The new IPO of Main Street Complex plc

Following the hugely successful Initial Public Offering (IPO) of PG plc in May 2017, a new entrant is expected to be added to the equity market in the weeks ahead. Main Street Complex plc published a Prospectus in connection with an offer of 7.5 million shares by its main shareholder Embassy Limited (which in turn is ultimately owned in equal proportions by the Gasan Group and the Big Bon Group) and the issuance of 5.23 million new shares both at a price of €0.65 per share. The total amount on offer for retail and institutional investors therefore amounts to €8.4 million, which is a relatively small amount compared to last year’s IPO of PG plc.

The company is the owner of the Main Street Shopping Complex located in the main square of Paola. The shopping complex originally opened its doors in 2004 and carried out an extension in 2011 following the acquisition of property adjacent to the original building. Currently, it comprises a total internal area of over 7,000 sqms, an external area of 1,000 sqm (including a terrace and roof area) as well as a small car park. The total rentable area, excluding the terrace, is 4,000 sqm which is currently almost fully occupied through 19 concession agreements covering retail, catering, services and entertainment outlets. The complex attracts a footfall averaging 67,500 per month or 800,000 persons annually.

This IPO provides an opportunity for Embassy Limited to realise part of its original investment in the company in a tax efficient manner following the fiscal incentives introduced as part of the 2017 budget. Moreover, the IPO and the subsequent listing of the company’s entire issued share capital on the regulated Main Market of the Malta Stock Exchange is also being undertaken for a number of other reasons which are generally associated with a conversion of a private company into a company that is publicly traded on a recognized stock exchange. The IPO will enable Main Street Complex to increase its share capital and repay all its bank borrowings thereby freeing up a large part of its cash flow and enabling it to commence a steady dividend payment stream to all shareholders. In fact, the proceeds to be raised from the issuance of the new shares of €3.4 million (5,230,769 shares at €0.65) will be used to repay all bank borrowings as well as to settle an amount of €0.7 million due to Embassy Management Limited. Additionally, the IPO will enhance the company’s public profile and create a liquid market in its shares while providing access to the capital markets to aid the company’s future growth. This is very similar to what Plaza Centres plc had done in May 2000 where it reduced its borrowings, distributed a steady and attractive dividend to shareholders over the past 17 years and also enabled the company to issue a bond two years ago in order to partly finance the acquisition of a commercial property to expand its business.

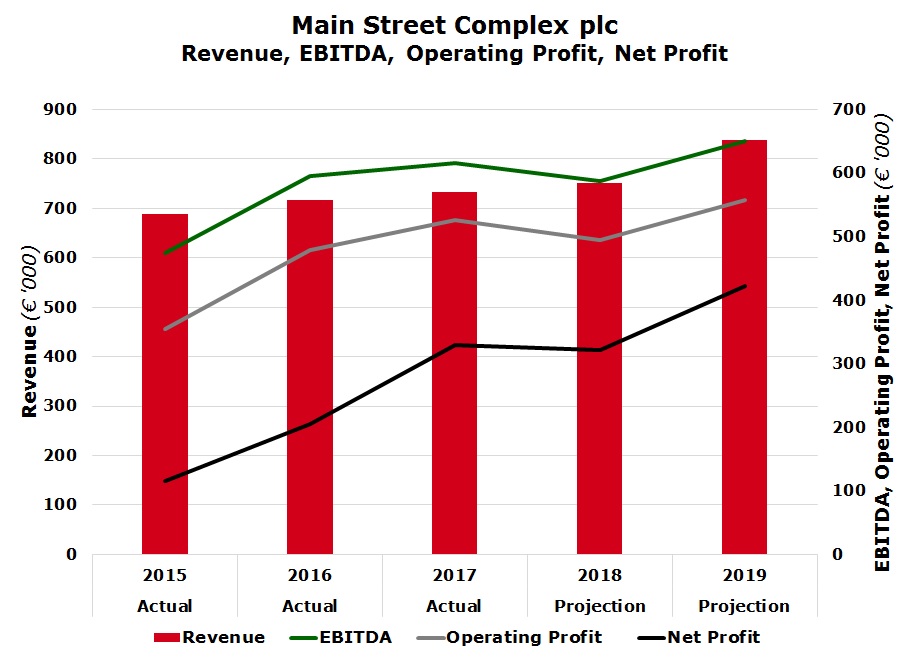

Similar to the two other commercial properties listed on the MSE, Main Street Complex plc has a simple business model with visible revenue streams and a predominantly fixed cost base. The company should therefore continue to build on the positive trends registered in recent years and should be able to meet the forecasts for both the current financial year as well as for 2019. The prospectus provides details of the 2018 financial forecasts and the projections for 2019. During the current financial year to 31 December 2018, the company expects to grow its revenue by 2.6% to €752,000 and register an earnings before interest, tax, depreciation and amortization of €587,000. As borrowings will be repaid following the IPO, finance costs are expected to decline to €50,000 (compared to €110,000 in 2017), thereby resulting in a profit after tax of €321,000. 2019 will be the first year which will show the full impact of the benefits of the IPO. The company expects revenue to rise to €839,000 in 2019 as a result of the annual increment in the concession agreements as well as the assumption that the only vacant outlet of 173 sqm will be leased out during the second half of 2018. Although expenses are expected to rise as a result of the costs related to the listing of the company’s shares on the MSE and the remuneration to directors, the profit after tax is anticipated to rise by 31% to €422,000 as finance costs are anticipated to amount to a minimal €5,000.

Given the simple business model with visible revenue streams and no financial obligations as a result of the repayment of all borrowings, the company’s objective is to distribute the entire annual net profit in the form of dividends to shareholders. The dividend will be split into two payments with around 40% of the overall dividend expected to be distributed as an interim dividend (payable around the end of October) while the balance of 60% will be distributed as a final dividend around May subject to shareholders’ approval at the Annual General Meeting. The company’s aim is to start distributing dividends immediately, with the first dividend of €128,000 in October 2018 followed by another dividend expected to amount to €193,000 in May 2019 representing the final dividend in respect of the 2018 financial year. The total dividend expected to be distributed covering the 2019 financial year (in October 2019 and May 2020) is anticipated to amount to a total of €422,000 which is equivalent to €0.0218 per share. Based on an offer price of €0.65 per share, this results in a net dividend yield of 3.3%.

If one were to compare this with other equities listed on the MSE (excluding the two banks), the dividend yield of Main Street Complex plc ranks in the top quartile ranking below that of GO plc at 3.6% and equal to Malita Investments plc at 3.3%.

The two peers of Main Street Complex are Plaza Centres and Tigne Mall. From a dividend perspective, the net yield of Main Street at 3.3% is superior to that of Plaza Centres (net yield of 2.9%) and Tigne Mall (2.6%). However, Tigne Mall’s dividend is based on the 2016 figures as the final dividend for 2017 has yet to be announced.

The investment rationale of these three companies ought to be compared with the interest returns being offered on bonds as these property companies offer consistent dividends to shareholders. In fact, the track record of regular dividends distributed by Plaza since its IPO in May 2000 and also that of Tigne Mall since 2013 will most likely be replicated by Main Street Complex in the years ahead. However, while a bond offers a fixed rate of interest to investors, the rental income streams of these companies increase on an annual basis in line with their tenants yearly rental increments which translate into rising profits and higher dividend payments to shareholders. In essence, gradually rising dividends protect investors against inflation.

Another important financial metric for such property companies is the price to book value. Total shareholders’ funds of Main Street Complex projected as at 31 December 2018 following the IPO of €11.6 million equates to a net asset value per share of €0.60. The IPO at €0.65 per share has therefore been priced at a 10% premium to book value. This is exactly in line with the current valuation of Plaza Centres but well below that of Tigne Mall which currently trades at a 50% premium to book value (a multiple of 1.5 times its book value).

The consistent footfall of Main Street Complex over recent years arises from the central location of the shopping centre in the main square of Paola. The town of Paola has a growing reputation as a retail and commercial centre and it is now considered as the most popular shopping destination in the south of Malta. It is also widely regarded as the third busiest destination after Sliema and Valletta. In the years ahead, Main Street Shopping Complex should also benefit from additional visitor traffic following the expected completion in July 2018 of the embellishment project of Antoine De Paule square as well as the eventual development of the sizeable health centre by the Government of Malta in very close proximity to the complex.

The upcoming IPO of Main Street Complex plc had been included in the indicative listing calendar published by the MSE earlier this year and which I had discussed in my article on 15 February. There was also mention of another equity issue during the first half of the year. New equity offerings are welcome news to the investing community as they complement those that are already listed on the regulated main market and create possibilities for further diversification of investor’s portfolios. Hopefully, these new offerings will all come from reputable companies thereby avoiding a repeat of the unfortunate circumstances which culminated in the MFSA using its powers last week to force the delisting of Pefaco International.

In the interests of all stakeholders, the growth of both the equity as well as the bond markets should not take place at all costs and without any due consideration to the preservation of Malta’s financial market reputation and the potential negative implications for investors. Growth needs to be managed carefully with this coming from reputable companies, having sound business models and profitable track records.

Rizzo, Farrugia & Co. (Stockbrokers) Ltd is acting as Sponsor, Manager & Registrar to the Main Street Complex plc Initial Public Offering.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.