PG maintains strong performance despite closure of Zara Sliema

On 19 December, PG plc published its interim financial statements for the six-month period between 1 May and 31 October 2018. Despite the closure of the Zara store in Sliema for most of the period under review, overall revenue of the PG Group grew by 5% to €51.2 million.

The turnover from the Zara and Zara Home franchise operations decreased by 35% to €4.9 million mainly due to the closure of the main outlet in Sliema in view of the expansion and refurbishment project. In fact, normal operations at the Sliema outlet were effectively brought to a close in mid-June and the store closed completely in mid-July following an extensive sale to dispose of all clothing stock. As such, the Zara store in Sliema was open for only 6 weeks.

On the other hand, PG registered a growth of 12.4% in revenue from the supermarkets and associated retail operations to €46.3 million. This increase was achieved as the Pama Shopping Village continued to grow in popularity whilst encouraging levels of growth were also being registered at the PAVI Shopping Complex in response to the ongoing refurbishment program. The improved performance of both the PAMA and PAVI shopping villages also led to a corresponding increase in the rental income from third-party tenants within the shopping villages.

PG convened a meeting for financial analysts shortly after the publication of the interim financial statements. PG’s Chairman John Zarb gave a detailed overview of the financial results and the overall operations over recent months.

Mr Zarb indicated that the PAMA shopping village registered a 15% growth in the overall level of sales while an increase of 8% was seen from the PAVI shopping village but this growth rate was accelerating after the end of the financial period on 31 October as a result of the benefits from the refurbishment programme which augurs well for the Group financial performance in the second half of the year.

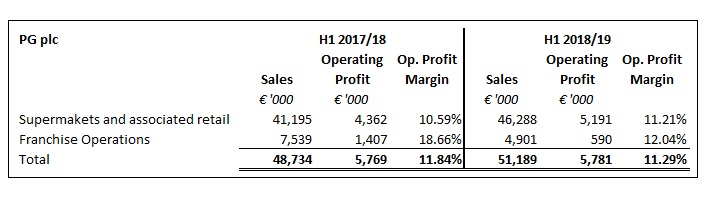

PG’s operating profits in the six months to 31 October 2018 were marginally unchanged at €5.8 million, representing an operating profit margin of 11.3%. The Chairman remarked about the encouraging profit margins with added efficiencies at the supermarkets offsetting the impact of lower clothing sales on which a higher profit margin is normally earned. In fact, in the previous financial year which ended on 30 April 2018, the operating profit margin of the supermarkets amounted to 10.4% while the Zara franchise operations was 18.2%. However, during the first half of the 2018/19 financial year, while the margin of the franchise operations declined to 12% due to the effect of the refurbishment and the extensive sale ahead of the store closure, the supermarkets business improved its margin to 11.2%.

Profits before tax were also largely unchanged at €5.5 million while due to a lower tax expense, the profit after tax for the first six months of the year improved by 12.1% to €4.1 million.

Mr Zarb made reference to the last meeting with financial analysts at the end of August to discuss the 30 April 2018 annual financial statements wherein he had indicated that the Group was expecting a weaker performance during the first half of the year with a recovery during the second half of the year as a result of the opening of the Zara store in Sliema. In fact, at the time, the Chairman had also explained that PG had hoped to maintain an overall stable level of profits between the 2017/18 financial year and the current financial year to 30 April 2019.

However, during the meeting on 19 December, PG’s Chairman stated that given that the profits in the first half of the current financial year are higher than expected and the fact that the Zara store opened on time on 28 November, the Group is now more optimistic on achieving an improved financial performance compared to the pre-tax profits of €11.1 million in the previous financial year to 30 April 2018.

During the presentation to financial analysts, the Chairman also shared the figures achieved during the first few weeks of the opening of the new Zara store. Mr Zarb explained that between 28 November and 16 December, overall revenue of the Zara franchise outlets totalled €1.91 million compared to €1.13 million during the same period last year representing an increase of 69%. The Chairman admitted that while this exceptional performance cannot be maintained throughout the year, the “early indications are that the performance may exceed our targets”. It was also revealed that PG had assumed that the Zara franchise business will register a 30% growth in revenue as a result of the substantial increase in the size of the new store.

The Zara franchise operations had generated overall revenue of €16.5 million during the last financial year so a 30% growth would equate to overall revenue of almost €22 million during a full twelve-month period. With revenue of €4.9 million from franchise retail operations in the first half of the year to 30 October 2018, and assuming €11 million in revenue between 1 November 2018 and 30 April 2019, the PG Group should manage to match last year’s revenue of €16.5 million despite the closure of the Zara store in Sliema for 5 months of the year. Should this be the case, it would be a remarkable achievement.

Although the commentary within the directors' report published on 19 December made reference on two occasions to ‘new growth opportunities’, both the Chairman as well as the CEO Charles Borg claimed that there is nothing concrete as yet but the Group is interested in pursuing new investments apart from the eventual redevelopment of the ‘United Macaroni’ factory. The CEO admitted that as yet there is no site earmarked for a third shopping village but the Group would eagerly evaluate such a proposition since it is their belief that PG needs a fourth operational asset in line with its long-term ambitions.

In the announcement and during the analyst meeting, no mention was made of the overall shareholder returns being generated. It is worth recalling that during the last financial year to 30 April 2018, the return on equity was of 24.9% while the annualized return on equity based on the interim financial statements published last week is of 24%. This high return augurs well for shareholders given the financial performance in the second half of the financial year between 1 November and 30 April is always superior to the first six months due to the positive seasonality effect of both Christmas and Easter in the second half.

Since the IPO in early 2017, PG has already distributed three dividends to shareholders with the most recent being earlier this month representing the first interim dividend for the 2018/19 financial year. PG had stated its dividend policy in the IPO Prospectus of a semi-annual distribution amounting to at least 50% of annual profits after tax. This commitment was highlighted once again in a recent interview with PG’s CEO who stated that “we are not prepared to invest at the expense of not distributing an adequate return to our shareholders”.

In view of the sizeable impact of the Zara franchise operations on the overall business performance of the Group, PG’s Chairman indicated last week that an announcement will be made in March once the Zara store in Sliema would have been operational for three months. This ought to be an important update for the market since it will provide further clarification on the success of the new Zara store and whether the Group will surpass the budgeted growth figure of 30% from the franchise stores. Furthermore, it would be an important indicator for overall profitability this year and eventual dividend payments to shareholders.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.