Plaza seeks expansion after record financial performance

Last week, Plaza Centres plc published its 2014 financial statements showing a 19% increase in pre-tax profits to a record level of €1.5 million. The improved financial performance, which was very much in line with expectations given the results of the first half of the year and the disclosure in the November Interim Statement, was both as a result of higher revenue as well as lower expenses, namely finance costs.

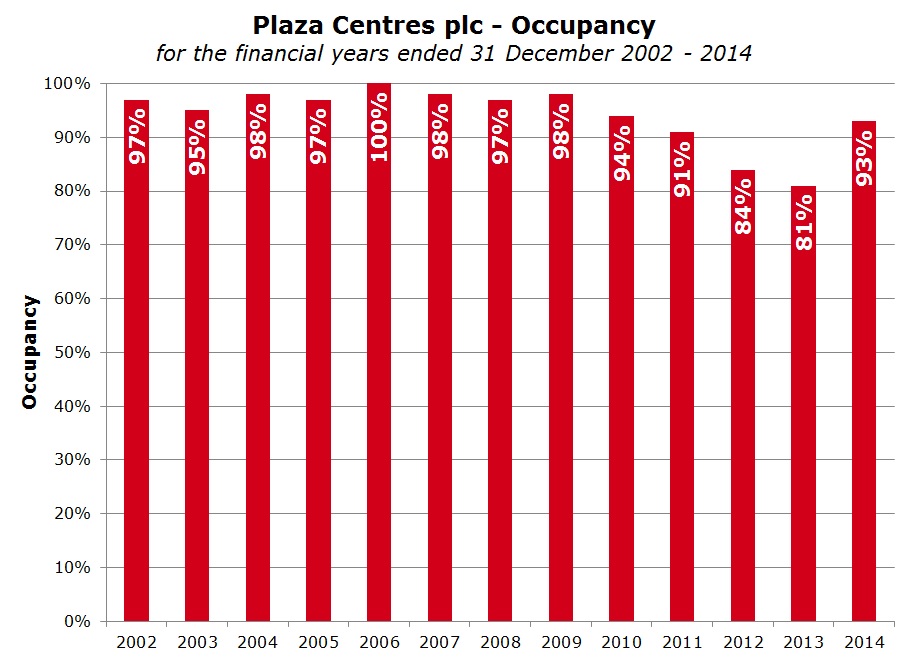

Plaza reported that turnover grew by 10.4% to €2.39 million reflecting the increase in average occupancy levels to 93% compared to 81% in 2013. The higher occupancy levels came about from the success of the leasing of the office spaces which had been vacated by their largest tenant in 2013. Although the average occupancy during 2014 was 93%, this increased to 96% by the end of the year and to 100% during the first quarter of 2015.

Operating expenses increased by 17.7% to €0.42 million although the majority of this increase is due to a bad debt provision of €40,793 with respect to a catering outlet which ran into financial difficulties. Meanwhile, finance costs dropped by 26.6% to €0.14 million reflecting the better interest rates contracted by the Company after it switched its banking facilities in August 2013.

“The Company has a waiting list of tenants seeking to open up shop within the complex…”

In last week’s announcement, Plaza indicated that occupancy within the complex during 2015 is expected to remain at the same average levels of 93% achieved in 2014. Although occupancy improved to 100% in the first quarter of 2015, the company expects four outlet leases to be terminated during the year. However, Plaza indicated that it is already in negotiations with prospective tenants and anticipates that it will conclude new leases in the third and fourth quarter of 2015. This important development was discussed at length during a meeting with the CEO Mr Lionel Lapira shortly after the publication of the results.

Mr Lapira indicated that 3 of the tenants relate to retail outlets which for varying reasons will be terminating their leases. The other outlet relates to a sizeable catering unit. When questioned on the possibility of McDonalds terminating their lease which expires on 31 July 2015, the CEO stated that discussions are still ongoing but indicated that other potential tenants are already showing a very keen interest in the area presently occupied by McDonalds should they decide to vacate their operation on Level 0 following the sizeable investment in their stand-alone outlet not far off from the Plaza shopping centre.

The CEO also confirmed that demand for retail and catering units is still very strong despite the intense competition in the sector and the growing threat from online shopping among Maltese customers. The Company has a waiting list of tenants seeking to open up shop within the complex and for this reason, the CEO is confident that average occupancy will be within the same levels in 2014 despite the lead time required for new operators to enter into any vacated retail or catering units . Mr Lapira explained that the tenant mix is very important for the success of any commercial centre and the Company is seeking to ensure that some new catering establishments start operating in the complex to improve the catering mix currently on offer.

Although the office areas are presently fully occupied, the CEO also confirmed that the company also has a waiting list of new tenants wishing to lease out office space while other existing tenants are also seeking additional space due to their expansion plans. Mr Lapira agreed with a comment recently attributed to Mr Ray Fenech of the Tumas Group who opined that demand from certain international operators relocating to Malta is “insatiable”. As such, despite the sizeable increase in office facilities in the coming years due to various upcoming projects in the immediate vicinity and in other locations, it is unlikely that Plaza will run into any difficulties to maintain full occupancy in the office spaces despite the lack of parking facilities. Plaza’s CEO believes that the Company’s main weakness is the absence of parking as part of the complex and the shortage of parking also in the immediate vicinity. Mr Lapira is adamant in seeking to address this issue in anticipation of the more intense competition emerging in the years ahead from upcoming office developments in close proximity such as Pendergardens, MIDI’s Business Centre and the Metropolis in Gzira apart from other larger projects in other locations such as Smart City, the Mriehel Towers of Tumas Gasan and the planned new business centre by Malta International Airport plc.

Plaza’s CEO indicated that discussions are ongoing with the owners of a large site in close proximity to the complex as well as with the authorities with a view to addressing the parking shortage. Although Mr Lapira was non-committal on the possibility of reaching an agreement within the current financial year, he indicated that discussions are taking place regularly and this eventual project could also see the Company increase its retail and office spaces in the years ahead once a phased development of the area is undertaken.

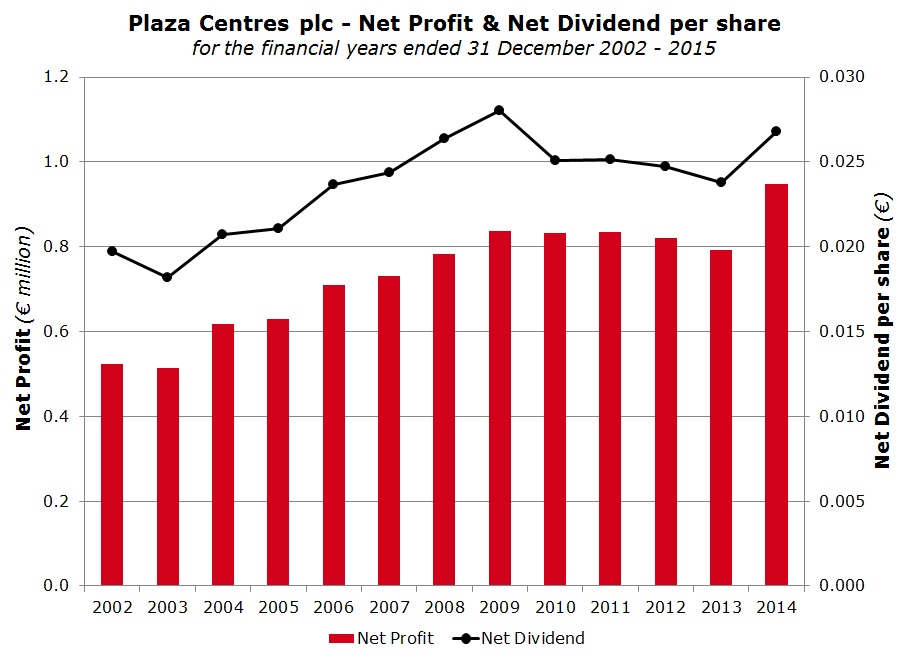

Plaza’s historic dividend distribution since the Initial Public Offering in May 2000 has been remarkable with a consistently strong dividend payout to shareholders. Following the record financial performance in 2014, the Directors recommended the payment of a final net dividend of €0.0268 per share representing a 12.6% increase over the previous year’s net dividend of €0.0238 per share. The dividend payout ratio declined to 80% as the Company retained additional profits to create a cash buffer in order to partly support the ongoing maintenance programme and also eventual expansion plans. Notwithstanding the additional cash retained by the Company, Plaza would undoubtedly also need to resort to additional debt funding which should not pose a problem given the currently conservative leverage position.

In fact, Plaza’s gearing level dropped below 15% in 2014 following the partial repayment of bank borrowings but more importantly following the increase in shareholder funds not only due to the profit retention but also as a result of the property revaluation. Plaza’s property is revalued every three years and last week the Company reported that the value of its ‘property, plant and equipment’ increased to €32 million from €28 million in 2011. Mr Lapira explained that the property valuation is conducted by an independent qualified architect based on the commercial value of the land and its location as well as on the lease contracts in hand. Furthermore, the property value is also dependent on the discount rate applied. Given the prevailing low interest rate scenario, this would also have contributed to the increase in property value. The increase in the property value helped shareholders’ funds rise by 15.7% to €23.79 million resulting in a net asset value of €0.842 per share, a key metric for property companies.

"...discussions are ongoing with the owners of a large site in close proximity to the complex as well as with the authorities with a view to addressing the parking shortage."

Plaza’s equity is the second best performer since the start of 2015 with a remarkable appreciation of 43.1% to a new record share price of €0.93. Following the announcement by the European Central Bank of the quantitative easing programme and the resultant sharp decline in yields across the sovereign and corporate bond markets, local investors also turned a keen eye to equities in the search for yield. The reaction was immediate with a steady increase in the share prices of those companies offering an attractive yield given the low interest rate environment. Notwithstanding the strong rally in Plaza’s share price, the dividend yield of Plaza, following the 12.6% increase in dividends for 2014, still ranks among the highest across the local equity market. At 4.43% gross (2.88% net of tax), Plaza’s yield is still well above yields on Malta Government Stocks. Plaza’s equity could therefore remain in the limelight especially in the coming weeks since the shares will continue trading ‘cum-dividend’ until close of trading on Thursday 23 April.

Following the payment of the dividend, investors will remain attentive to Plaza’s announcements on occupancy levels as well as upcoming expansion plans with the latter being the major driver for future growth over and above the contracted annual increments in lease payments.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.