks to predict a further weakening of the euro. Most economists had said that the euro could drop to parity against the US Dollar for the first time since 2002 and weaken further to USD0.95 by the end of 2016.

The much anticipated final ECB meeting of 2015 took place last Thursday. The ECB announced a reduction in its deposit rate to -0.3% but kept the main refinancing rate steady at 0.05%. Moreover, the ECB maintained its QE programme at €60 billion per month but extended it by a further six months, from September 2016 to March 2017 (or beyond, if necessary). The ECB also broadened the list of eligible securities that may be purchased by the ECB to include regional and local government bonds.

The actions by the ECB were less than widely expected and the disappointment across global financial markets was immediately evident. Although the ECB President stated that “abundant liquidity will continue for a long, long time”, bond yields jumped (bond prices declined), the euro strengthened and equity markets declined.

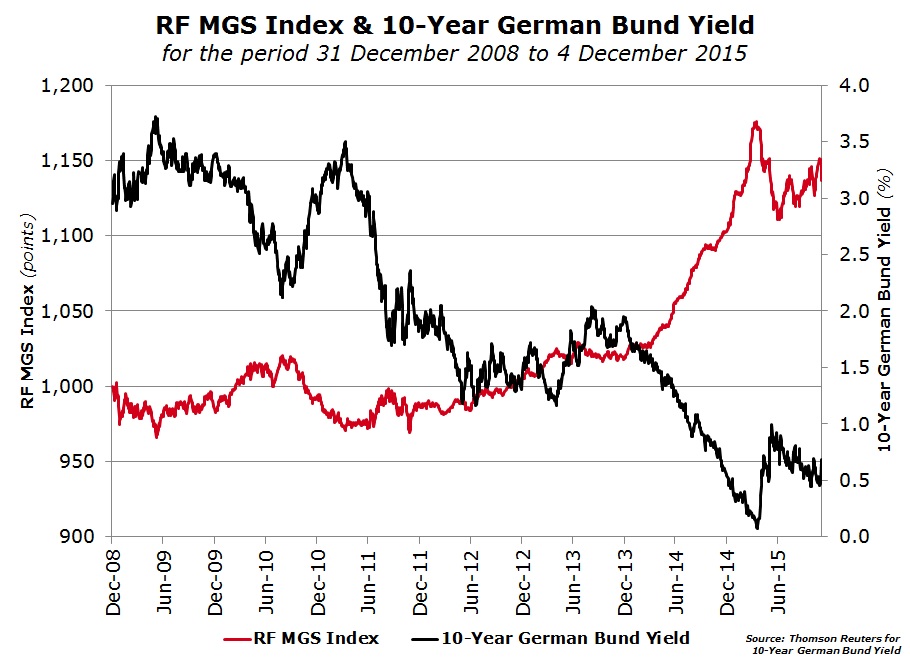

The 10-year german bund yield unexpectedly jumped from 0.47% on Thursday morning to 0.68% after the announcement – one of the biggest one day moves in a long time. This was reflected in the movement in Malta Government Stock prices on Friday morning. The Rizzo Farrugia MGS Index dropped by 1.2% on Friday to a 3-week low as all MGS’s with a maturity above 2024 dropped between 200 and 300 basis points.

In the currency markets, the euro strengthened by more than 4% against the US Dollar surpassing the USD1.09 level – the biggest daily rise in the euro since 2009.

Equity markets also reacted negatively with the German DAX 30 Index and France’s CAC40 both sliding by 3.6%, the worst decline since 24 August when equities had tumbled in reaction to the sell-off across China.

Markets were clearly anticipating a sharper drop in deposit rates and an increase in the QE programme above €60 billion per month.

Mr Draghi had another opportunity to clarify Thursday’s ECB policy decision during a speech at the Economic Club of New York on Friday evening. The President of the ECB sought to reassure financial markets as he stated that the European Central Bank would intensify efforts to support the eurozone economy and boost inflation toward its 2% goal if necessary. Mr Draghi insisted that "there is no particular limit to how we can deploy any of our tools", within the ECB’s mandate.

The ECB chief’s comments highlighted that the latest stimulus package isn’t necessarily the last one, particularly if officials conclude that their inflation target of just under 2% remains out of reach. He re-iterated that the ECB is constantly monitoring economic and financial conditions and stated “we are of course ready at any time to adjust this array of tools to secure the return of inflation to our objective without undue delay.”

The decision by the ECB not to increase the QE programme to above €60 billion per month could also be possibly due to the improvement in the economic outlook although new inflation forecasts were weaker with an inflation rate of 1% in 2016 and only 1.6% in 2017.

Other commentators argued that the decision by the ECB reflected the need to maintain some further stimulus for possible use in the future, while others claimed that this was due to opposition for more aggressive easing by some members on the ECB Governing Council including the head of Germany’s Bundesbank.

Last week’s events and the reaction across bond, equity and currency markets were a stark reminder of the volatility across financial markets and the influence of communications by the major central banks, particularly when interest rates are near zero. The ex Chairman of the Federal Reserve Ben Bernanke recently commented in a book he published that “monetary policy is 98% communication and only 2% action”.

All eyes are now on the statement by the Federal Reserve due on 16 December where interest rates in the US are expected to rise for the first time since 2006.

The chairperson of the Federal Reserve Janet Yellen again stated that the US economy had been improving in recent weeks paving the way for the long-awaited rate lift off. However, Janet Yellen stressed that the Fed will move slowly and cautiously in 2016 as "even after the initial increase in the federal funds rate, monetary policy will remain accommodative".

If rates in the US do indeed increase, the monetary policy divergence between the US and Europe will be a key theme for 2016 and investors will need to position their investment portfolios accordingly to reflect this new reality.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.