The status of the MGS market

In 2017, the RF MGS Index dropped by 3%, its first annual decline since 2011. Prices of Malta Government Stocks continued to trend lower since the start of the year albeit with a high degree of volatility from one week to the next. In fact, the RF MGS Index is down another 2.5% this year.

In recent months I published several articles about how MGS prices are influenced by various factors including the publication of economic data, international economic and political developments as well as monetary policy announcements.

In today’s article I will not be explaining the various reasons for the continued decline in MGS prices but rather delve upon a few aspects to highlight the current status of the MGS market.

Some investors may have realised that there was a marked decline in trading activity in MGS on the secondary market. Since the start of 2018 just over €142 million worth of MGS traded, a significant decline from the volumes in previous years. Few investors may recall that in 2015, a total of €775 million worth of MGS changed hands on the secondary market. This declined to €551 million in 2016 and €403.8 million in 2017. As such, the downturn is not a new trend this year, but it started some time ago.

The steep decline in trading activity is partly attributable to the launch of the quantitative easing (QE) programme by the European Central Bank since the larger investors would opt to dispose of their securities via the QE programme on the OTC market in order to obtain a more favourable price. Since the start of the QE programme in 2015, a total of €1.1 billion in MGS was repurchased by the Central Bank of Malta on behalf of the European Central Bank and this volume is not included in the trading activity on the secondary market. As such, although the decline in MGS trading activity is still evident, it is also a natural consequence of the QE programme. In 2016, for example, a total of €525 million was repurchased by the Central Bank of Malta under the QE programme and if one were to include the activity on the secondary market of €551 million, over €1 billion worth of MGS activity took place that year.

Another reason for the lower level of trading activity is related to the fact that in previous years, several investors acquired MGS on the primary market for speculative purposes in order to take advantage of quick capital gains once trading commences on the secondary market. However, following the decline in MGS prices in recent years, fewer investors participated in primary market issues which, in turn, also resulted in a lower level of new issues taking place aimed at the retail investing public. Moreover, the reduction in overall MGS issuance as from 2017 also reflects the need for the Government of Malta to borrow much less than in previous years as it is now registering a budgetary surplus.

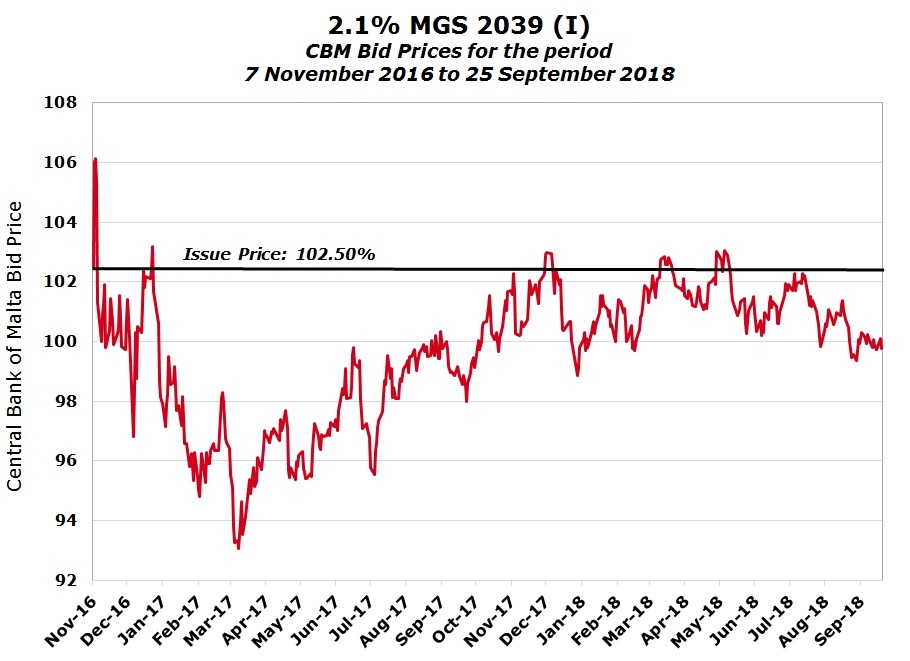

The turning point was in 2016 when there was a record amount of primary market issuance which amounted to almost €600 million. However, as MGS prices declined rapidly shortly after the commencement of trading of the 2.1% MGS 2039 (coinciding with the election of Donald Trump as President of the US in November 2016), the enthusiasm for new MGS issues came to abrupt end. The 2.1% MGS 2039 had been offered to the public at 102.50% in October 2016 and initially traded up to a high of 106%. However, it fell to a low of 93.08% in March 2017 before recovering to just above 103% in May 2018 and dropping back below 100% as from last month.

Following the sudden downturn in MGS prices in November 2016, subscriptions from retail investors for the three new MGS’s issued by the Treasury of Malta in early 2017 amounted to a mere €19.1 million (nominal). Moreover, there was also weak demand from institutional investors as the total amount issued across the three MGS’s of €182.87 million was below the maximum permissible amount of €220 million.

The lack of investor appetite during the first MGS issue in 2017 left an impact on the fund raising plans by the Treasury of Malta since then and no new MGS issues have since been launched in the traditional manner solely to retail and institutional investors. In fact, the following MGS issue took place in August 2017 but this was available solely to institutional investors who were allotted only €74.9 million (nominal). The Treasury of Malta then raised a total of €100 million in a newly designed instrument, the 62+ Savings Bonds, in August and October 2017. Another tranche of the 62+ Savings Bonds was offered to qualifying investors earlier this year when just under €94 million was raised. These 62+ Savings Bonds are not listed on the MSE since they are not tradeable, thus leading to lower overall secondary market trading activity.

Despite the positive assessments on Malta by the various international credit rating agencies in recent months which was evident again a few days ago when Standard & Poor’s maintained its ‘A-‘ rating with a positive outlook, investors need to remain aware that price risk for the medium and long-term MGS remains elevated as a result of international developments.

The ECB has repeatedly indicated that it will be halting its QE programme by the end of 2018 and various ECB rate setters are widely advocating that the normalisation of monetary policy should take place at a quicker pace. This could lead to further increases in yields across eurozone bond markets and consequently extended downward pressure on sovereign bond prices. It is worth recalling that the yield on the benchmark 10-year German bund had dropped to an all-time low of minus 0.2% in July 2016 and has recovered steadily since then although remaining very volatile from one week to the next. Earlier this year, the yield on the benchmark 10-year German bund had risen to its highest level in two years of 0.77% and many international analysts forecast that this level will be regained by the end of the year.

Once the QE programme is discontinued by the end of 2018, a higher level of secondary market activity in MGS may take place next year as the larger holders who wish to reduce or exit some exposures would largely need to do so in the traditional manner although the ECB had indicated that it will reinvest its principal payments from maturing securities. However, such investors need to be aware of the increased difficulty to command an attractive price as the stockbroker of the Central Bank of Malta (who is regarded as the ‘buyer of last resort’) generally reduces bid prices when faced with high levels of supply.

Given the indications of a continued Government budget surplus also in the years ahead, the amount of new MGS issuance is likely to remain subdued. In view of the expected further decline in MGS prices and the lower level of issuance, there could be an increased appetite for corporate bonds by investors solely wishing to having an exposure to fixed coupon bonds. This necessitates increased vigilance from investors in order to assess the credit risk of the various corporate bond issuers, in particular also distinguishing between the two trading venues, namely the Regulated Main Market (Official List) and Prospects.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.