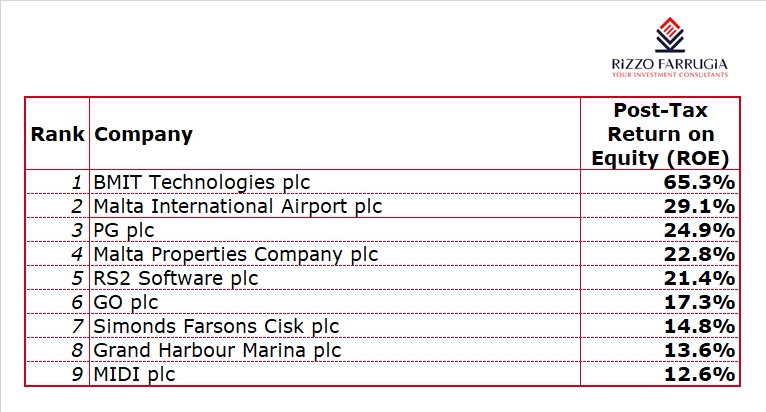

The highest ROE’s on the MSE

In view of the importance for investors to consider various metrics and financial indicators before contemplating an investment decision, on an annual basis I publish league tables of some of these metrics to help readers distinguish between those companies generating the highest dividends, return on equity, etc.

Following the publication of the dividend league table on 2 May, in today’s article I will be providing an analysis of those companies generating a double-digit return on equity. The figures are based on the most recent financial statements published by each of the companies. Most companies have a financial year ending in December and therefore the figures are based on the December 2018 financial statements. The only two companies with a different financial year-end which are mentioned in this table are PG plc (30 April) and Simonds Farsons Cisk plc (31 January). The ROE of PG is based on the financial statements as at 30 April 2018 and that of Farsons on the January 2019 financial statements published last week.

As I explained over the years, the ROE is a very important metric to measure a company’s overall level of profitability when compared to the level of shareholders’ funds.

The top position in the ROE league table goes to the newcomer BMIT Technologies plc. The figure of 65.3% may astonish many readers and this is based on the capital structure of the company before the Initial Public Offering when the company was still a fully-owned subsidiary of GO plc. Although a certain level of capital restructuring took place in conjunction with the IPO involving the capitalisation of an amount of €11.2 million due to GO in exchange for the issue of new shares to GO in BMIT Technologies, which led to an increase in the issued share capital from €9.1 million to €20.4 million, the overall equity base is still low due to certain negative reserves as a result of the restructuring ahead of the IPO. The low level of shareholders’ funds (estimated at €10.9 million at the end of 2019) which is possible due to the company’s business model, then leads to a high ROE. Moreover, given the company’s dividend policy of distributing most of its profits to shareholders also as a result of the low level of capital expenditure required, the equity base of BMIT is expected to remain low going forward and this should sustain a high ROE. In fact, the projections provided in the Prospectus reveal that based on the expected profits after tax of €5.2 million for 2019, the ROE would still remain high at 58.8%.

Malta International Airport plc has seen a strong increase in profits in recent years following the surge in passenger traffic. This resulted in a consistently high ROE which improved further to 29.1% in 2018. MIA had announced in January 2019 that for the current financial year it expected to register a further improvement in profitability to above €31 million which if achieved, will continue to generate a very attractive ROE.

PG plc ranks in third position in the league table with a ROE of 24.9% during the financial year ended 30 April 2018. Although no financial forecast was published by the company for the most recent financial year to 30 April 2019, the company had stated in December 2018 at the time of the publication of the interim financial statements, that despite the closure of the Zara store in Sliema for a large part of the financial year, it expects to achieve an improved financial performance when compared to the pre-tax profits of €11.1 million in the financial year to 30 April 2018. In fact, in the first six months of the 2018/19 financial year, PG reported an unchanged level of pre-tax profits at €5.5 million but the profit after tax grew by 12.1% to €4.1 million as a result of a lower tax expense. The ROE is therefore expected to exceed 25% in the financial year which came to an end on 30 April 2019 and to strengthen further in the current financial year which commenced on 1 May 2019 as a result of the impact of the enlarged Zara store for the entire financial year.

Malta Properties Company plc registered a strong improvement in its ROE from 12.1% in 2017 to 22.8% in 2018. Due to the restructuring of the company’s property portfolio, the 2018 financial performance was once again largely impacted by positive adjustments to the value of properties. In 2018, MPC registered higher positive movements in its property portfolio amounting to €9 million compared to €4.97 million in 2017, largely reflecting the promise of sale agreement in respect of the St George’s exchange as well as the realised gains of €2.14 million from the sale of the old exchange in Sliema. The financial statements of MPC will likely continue to be impacted by such adjustments in future years as a result of ongoing works at the former Zejtun exchange scheduled for completion in 2020 and eventual developments in Marsa and Birkirkara.

The return on equity of 21.4% for RS2 Software plc in 2018 is somewhat misleading due to the adoption of new international financial reporting standards which hugely impacted the 2018 financial results. Hopefully, the company will begin to provide additional guidance going forward on their ability to monetise their current strong business pipeline and how this will reflect on the financial performance of the company. This will enable investors to calculate important financial metrics and ratios such as the ROE also for future years.

GO plc has also been among the more consistent positive performers in recent years. The ROE improved to 17.3% in 2018 from 16.1% in 2017 following a 6% growth in EBITDA EBITDA to €69.5 million despite the continued highly competitive operating environment.

For the third successive year, Simonds Farsons Cisk plc generated a return on equity in excess of 10%. Last week Farsons published its 2018/19 financial statements showing a 5% increase in net profits to a fresh record level of €15.1 million leading to an improved ROE to 14.8% compared to 12.5% in the previous financial year.

The ranking of Grand Harbour Marina plc in the table may surprise many investors as the company generated a ROE of 13.6% in 2018 which is far superior to the meagre 1.8% return in 2017. The company registered an improved level of profits as a result of enhanced revenue generation in Malta as well as a reduction in finance costs following the issuance of a new bond at a lower coupon. It is also worth noting that the ROE is also high due to the low level of shareholders’ funds which reflects the low asset base which merely consists of the cost of the pontoon and does not reflect the water area available for rent or long-term lease.

The ROE of MIDI plc declined from 27% in 2017 to 12.6% in 2018. This decline was expected since the 2017 financial performance was significantly boosted by a €26.3 million contribution from the revaluation of ‘The Centre’. Meanwhile, MIDI’s financial performance in 2018 reflected the delivery of a large number of the Q2 apartments which helped the company register a significant increase in revenue to €52.5 million. On the other hand, the profit after tax dropped from €20.8 million to €11.6 million since no major revaluation was repeated. Since MIDI is one of the companies that publishes its financial forecast as part of its bond obligations, it would be interesting to see the number of remaining Q2 apartments that will be delivered in the 2019 financial year and whether the level of profits envisaged for 2019 will subsequently lead to a double-digit ROE once again.

Although the figures presented in the ROE league table may not be comparable due to the different sectors in which the various companies operate, it is still important for investors to gauge those companies generating the highest and most sustainable returns. In view of the difficulty in predicting future returns for some companies given their business models, it would be helpful for these companies either to begin publishing their projected financial metrics or to issue more regular company announcements to guide the market on their business performance.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.