The MGS market after Trump

In last week’s article I documented the unexpected reaction across equity, bond and foreign exchange markets following the surprising election of the Republican nominee Donald Trump to the White House.

From the various telephone calls and emails received in recent days, it seems that few Maltese investors had ever imagined that a Presidential Election on the other side of the world could have such a profound impact on the Malta Government Stock market.

As I have been stating in various articles over recent years, developments across international markets (especially the Eurozone) also affect the Malta Government Stock market. Unfortunately, many investors still fail to understand the dynamics of the MGS market and many continue to believe that the prices of MGS are simply determined by supply and demand dynamics in Malta.

In recent months, the yield on the 10-year US Treasury had already begun to rise gradually in anticipation of a further hike in interest rates by the Federal Reserve at its upcoming December meeting. Prices of US Treasuries started to decline as the yield had recovered from a low of 1.32% on 6 July 2016 to 1.86% shortly before the US election. However, the expected increase in inflation from the tax and fiscal stimulus measures promised by the new US President should lead to a faster pace of interest rate hikes, causing an immediate upturn in yields. The 10-year US Treasury yield rose to 2.36% last Friday – its highest level since early November 2015.

The sharp movements in yields in the US also spilled over into other bond markets across the world. In UK, the yield of the 10-year gilt jumped to 1.49% from an all-time low of 0.53% in August. The movements in UK yields have been rather dramatic since the Brexit referendum in June. Yields began the year at 1.92% and retreated to 1.37% before the June referendum. However, following the unexpected outcome, yields dropped to an all-time low of 0.53% in August but quickly recovered as the Bank of England did not announce further rate cuts at its September monetary policy meeting and statistics showed no immediate impact from Brexit.

Yields across the Eurozone also mirrored the movements in the US and UK following the US election. The 10-year Bund yield rallied up to +0.40% on Monday 14 November from a level of just below +0.20% before the US election due to higher inflationary expectations in the US and renewed fears of political instability across the eurozone. In the wake of the victory by Donald Trump, market observers fear a similar populist result in the Italian referendum on 4 December and in elections in France, Germany and Netherlands scheduled to be held next year.

“… investors who purchased MGS mainly for speculative purposes need to be extremely vigilant …”

So how does the increase in yields across the world translate into lower MGS prices?

Trading in the MGS market takes places on a daily basis and prices generally revolve around the indicative prices quoted by the Central Bank of Malta based on international market movements especially in the eurozone and particularly those countries with similar credit ratings to Malta. The role of the Central Bank of Malta is rather unique across the Eurozone as it acts as a market maker in the MGS market. As such, every morning, the Central Bank publishes an indicative list of prices at which they would be willing to purchase limited quantities of each MGS listed on the Malta Stock Exchange. An indicative price is also quoted for those stocks in which the Central Bank is also willing to sell.

Prices of MGS have been particularly volatile in recent years. A similar sell-off to that experienced after the US election had also taken place in May 2015 when I had published an article titled “Why have MGS prices suddenly dropped?”. In this article I had explained the reasons behind the sudden drop in MGS prices between the record prices at the time on 16 April 2015 and mid-May 2015. At the time, within the space of a few weeks, prices of all the longer-dated MGS dropped between 600 and 800 basis points as the 10-year German bund had rallied up to a 5-month high of +0.796% compared to the low at the time of +0.05% on 17 April 2015. The justification behind the sudden change in yields was as a result of encouraging economic data in the Eurozone and higher inflationary expectations primarily arising from a rebound in the oil price.

The sell-off across the MGS market in mid-2015 (triggered by the turmoil in Greece) and the dip in early November 2015 (triggered by growing rumours that the US Federal Reserve may be hiking interest rates) both proved to be relatively short-lived as MGS prices subsequently began to recover gradually following a renewed downturn in yields across the eurozone. The bond market rally gathered momentum in 2016 after the European Central Bank announced in December 2015 an extension to its quantitative easing programme until March 2017 and subsequently increased the size of its monthly purchases to €80 billion a month following its March 2016 monetary policy meeting. This resulted in a strong rally across Eurozone bond markets which was similarly reflected in Malta with most MGS prices reaching a fresh record level towards the end of October 2016 as the 10-year Bund dropped to a new low of -0.20%.

However, as a result of the rally in yields across Europe in the immediate aftermath of the US election, MGS prices declined significantly on Friday 11 November and Monday 14 November.

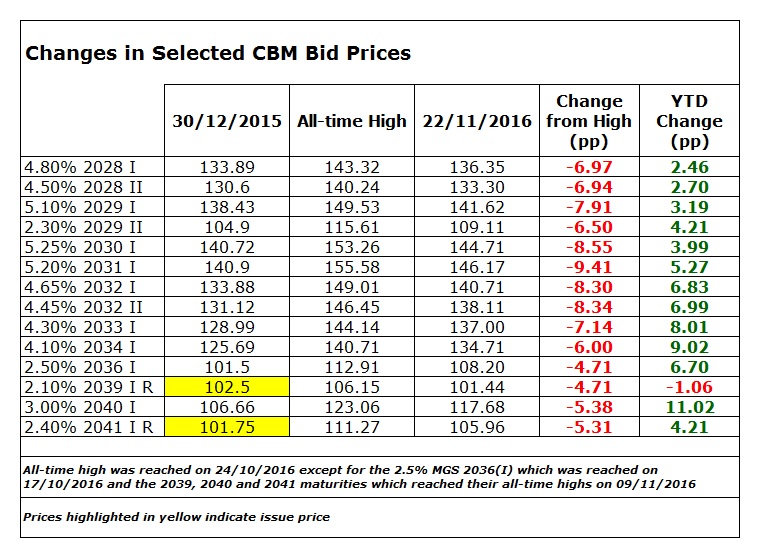

This table depicts the decline in yields for those MGS’s maturing in 2028 onwards between the record levels in October 2016 and the low on Monday 14 November. Since then prices partially recovered and the table also shows the movement in prices on a year-to-date basis.

As I mentioned last week, despite the sudden decline in MGS prices, a number of the longer-dated bonds are still showing some very strong gains.

A common benchmark across all bond markets is the 10-year yield. It is worth highlighting that the yield on the 10-year MGS has now reached 1.38% from a low of 0.83% on 24 October 2016.

Following the sudden decline in MGS prices, many investors are naturally concerned and they are increasingly enquiring whether prices will recover or whether they will continue to decline in the weeks and months ahead. It is rather impossible to predict short-term movements in any asset class. The events across financial markets over recent years have clearly portrayed that volatility across all asset classes has indeed intensified on a daily basis. This is likely to persist especially across the bond markets also in the coming weeks in view of the referendum in Italy on 4 December and the European Central Bank meeting scheduled for 8 December.

Although one of the senior officials of the ECB stated last week that the bond-buying scheme should be withdrawn as soon as possible, many analysts are expecting the ECB to announce an extension to the QE programme until September 2017. Moreover, a leading investment bank in the US was quoted last week as indicating that the ECB will be forced to carry on with its bond-buying programme until 2018, while interest rate hikes in the eurozone are not expected until 2019.

The need for continued monetary easing is widely regarded as being necessary due to the fragile economic recovery and persistent low inflation. The likely continuation of the bond-buying programme was practically confirmed by the President of the ECB Mario Draghi who in a speech delivered last Friday, stated that the economic recovery across the euro area still relies to a considerable degree on accommodative monetary policy. Mr Draghi claimed that “the ECB will continue to act, as warranted, by using all the instruments available within the central bank's mandate”.

Although this may be supportive of eurozone bond markets (including MGS) in the coming weeks and months with yields possibly edging lower and prices rising, developments in the US will likely continue to lead to intense volatility going forward. As such, investors who purchased MGS mainly for speculative purposes need to be extremely vigilant. Movements in prices of long-term bonds can be very sharp indeed even from one day to the next as was first experienced in May 2015 and again in early November 2016. Investors must also ensure that their portfolios are correctly aligned to their ultimate objectives and they can also withstand negative price movements.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.