Second consecutive cash dividend from IHI

International Hotel Investments plc published its 2018 Annual Report on 30 April and there are some important details contained in the lengthy statements by the Chairman as well as the joint-CEO’s which I think would be best to highlight for the investing community.

Since IHI also has several bonds listed on the Regulated Main Market of the Malta Stock Exchange, it publishes its financial forecasts on an annual basis given its obligations under the Listing Policies. The 2018 financial forecasts had first been published in June 2018 and an updated set of financial forecasts was contained in the Financial Analysis Summary annexed to the Prospectus published in March 2019 in conjunction with the new €20 million bond issue.

The actual results for 2018 should therefore not have been a surprise to the market given the information already in the public domain. The IHI Group registered an adjusted EBITDA of €61.3 million in 2018 compared to €58 million in 2017.

The most awaited piece of news on 30 April related to any dividend recommendation following the payment of an interim cash dividend of €0.02 per share in July 2018 which was the first cash dividend since the distribution of €0.03 per share in May 2014. The dividend in 2014 had come about following the sale of most of the apartments in London adjoining the Corinthia Hotel.

In the meantime, since IHI’s listing on the MSE in the year 2000, bonus shares were issued on various occasions which increased the absolute number of shares held by each shareholder.

IHI announced on 30 April that it will be recommending the payment of a further cash dividend of €0.02 per share in July 2019. While the prospect of a second consecutive cash dividend may have possibly surprised many investors, it seems that this represents a new policy by IHI. In fact, in his address to shareholders in the 2018 Annual Report, Chairman Alfred Pisani stated that “we shall use our best endeavours to maintain a regular cash dividend policy, yet I do not exclude the possibility that through the ever-increasing value of our assets, our accumulated reserves will likewise provide us with the possibility of issuing further bonus shares together with cash dividends”.

Mr Pisani also repeated this during a meeting held with financial analysts on 2 May. Given the improved operating performance in recent years from some of the hotels within their portfolio (most notably in Lisbon, Budapest and St. Petersburg), IHI are favouring the distribution of cash dividends notwithstanding their heavy investment programme in the years ahead.

In his address to financial analysts on 2 May, Simon Naudi, joint-CEO, started off by re-iterating the strategic vision of IHI. Mr Naudi explained that “IHI is a diversified business with one principal mission, that is the global expansion of our Corinthia brand through our activity as investors, developers and operators of luxury hotels and branded real estate”.

He explained that IHI has six areas of business, namely (i) ownership stakes in 13 hotels; (ii) acting as operators of 22 hotels via the ownership of the Corinthia brand and Corinthia Hotels Ltd; (iii) acting as a developer for IHI and other investors via Corinthia Developments International Ltd; (iv) project management via QP Ltd; (v) event and catering via Corinthia Caterers as well as the Costa Coffee franchise in Malta and Spain; (vi) ownership of land, commercial and residential real estate.

On the latter point, Mr Naudi explained that IHI owns a number of prime sites in Malta, Tripoli, London, St.Petersburg, Budapest and Moscow and some are earmarked for development while others are providing a steady rental income stream. For example, the penthouse adjoining the Corinthia Hotel in London which had not been sold together with the 11 serviced apartments in 2014, has been rented out at GBP1.8 million per annum.

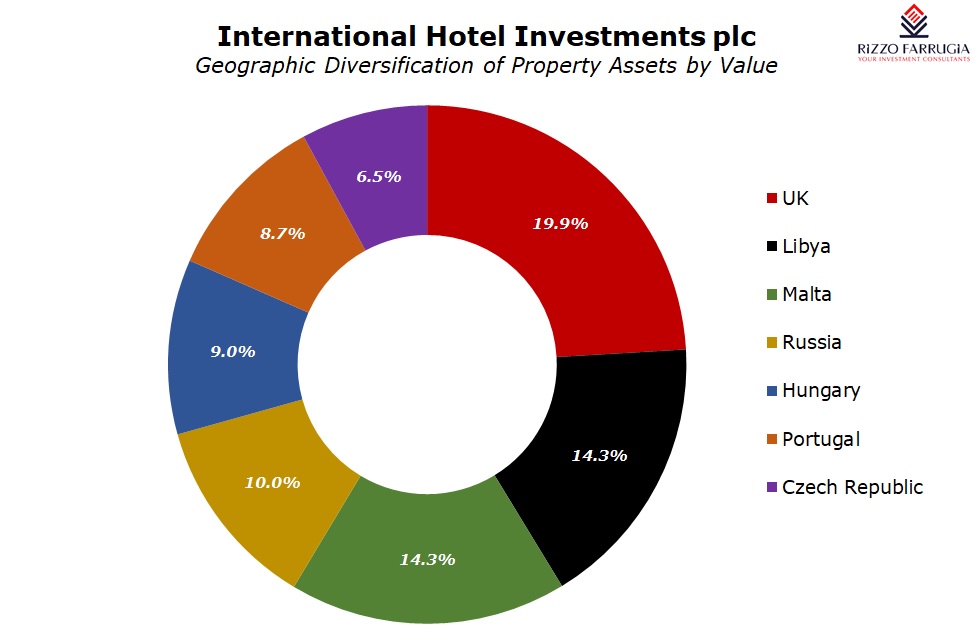

During the meeting with financial analysts, Mr Naudi provided a detailed overview of the operations of each of the hotels owned by IHI in which he highlighted the continued strong performances by the hotels in St.Petersburg, Budapest and Lisbon. He also depicted a graph showing the improved diversification achieved over the years both across the various properties and also from a geographical perspective by highlighting that several years ago, the hotel in Tripoli contributed almost 65% of the overall EBITDA. In contrast, the hotel in Tripoli generated a negative EBITDA in 2018 while the rental income of the commercial centre in Tripoli amounted to €6.4 million.

An important revelation within the 2018 Annual Report was the statement made by the Chairman that “the board is also considering to strategically exit the ownership of specific assets which have reached maturity in their capital gain”. While no specific property was mentioned, this strategy is important since it could corroborate whether IHI’s strategy of generating capital gains from its property investments has indeed materialized.

Mr Pisani explained to financial analysts on 2 May that since the main strategic focus is to “establish Corinthia Hotels as a global luxury hotel brand”, IHI will continue to invest in property assets throughout the world. However, the Chairman explained that “the only difference going forward is that rather than holding 100% in each project, we shall share these developments with third parties, as we did in London, Brussels and very recently in Moscow”.

IHI has a 50% shareholding of the properties in London and Brussels and while the other shareholder in these properties is also one of IHI’s largest shareholders, the situation is somewhat different in Moscow. Earlier this year, IHI announced that it acquired a 10% shareholding in a company which was formed with a consortium of investors to develop a luxury Corinthia Hotel and branded serviced apartments in a very central location in Moscow.

The Chairman further explained in the Annual Report that the sale of certain property assets “will free up cash which would allow us to finance new acquisitions and developments and/or provide support in the form of key money or guarantees to secure more management agreements, restructure our debt funding and consider ad hoc distribution of profits”.

Apart from the upcoming developments in Brussels and Moscow, IHI will be involved solely as hotel operators as from 2020 in another two properties in Bucharest and Dubai.

IHI had entered into a strategic partnership with the Meydan Group in 2016 which so far consists of providing management services in two other hotels in Dubai, namely the Meydan and the Bab al Shams Desert Resort. However, the new property being built by the Meydan Group on the prestigious Jumeirah Beach Resort will be branded as a Corinthia Hotel, the first for Corinthia in the Middle East. The 55-floor Corinthia Meydan Beach Hotel is expected to welcome its first guests next year.

Likewise, IHI will be acting as hotel operators in a new boutique hotel opening in Bucharest also in 2020 following extensive restoration to a historic building.

While IHI had set their sights some years ago on becoming involved as minority investors or solely as developers and hotel operators in certain places such as Rome and New York, Mr Pisani indicated in the 2018 Annual Report that IHI is pursuing property developments and management opportunities in other regions including Saudi Arabia, Tunis and Beirut. These locations may also surprise many shareholders as the main focus of IHI in recent years was to establish Corinthia as a hotel operator in renowned city centres and tourist destinations. However, Mr Pisani explained to financial analysts that IHI is constantly searching for new opportunities mainly as hotel operators and the increased attention to certain regions in Africa and the Middle East is due to the fact that there are added opportunities in these areas since several new hotels are being built and Corinthia may approach the investors to act as hotel operators.

The second consecutive cash dividend from IHI is a positive development. Hopefully, the operational improvements in recent years will be sustained and will enable IHI to continue to distribute an annual cash dividend to shareholders. However, possibly a more interesting aspect is the potential sale of certain properties which could not only enable IHI to crystallise a capital gain but more importantly to redirect the eventual proceeds to other development opportunities in order to generate more positive returns for shareholders in the future.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.