RS2 focusing on increasing recurring revenue streams

The 2014 interim financial statements of RS2 Software plc published on 28 August require some detailed analysis due to the fluctuations in the performance from one period to the next reflecting the timing of licence fee income.

During the first half of 2014, overall revenue generated by the RS2 Group amounted to €7.8 million, representing a 20.2% drop from the €9.7 million registered in the first six months of 2013. However, it is important to highlight that €5.5 million out of the €9.7 million turnover figure during the first half of 2013 resulted from the initial recognition of the licence sale to Barclays Bank plc of GBP8.5 million. The balance of around €4.5 million will be recognised in future accounting periods once certain milestones are reached in the implementation of the Bankworks software for Barclays.

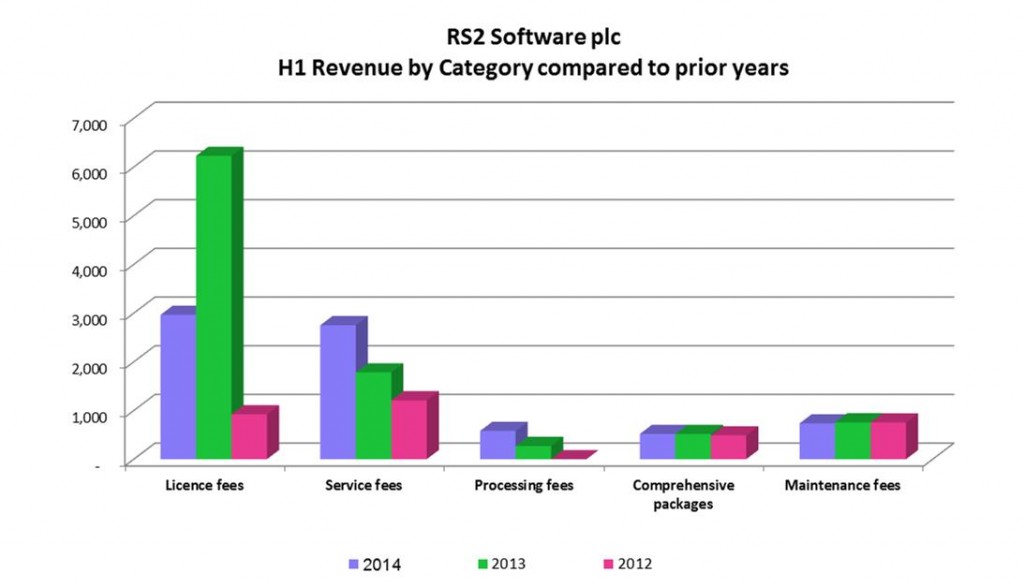

RS2 convened a meeting for financial analysts last week to explain the performance during the first half of the year and to discuss the near-term outlook for the Group. The Chief Financial Officer Ms Fiona Ciappara Cascun presented a chart showing the revenue breakdown during the first half of 2014 and the movements in the various revenue streams during prior years.

Licence fee income dropped by 52.4% from €6.2 million in the first half of 2013 to just under €3 million during the first six months of 2014. The CFO explained that this decline occurred despite the fact that RS2 entered into its largest ever licence agreement in the company’s history during the first half of 2014. In fact, on 4 June, RS2 announced that it entered into a licence agreement with a global payment processing company for a total value of €12 million. Ms Ciappara Cascun explained that since the licence is granted for a five-year term with an option to convert to a perpetual license, in line with international accounting standards the licence fee revenue will be recognised on an annual basis during the five-year term as opposed to the recognition of revenue when the agreement is signed and once the system is finalized as is the case with the Barclays contract.

As such, the CFO claimed that the licence fee income during the first six months of 2014 includes the initial annual revenue from the new agreement with the global payment processing company as well as a licence agreement with OKQ8 in Sweden which was announced in February. A similar amount to that booked in the first half of 2014 which is in the region of €2 million in respect of the contract with the payment processing company will be repeated also during the next four years with an additional amount in the fifth year should the client opt to convert the licence to perpetual use. This amount is however already included in the overall figure of €12 million.

Furthermore, the agreement with the global payment processing company also incorporates the servicing element. The agreement stipulates an annual minimum spend by the licensee of €1.5 million for the first three years of the agreement for a total value of €4.5 million. At a meeting convened in June specifically to discuss this milestone agreement, RS2’s CEO had explained that this is the minimum amount of committed services and normal charge-out rates will then apply for additional services requested. Although none of the service income from this new client was included in the financial statements during the first half of the year, the RS2 Group still generated circa €2.8 million in service fee income during the period. This is a sizeable increase over the €1.8 million registered in the first six months of 2013. The Chief Executive Officer Mr Radi El Haj explained that this reflects the surge in demand for services especially by the new large clients following the agreements signed up. Presumably, this mainly relates to the service requests in the implementation of Bankworks for Barclays.

The breakdown of revenue also shows a significant hike in processing fee income. This relates to the revenue generated by the fully-owned subsidiary RS2 Smart Processing Limited which accounted for 7% (equivalent to approx. €0.58 million) of overall Group revenues during the first half of 2014. This is encouraging given the fact that the company was recently set up and only signed up its first client in 2013. Mr El Haj referred to the two letters of intent mentioned in the Interim Directors Statement of 13 May with two prospective clients. The CEO confirmed that the company is in the final stages of converting these into formal contracts. The CEO indicated that both agreements are expected to be finalized by the end of October. Mr El Haj again re-iterated that the company has other pending proposals for the managed services business and this subsidiary will enable the company to generate additional recurring revenue which will compensate for the volatility in revenue from the recognition of licence income.

The CEO again re-iterated the medium-term vision for the Group, i.e for the recurring income from the managed services business to grow to a level which exceeds the current level of revenue being generated by the traditional business of licensing, service and maintenance income.

"Processing income from the managed services business and maintenance income will be the key recurring revenue generators for the RS2 Group in the years ahead."

Nevertheless, Mr El Haj indicated that RS2 will also continue to focus on the licensing aspect of Bankworks. However, as opposed to the past strategy of targeting small to medium-sized financial institutions and payment services providers, the objective now is to focus on attracting other Tier 1 banks and sizeable organisations to utilize the Bankworks platform. The recognition gained by the enrolment of Barclays and the global payment processing company for Bankworks in recent months provides the confidence for RS2 to seek other very large licence fee agreements with other important global players.

The CEO confirmed that this will translate into significant service income levels if any such agreements are signed up and additionally recurring maintenance fees once the system goes live. In an analyst meeting earlier this year, it had been explained that maintenance fees normally amount to between 18% and 21% of the contract value. Maintenance income during the first half of 2014 amounted to 9% (equivalent to circa €0.73 million) of overall Group revenues.

Processing income from the managed services business and maintenance income will be the key recurring revenue generators for the RS2 Group in the years ahead.

Unfortunately the CEO and the CFO did not provide any forward guidance on the financial expectations for the second half of the year. Growth companies such as RS2 need to understand the importance of issuing financial projections since this would greatly assist financial analysts and investors in their investment deliberations. Notwithstanding this, the market seems to have a bullish outlook for the company as the share price continued to reach new record levels and climbed to a high of €2.95 last Tuesday, placing the equity once again among the top performers of the year with a year-to-date gain of 37%.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.