Monitoring bond issuer developments (4)

There are three issuers within the maritime sector that have bonds listed on the Malta Stock Exchange. However, each of these companies are very different indeed since they operate within different areas of the wide-ranging maritime industry. It is however very important to track their financial performances and their financial metrics so that investors can gauge the level of risk that they will be undertaking when acquiring an exposure to such companies.

Virtu Finance plc is one of the newcomers to the bond market this year. The company is the finance arm of Virtu Maritime Limited (the guarantor) which in turn is the parent and holding company of a number of subsidiaries principally engaged in the ownership and operation of two large high-speed vessels, namely the HSC Jean De La Valette and the HSC Maria Dolores. Currently, the Jean De La Valette provides transportation services to passengers, vehicles as well as heavy commercial cargo vehicles between Malta and Pozzallo, Sicily while the Maria Dolores is chartered to a third-party entity that operates a route between Tarifa, Spain and Tangier Ville, Morocco. Revenue from the Malta-Sicily route operated by the Jean De La Valette accounts for over 80% of overall group revenues.

The €25 million bond issued by Virtu Finance very recently is earmarked for part-financing the €75 million acquisition of a new high-speed vessel which, upon commencement of operation in mid-2019, will complement the Jean De La Valette along the Malta-Sicily route. Virtu Holdings Limited, which is the ultimate holding company of the group, has been successfully operating the Malta-Sicily route for almost thirty years.

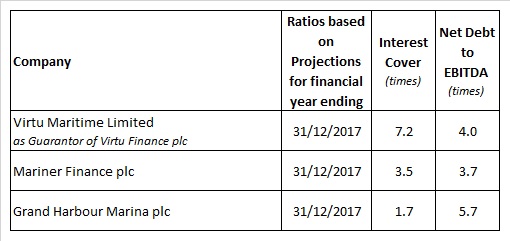

Along the years, Virtu has managed to create and increase its business considerably. In fact, over the past ten years, the number of passengers using Virtu’s services to travel to Sicily expanded by a compound annual growth rate (“CAGR”) of 5.4%. In addition, the aggregate number of vehicles (both light passenger cars and heavy commercial cargo vehicles) carried by Virtu along the Malta-Sicily route grew at a CAGR of 16.8% per annum during the 10-year period between 2006 and 2016. The success of Virtu is also reflected in a very profitable track record. The Prospectus issued a few weeks ago shows that the Virtu Maritime Group generated revenues of €32.7 million in 2016 and EBITDA of €13.8 million giving an interest cover of just above 9 times and a net debt to EBITDA multiple of 2.7 times. However, the Virtu Maritime Group is increasing its borrowings substantially between 2017 and 2018 to fund the acquisition of the new vessel. Accordingly, one needs to analyse the credit metrics based on the impact of the new borrowings as well as the potential benefits arising from the new ferry as from 2019. Virtu is anticipating that during the current financial year ending 31 December 2017, revenues and EBITDA will improve marginally to €32.8 million (+0.4%) and €13.9 million (+0.7%). As the group took on additional debt in 2017 to part-finance the acquisition of the new high-speed vessel, the interest cover and the net debt to EBITDA multiple for the current financial year ending 31 December 2017 are expected to revise to 7.2 times and 4 times respectively.

Meanwhile, more substantial growth is projected for 2018 mainly driven by the expected increased business in the transportation of trucks and other heavy commercial cargo vehicles. Revenues are expected to increase by 5.3% to €34.5 million and EBITDA is projected to grow by 7.7% to just under €15 million. As a result of this anticipated improvement in the financial performance for 2018, the interest cover should rise again to 8.2 times while the net debt to EBITDA multiple is projected to improve to 2.8 times. Unfortunately, the FAS did not provide any information about the expected financial performance in 2019 once the new vessel commences operations. On the one hand, the group should generate additional revenue from the sizeable increase in capacity on the Malta-Sicily route but on the other hand, it will also have to support the additional bank debt of €40 million that will also be used for the acquisition of the new vessel. Hopefully these figures will be provided in the next Financial Analysis Summary due by mid-2018.

Mariner Finance plc is involved in the ownership and/or management of ports, storage and logistics facilities outside Malta. Mariner Finance does not carry out any trading activities and acts as the holding company as well as a finance and investment company for its two operating subsidiaries – SIA Baltic Container Terminal (BCT) and SIA Equinor Riga (EQR). BCT is by far the largest financial contributor to the group’s operations as it carries out port and related services in the port of Riga, Latvia over which it holds a concession licence until April 2047. Meanwhile, EQR owns and operates a 3,880-square metre commercial and office building in Riga, Latvia. Mariner’s clients include some world-renewed container shipping lines that are engaged in the business of transportation of a wide array of goods and commodities by sea.

Despite the unfavourable environment experienced across the container shipping industry in recent years, Mariner still managed to generate a strong financial performance. 2016 revenues amounted to €15.5 million with EBITDA of €8.6 million giving an interest cover of 4.3 times and a net debt to EBITDA multiple of 3.8 times. During 2017, Mariner is expected to register a 3.1% increase in revenues to a three-year high of €16 million resulting in an EBITDA of €8.82 million. The interest cover is expected to remain unchanged at 3.5 times in 2017 while the net debt to EBITDA multiple is expected to improve marginally to 3.7 times.

Mariner had approached the market in June 2014 with a €35 million bond issue not only to refinance bank borrowings but also to fund other potential investments within its core business activity, namely the ownership and/or management of ports, storage and logistics facilities outside Malta. Unfortunately, Mariner has not yet managed to acquire another port terminal over the years. Hopefully, Mariner Finance will succeeed to operate other ports in the future thereby extending its geographical presence beyond Latvia. Although Mariner Capital has equity stakes in two other international ports, these do not form part of Mariner Finance and therefore bondholders are so far exposed only to the Latvian operation.

Grand Harbour Marina plc owns and operates (under a 99-year sub-emphyteusis agreement) the Grand Harbour marina in Vittoriosa and also owns a 45% equity stake in the company IC Çeşme Marina Yatirim, Turizm ve Isletmeleri Sirketi, which in turn owns and operates a marina located in the Turkish resort town of Çeşme. Both marinas are operated and managed in association with Camper & Nicholsons. GHM issued a new bond earlier this year mainly to the refinance the early redemption of the company’s first bond issue. However, GHM also raised additional funds for further waterside investments within the Grand Harbour marina as well as other possible investments that may fall within its wider objectives. GHM had listed its shares on the MSE in 2007 and during the first half of the last ten years, GHM’s financial performance was very volatile reflecting the timing of long-term berth licence sales which generate large one-off positive impacts as opposed to the more regular income generated from ongoing short-term berth leases. In view of the changing market dynamics following the international financial crisis which adversely affected the market for long-term berth licences, GHM’s focus turned towards improving the operational performance of the company via the annual leases of pontoon berths, increased visitor traffic for short-term superyacht berth rents and the reconfiguration and enlargement of the rentable areas within the marina in Malta. GHM succeeded in growing its EBITDA in each of the last four financial years helping the interest cover to rise above 2 times during 2016 and the net debt to EBITDA ratio to 6.3 times from above 10 times in previous years. The Financial Analysis Summary annexed to the recent Prospectus shows that GHM is expecting to register a weaker performance in 2017 as revenues are expected to decrease by 2.1% to €4.14 million and EBITDA is anticipated to drop by 9.8% to €1.39 million bringing the interest cover back down to below 2 times.

GHM is currently undergoing the first phase of the reconfiguration process within the Grand Harbour marina which will create additional berth spaces. In the years ahead, GHM may also carry out a second phase of the reconfiguration process within the Grand Harbour marina which could take place in 2019 at a cost of €2.7 million. It would be interesting to gauge the impact of these changes to the marina on the financial performance of the company. The Prospectus also noted that GHM may pursue other potential growth initiatives, such as the acquisition of one or more existing marina management businesses or the acquisition of other marinas particularly within the Mediterranean basin (including co-investment opportunities with Camper & Nicholsons). Following the announcement last month of the involvement of two new directors of GHM representing the indirect interests of First Eastern (the largest ultimate beneficiaries of the majority shareholder of GHM), it would be interesting to see whether any of these various initiatives will indeed be undertaken.

Given the predominance of companies involved in the property, financial and tourism sectors, bond issues from companies in other economic sectors such as the maritime industry are important for the local capital market. Hopefully, other companies within this sector understand the benefits of raising finance from a wide array of investors and will likewise carry out similar fund-raising exercises in the years ahead.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.