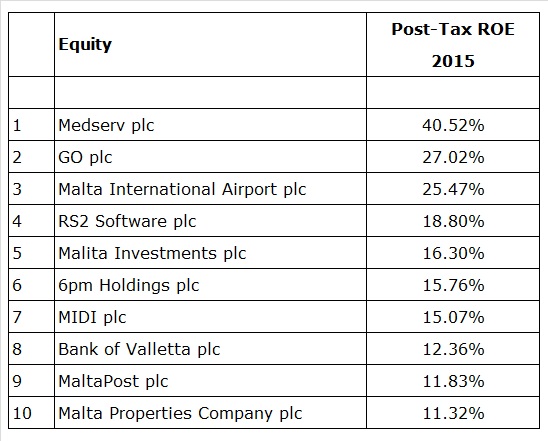

The ROE League Table

In last week’s article I shared my view that, apart from dividend returns, investors should also take into account the return on equity (ROE) when considering which companies to invest in.

Following the end of the 2015 annual reporting season, the updated ROE league table highlights those companies which are generating the highest returns and also enables investors to compare the changes from one year to the next.

Today’s article reviews the 10 companies that generated double-digit ROE’s during their 2015 financial year.

By far, the company that generated the highest ROE in 2015 was Medserv plc with an impressive return of 40.5%. The ROE of Medserv increased significantly from 22.7% in 2014 as the company’s profits after tax surged to €4.12 million in 2015 from €1.94 million in 2014. It is also worth highlighting that Medserv’s ROE during the 2013 financial year was only 5%. The significant upturn in the ROE over the past two years is testament to the strong improvement in profits as a number of contracts offshore Libya commenced and the company also benefited from the contribution of the new Cypriot base. By the end of this month, Medserv will be publishing its 2016 financial projections and investors will have an indication whether the Directors are expecting this return to be sustainable or otherwise during the current financial year. The projections will also include the initial contribution from METS following the acquisition of this company in February 2016 and investors will gain an early insight as to analyse whether this strategic move will immediately begin to generate positive returns for shareholders.

GO plc ranks in 2nd position in the 2016 ROE league table with a return of 27%. The ROE improved substantially from only 7.8% in 2015 on account of two factors (i) the improved profitability in 2015 (comprising a €6 million uplift in operational results, the fair value uplift of €7 million related to the option which GO held in relation to its investment in the Cypriot telecoms company Cablenet as well as the €6.6 million impairment on the investment in Forthnet accounted for in the restated 2014 results) and (ii) the reduction in shareholders’ funds by 11% to €92.1 million following the spin-off during the year of Malta Properties Company plc. Although the immediate focus for GO shareholders in the coming weeks will be news regarding the identity of the selected preferred bidder for the company and the price which will be offered to all shareholders, the interim financial statements as at 30 June 2016 (generally published by early August) should begin to show the contribution of the Cypriot company after GO increased its equity stake to 51% in January 2016.

Malta International Airport plc has been one of the most consistent performers in recent years. Although the ROE of the airport operator improved from 24% to 25.5% between 2014 and 2015, the company dropped to 3rd position from the top ranking position last year. 2016 should be another very positive year for MIA as passenger traffic is expected to reach yet another record following the 12% increase in the first four months of the year coupled with the additional seat capacity in both the summer schedule and also the winter months.

The two companies in the IT sector both rank among those that generated double-digit returns. RS2 Software plc is in 4th position with an ROE of 18.8% during the 2015 financial year, up from 12.5% in 2014 following the 70% increase in profits despite the impairment on receivables of €1.2 million. Meanwhile, the ROE of 6pm Holdings plc only improved from 14.5% to 15.8% although the profits more than doubled to GBP1.69 million from GBP0.81 million in 2014 largely reflecting the consolidation of Blithe Computer Systems Ltd in the UK as from July 2015. The increased profitability was counter balanced by the fact that the company’s equity base improved by GBP11.5 million to GBP15.8 million reflecting the GBP9 million (net of deferred tax) revaluation of the Group’s proprietary software solutions.

In the banking sector, only Bank of Valletta ranks in the top 10 positions with an ROE of 12.4% during its 2014/15 financial year. Recently, BOV issued its interim financial statements for the six months ended 31 March 2016 with profits after tax rising by 11% to €44.6 million translating into an annualised ROE of 13.2%. However, the Bank has continued to indicate that they will need to increase their Tier 1 capital in the near term (possibly through a mix of higher profit retention and additional equity through a rights issue or a placement of shares to new investors) and this could negatively impact the ROE going forward.

On the other hand, the ROE of HSBC Bank Malta plc declined from 7.8% during their 2014 financial year to 6.5% as the bank’s performance was impacted by the cost of the voluntary early retirement scheme of €14.7 million. Lombard Bank Malta plc saw its ROE improve slightly from 4.2% in 2014 to 5.1% mainly on lower impairment provisions.

Tracking the ROE’s and other financial indicators of companies over a number of years also provides a good overview of trends across a specific company or sector. In this respect, it is worth highlighting the rapid decline in returns across the banking sector. The ROE of HSBC Malta was above 20% in 2008 but dropped to below 10% in 2014 and 2015. Likewise, Lombard Bank Malta plc saw its ROE drop from 15% in 2008 to below 10% in each of the last 5 financial years.

On the other hand, BOV’s ROE was more volatile due to the impact of fair value adjustments in their income statement. However, BOV continued to generate double-digit ROE’s during each of the last four financial years.

MIDI plc also registered a double-digit ROE in 2015 and ranks 7th in the league table with a return of 15%. This property development company benefited from the recognition of property sales revenue amounting to €38.8 million in 2015 as the company concluded the final deeds on the large majority of apartments from the Q1 residential block. However, this return is unlikely to be repeated in 2016 on a lower amount of final deeds of sale during the current financial year as the Q2 apartments (60 in total) are being sold on plan with final deeds expected during the first half of 2018 upon delivery of the finished apartments.

The three property rental companies have differing ROE’s due to their unique characteristics. Malita Investments plc ranks among the top 10 companies on the MSE as the company’s performance was again very positively impacted by the fair value gains amounting to €11.6 million which helped the company’s profit amount to €16.6 million. On the other hand, the other two companies (Tigne Mall plc and Plaza Centres plc) do not hold investment property and therefore their income statement is not impacted by any changes in value to investment property. Instead, property revaluations are reflected only in the balance sheet. In fact, the ROE’s of these two companies are similar. The ROE of Tigne Mall improved from 4.1% in 2013 to 5.2% in 2015 and Plaza’s edged up to 4.2% from 3.9% in 2013. The ROE of Tigne Mall is higher than that of Plaza due to its relatively higher leverage which offsets the better operational performance of Plaza.

Although the two ratios I discussed in my latest articles are very important indicators, they are definitely not the only ones which need to be take into consideration when analysing companies. Additionally, it is important to highlight that financial ratios are based on historical figures. More importantly, one would need to understand the potential future prospects of the company or sector in question and additional information in this respect is essential from local companies to assist investors accordingly. Furthermore, investors should also be cognisant of the various risks related to a specific company and the industry in which it operates, in order to assess whether this is in line with the investor’s own risk profile before taking an investment decision.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.