The impact of the ECB’s QE on Maltese investors

Global markets had been speculating for several months about the timing, structure and size of the bond buying programme to be launched by the European Central Bank and as expected the ECB announced the launch of its quantitative easing (QE) programme last Thursday. What was unexpected though was the size of the scheme which at €60 billion per month starting in March 2015 was higher than the €50 billion a month that was widely talked about ahead of the ECB meeting.

In July 2012 the ECB president Mario Draghi had declared that he would do “whatever it takes” to protect the euro and this QE programme finally seems to be the right plan to safeguard the region’s prospects.

Some may ask, but what is quantitative easing? This is basically another form of ‘printing money’. However, instead of physically printing new notes and coins, central banks use a sophisticated process to inject cash into their economies by buying assets (normally government bonds) from banks or other institutions. The intention is for banks in turn to use the extra funds to increase lending to households and businesses thereby helping to provide a boost to economic growth. This type of monetary easing has already been conducted in Japan, the US and also the UK with mixed results. Japan began in 2001 while the US and UK followed after the start of the international financial crisis in 2008.

The eurozone is suffering from a long period of stagnation with high unemployment and some countries are once again in recession. Meanwhile, inflation dropped into negative territory in December. With this QE programme, the ECB hopes to bolster confidence in the region and push down the value of the euro thereby giving a boost to exporters.

“…this bond buying programme may extend beyond September 2016 if inflation remains far too low.”

The ECB basically announced that it will be spending €60 billion per month until at least September 2016 by purchasing investment grade securities only with maturities between 2 years and 30 years. However, the key message from last week’s statement is that in the words of Mario Draghi QE will be “conducted until we see a sustained adjustment in the path of inflation, which is consistent with our aim of achieving inflation rates below but close to 2 per cent over the medium term”. As such, this bond buying programme may extend beyond September 2016 if inflation remains far too low. Although Mr Draghi hinted that the ECB expects inflation to gradually rise towards 2% next year, in the near term the deflation rate may worsen further due to the decline in the price of oil.

National central banks will be responsible for 80 per cent of losses of any government bonds which default, while the ECB will shoulder the other 20 per cent.

So what are the implications for investors? QE lowers the yields that investors can get from investment grade or ‘safe assets’. By making such investment grade bonds less attractive, in theory it should encourage investors to buy riskier assets at higher returns. This should instigate companies to borrow more, increase employment and thus boost economic performance. The ‘money printing’ programme also aims to weaken the currency and trigger an export driven recovery and a rise in inflation. Additionally, this will also positively impact equity markets as corporate earnings should be helped by a weaker currency and the search for yield will also spill into certain equities.

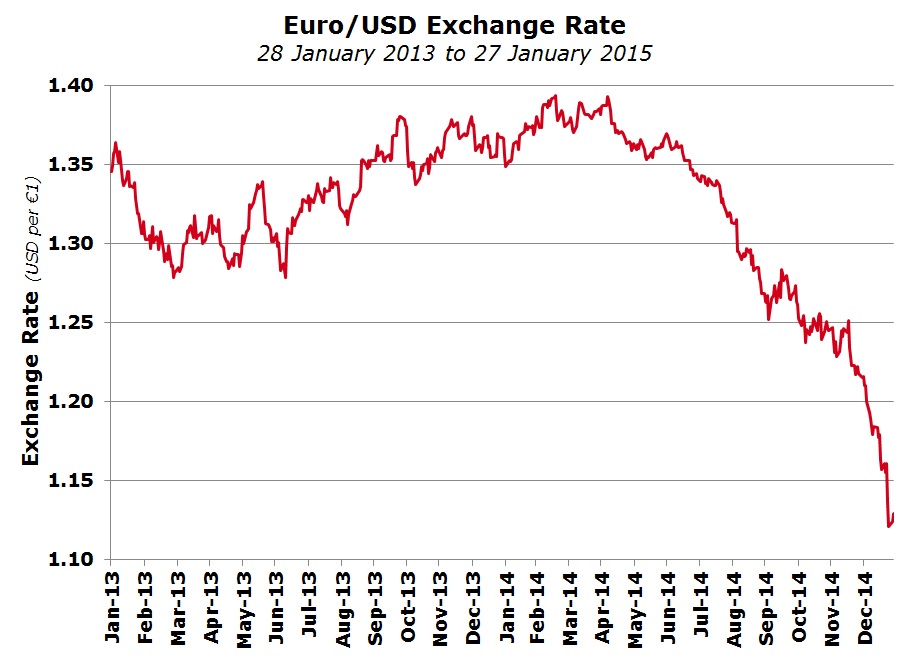

Although the ECB programme had been widely anticipated especially after data indicated that the Eurozone region fell into deflation in December for the first time in more than 5 years, since the amount of QE was larger than expected, the immediate reaction in the market was a further decline in Eurozone yields to record levels, a drop in the value of the euro to fresh 11-year lows against the US Dollar and a rally in equity markets.

Benchmark 10-year Eurozone yields dropped below 0.4% last Friday in reaction to the news leading to a continued rally in the bond markets across most of the eurozone countries. This also took place in Malta with prices of Malta Government Stocks surging to fresh record levels. The yield on the longest dated 2034 MGS dropped to below 3% per annum and with an upcoming MGS issue in February, many investors are already enquiring what the coupon and maturity structure of the new offerings are likely to be. Many retail investors will need to come to terms with the new low yields following recent developments. Will the Treasury launch a 30-year bond thereby offering a relatively ‘attractive’ yield for investors? This may be tempting given that other Eurozone governments do have 30-year paper in issue and the ECB indicated that this maturity profile falls within its bond buying programme.

Although the immediate reaction in the currency markets was volatile, the euro dropped to fresh 11-year lows against the US Dollar last Friday and declined further towards the USD1.10 level early on Monday morning following the outcome of the Greek election. The single currency has depreciated by 16% against the US Dollar over recent months with some international analysts claiming that the EUR/USD rate could reach parity in the not too distant future. This would be a huge competitive boost for European exporters.

The quantitative easing programmes conducted in the US and the UK over the years led to a sustained rally across equity markets in these countries. A similar trend is expected across Europe and after the ECB announcement last week, the equity markets in Germany and France climbed to fresh record levels with the DAX30 already up almost 10% since the start of 2015. The local equity market also started the year on a positive note with an increase of 2.9% in the MSE Share Index. Although this is certainly not related to the ECB’s QE programme but to some company-specific announcement such as the unexpected acquisition of Island Hotels Group Holdings plc by International Hotel Investments plc, some equities may continue to benefit as a result of a renewed search for yield by local investors. In fact, after all three property-related companies offering sustainable and attractive dividends (namely Malita Investments plc, Tigne Mall plc and Plaza Centres plc) registered double-digit gains last year, the trend continued during the first few weeks of 2015. The consistent demand for such equities by retail and institutional investors could also instigate other issuers having a similar business model to launch new equity offerings. This would be welcome news for investors and for the market at large given the upcoming de-listings of Crimsonwing plc and Island Hotels Group Holdings plc.

"The effectiveness of this QE programme will take time to filter through the eurozone economy..."

The ECB stated that it will buy up to a maximum 33% of the bonds in issue by any single government and not more than 25% of any one security. Although it is not yet certain how this programme will be conducted in Malta, the additional excess liquidity that could be created and the decline in yields also across the corporate bond market should instigate additional companies to launch new bonds as issuers would then be able to budget ahead with more clarity after locking-in a relatively low fixed interest rate over the lifetime of the bond.

Some critics claim that the ECB has waited too long to announce its stimulus plans. The effectiveness of this QE programme will take time to filter through the eurozone economy so investors should brace themselves for further volatility across the bond, equity and currency markets especially in the light of the changing political landscape in some of the eurozone members.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.