Profitability at RS2 more than doubles during first half of 2015

The interim financial statements published by RS2 Software plc on 14 August may have caught investors and financial analysts by surprise. Few would have possibly expected such a strong increase in revenue and profitability during the first half of 2015 given the lack of any major contracts announced by the Company.

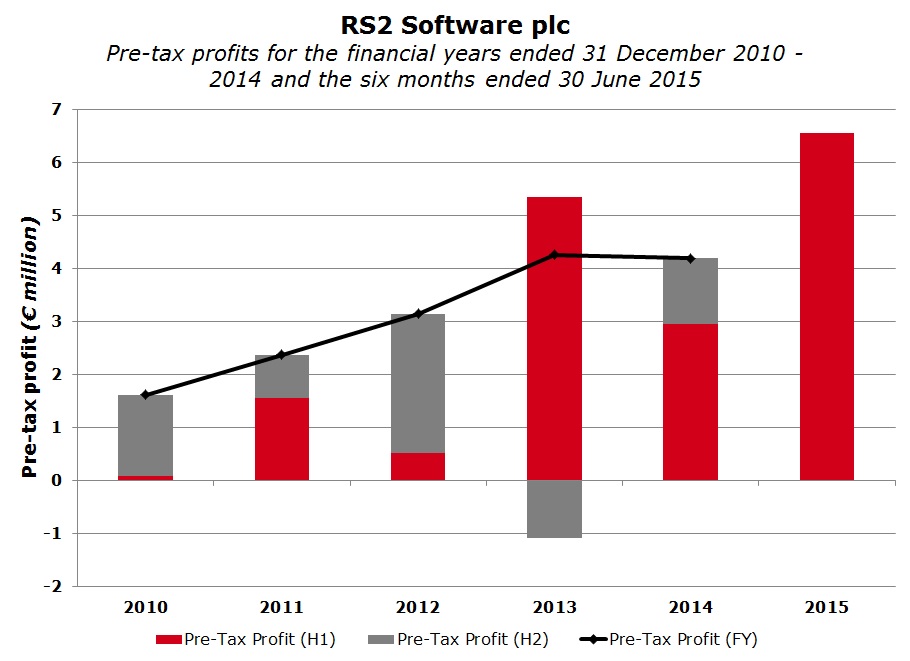

RS2 reported a 48.5% increase in revenue to €11.5 million and pre-tax profits surged by 121% to €6.6 million (June 2014: €2.9 million).

The only new contract announced by the Company in the first half of the year was the licence agreement with Viet Capital Bank, a bank in Vietnam, for an undisclosed amount.

However, shareholders and market participants who attended the Annual General Meeting on 9 June 2015 ought to have been less surprised at the revenue and profitability growth in the first half of the year. In his speech during the AGM, CEO Mr Radi El Haj had indicated that the results for H1 2015 are positive and exceeding expectations. The CEO also commented that the second half of 2015 should also be very successful for the company.

Unfortunately, the interim financial statements do not provide a breakdown of the various revenue sources split up into licence fees, service fees, income from maintenance agreements as well as from processing services. As such, it is difficult to analyse the exact changes that took place during the first half of the year.

However, RS2 indicated that the growth in revenue was mainly attributable to the recognition of new licence fees and an increase in service fees. Moreover, the Company reported that maintenance fees for new and existing clients also contributed to the increased revenue figure while processing fees grew by 16%.

During the 2014 financial year, RS2 registered an increase in revenue of almost €8 million (+84%) largely due to the booking of licenses and additional implementation and consultancy services provided to various clients, which included services over and above what RS2 used to offer in the past. These new services, related to infrastructure design, implementation and consultancy, are being offered based on the knowledge RS2 has gained from implementing these services for its own managed services subsidiary which is now offering outsourced services to large clients in the financial industry. At the time of the publication of the 2014 annual financial statements, Mr El Haj had confirmed that service fee income should continue to grow in 2015 and future years. As such, this strong trend ought to have continued during the first half of the year largely contributing to the 48.5% overall revenue growth.

The 2015 interim financial statements provide further confirmation of the profitable business model of RS2. The gross profit margin improved to 59% (June 2014: 50%) and likewise, the EBITDA margin surged to 62.7% from 49.3% in the first half of 2014. Additionally, the net profit margin increased to 41% compared to 29% in the first half of last year.

Another very important ratio for financial analysts is the return on equity, measuring the profit achieved by a company from the amount of money invested by shareholders. However, since this ratio is calculated by dividing profits by the amount of average shareholders’ funds, it is not always a good measure to use at the interim reporting stage for certain companies since one cannot annualize the interim profit due to fluctuations in profits from one accounting period to the next. This is very relevant in the case of RS2 Software. In fact, in recent years, revenue and profits from one accounting period to the next fluctuated remarkably and were very much dependent on the timing of licensing contracts. RS2’s Directors again cautioned investors about this likelihood in the recent Company Announcement by stating that since the performance for a specific accounting period is influenced by revenue recognition criteria, the performance between accounting periods may not be linear.

This may start to smoothen out given the surge in service fee income as well as the growth in processing fees. However, RS2’s financial performance is still somewhat dependent on the timing of new licence agreements and one cannot simply assume that the profits achieved in H1 2015 will double during the second half of the year.

As such, although the interim ROE is very strong indeed, it would not be prudent to assume that this ratio will be similar at the year end. Notwithstanding any fluctuations in the second half of the year, the 2014 ROE of RS2 at 12.5% was still relatively attractive but somewhat lower than the top achievers, namely Malta International Airport plc and Medserv plc who are both above 20%. It would be interesting to see whether RS2 can achieve this ratio once the 2015 full-year financial statements are published.

So what could one expect from RS2 during the second half of their financial year? It is worth recalling that in the Interim Directors Statement published on 19 November 2014, the Directors had stated that the Group is in the process of negotiating a new licence deal with a client in Europe and this was expected to be concluded during the first quarter of 2015. No news of this has so far emerged.

Moreover, last November, RS2 had confirmed that in the area of transaction processing, (i) negotiations on a second letter of intent were ongoing and were at an advanced stage while in the Interim Directors Statement published on 13 May 2015, the Directors indicated that contract negotiations are taking place with a UK company; (ii) negotiations on new letters of intent were ongoing with potential clients across Europe and North America. In both instances, no further updates were provided in the recent announcement.

Presumably, RS2 will be providing an update on the progress achieved in each of these cases as they occur.

In addition to all of the above, during the AGM held on 9 June 2015, Mr El Haj confirmed that the licence agreement with the Vietnamese bank was an important step to achieve further penetration across the Asian market and RS2 was also targeting other potential clients in Asia.

RS2’s immediate strategy also involves penetrating the market in the US and during 2014, RS2 increased its equity stake in the US company Transworks from 25% to 64%. This vehicle is being used to expand the Group’s business in the US. At the AGM, the CEO hinted that some positive developments could materialise in the months ahead. Furthermore, last week’s announcement revealing the appointment of Mr John Elkins to the Board of Directors of RS2 could also be linked to the company’s expansion strategy in the US. Mr Elkins has extensive experience in the industry having served as executive vice president and Chief Marketing Officer for Visa International and more recently as President and Executive Management Committee member (International Regions) of First Data, a global electronic payment processing enterprise, with operations in 35 countries. Additionally, the press release published by RS2 on this new appointment, revelas that the Company has worked with Mr Elkins at First Data since 2011 and believes that Mr Elkins tremendous knowledge of the payments industry should enable RS2 to continue its global expansion strategy.

RS2’s share price has by far been the strongest performer in recent years. Shortly after the 2-for-1 share split in mid-June, the equity traded up to a new record and touched the level of €2.26 on 20 July before easing to €2.05 last week. However, following the publication of the interim financial statements, the share price rebounded sharply and traded up to a new record high of €2.30. The strong rally over the past 3 years increased the market capitalization of RS2 from €20 million to over €200 million. RS2 is now the 7th largest company on the Malta Stock Exchange and its market capitalisation exceeds many of the longer-established companies. RS2 now needs to conclude a number of the international contracts referred to in recent months and communicate these to the market accordingly to justify the significant increase in its market capitalisation.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.