2018 – An eventful year for the Maltese equity market

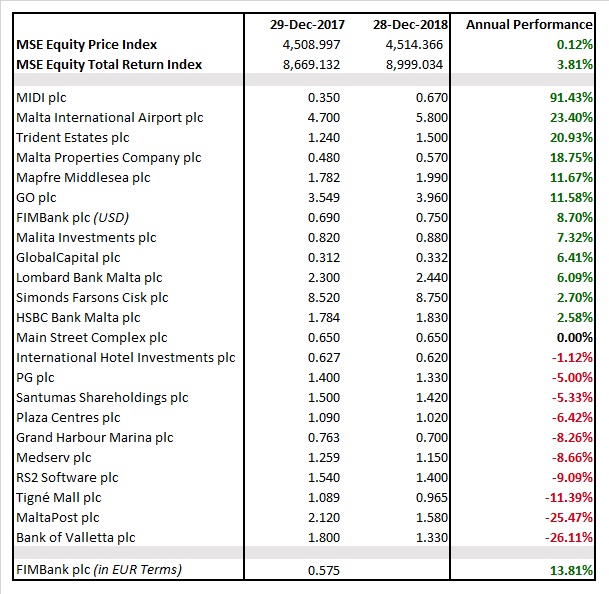

The performance of the equity market can be measured either by the MSE Equity Price Index or the MSE Total Return Index. The MSE Equity Price Index increased by a minimal 0.12% during the past twelve months while the MSE Total Return Index increased by 3.8% reflecting the importance of dividends to the overall returns to investors.

At first glance, a slight rise of 0.12% in the MSE Equity Price Index may indicate a rather lackluster year for the Maltese equity market. However, it was certainly not the case, and 2018 can be described as a very eventful year with many company-specific developments characterising the activity and share price movements in many companies.

Overall trading activity across the equity market remained strong at €86.3 million. Although this represents a slight decline of 1.9% over the volumes registered in 2017, it is worth highlighting that the 2017 activity reached the highest level since 2006 so the multi-year highs of 2017 were sustained also in 2018. Moreover, it is always good to analyse the main contributors to equity volumes and highlight the shares that experienced substantial changes in volumes from one year to the next. Bank of Valletta plc remains the most actively traded equity and during 2018, almost €23 million worth of shares changed hands representing a decline of 11% over the previous year. BOV accounted for almost 27% of the overall equity market activity compared to 29.4% in 2017. Malta International Airport plc was the second most actively traded equity with almost €9.4 million worth of shares changing hands compared to almost €12 million in 2017. On the other hand, activity in GO plc shares increased by 57% to €9.2 million accounting for 10.6% of the equity volumes in 2018 compared to 6.6% the previous year. HSBC Bank Malta’s share of equity market volumes remained practically unchanged at 9% with €7.8 million worth of shares changing hands once again over the past 12 months. There were notable declines in activity in RS2 Software plc, PG plc, Medserv plc and Tigne Mall plc, whilst the equities of MIDI plc, Simonds Farsons Cisk plc, Malita Investments plc and Malta Properties Company plc experienced a significant increase in trading activity.

It may seem odd to many observers that the equity benchmark only increased by a minimal 0.12% when the number of positive performers (12 in total) surpassed the negative performers (10 in total) with half of the positive performers registering double-digit gains. This is mainly due to the fact that the worst performer in 2018 was Bank of Valletta plc with a decline of 26%. As a result of BOV’s high market capitalisation, it accounts for a large part of the movement in the equity benchmarks and the sharp downturn in 2018 offset the very positive performances of several other equities.

Among the twelve positive performers, it is interesting to note that six companies saw their share prices register double-digit movements, namely MIDI plc (+91.4%), Malta International Airport plc (+23.4%), Trident Estates plc (+20.9%), Malta Properties Company plc (+18.8%), Mapfre Middlesea plc (+11.7%) and GO plc (+11.6%).

MIDI plc was the star performer with its share price ending the year almost double the value compared to that at the end of 2017 on total activity of €4.2 million. The equity began to rally during the second quarter of the year when it finally surpassed the 2010 IPO price of €0.45 following the publication on 23 April of the 2017 annual financial statements showing an increase in the net asset value per share to €0.404 arising from the revaluation of the company’s shareholding in Mid Knight Holdings, the owner of ‘The Centre’. Towards the end of June, MIDI published its updated Financial Analysis Summary in which it revised higher its 2018 financial projections due to the expected delivery of most of the units within the new block of apartments which is expected to boost the net asset value per share to €0.47 per share. Moreover, the company issued another announcement at the end of June stating that it entered into preliminary discussions with Tumas Group Company Limited to explore the possibility of establishing a joint venture for the development of Manoel Island. This continued to positively impact the share price. The equity rallied to a record level of €0.74 on 25 October as a media report on 9 October speculating on the possible financial terms of the joint-venture between Tumas and MIDI continued to ignite investors’ interest for this equity. The share price eased lower during the last two months of the year to the €0.67 level on lack of further news regarding the joint venture and possibly also due to the very recent postponement of the decision by the Planning Authority regarding planning approval of the Manoel Island development.

Malta International Airport plc was the second-best performer in 2018 as its share price climbed by 23.4% to end the year at the €5.80 level after touching an all-time high of €6.25. The steep increase in MIA’s share price coupled with the sharp decline in that of BOV resulted in MIA becoming the largest capitalised company on the MSE when taking all of its issued shares into consideration. MIA only has its ‘A’ shares listed on the MSE (the ‘A’ shares represent 60% of the issued share capital).

The main factors contributing to the strong share price performance of MIA were the approval by the Planning Authority of the company’s master plan and the continued robust financial and operational performance which led to another record year for passenger movements. Another positive factor was the additional ten new routes announced by Ryanair for Summer 2019 which augurs well for another strong year ahead.

The share price of Trident Estates plc was very volatile over the past twelve months. The equity was listed at the end of January 2018 and within a few weeks, the share price rallied by 53%. It subsequently declined by 33% during the second quarter of the year heading back towards the spin-off price of €1.24 but then started to edge higher again towards the end of the year to close at the €1.50 level representing an overall increase of 20.9%. The company confirmed that it will be undertaking a two-stage rights issue of €15 million in total during 2019 and 2020 which is earmarked to part-finance the Trident Park development along with bank financing that has already been secured. Meanwhile, development on the Trident Park project is ongoing and the company expects to receive its first tenants at the start of 2021.

The share price of Malta Properties Company plc also advanced by almost 19% during 2018 to €0.57 on overall volumes of €2.1 million compared to €1.2 million the previous year. The equity traded within a tight range during the first few months of 2018 but then rallied by 17.5% during the month of May following the surprise announcement on 17 May of a possible acquisition of Dubai Holding’s 91% majority shareholding in SmartCity (Malta) Limited. Later on in the year, the company reported that one of its wholly-owned subsidiaries entered into a promise of sale agreement (valid and effective for up to three years) with Mercury Exchange Limited for the sale and transfer of the St George’s Exchange (including its surrounding land) for €13.75 million which upon execution would result in a considerable increase in the net asset value of the company. Moreover, MPC also confirmed that it entered into the final deed of sale on the Sliema exchange for €5 million. The company issued an update to the market last week wherein it confirmed that it is in the final stages of its evaluation of the potential acquisition of SmartCity (Malta) Limited and any eventual agreement would be subject to general meeting approval, various terms and conditions, as well as satisfactory due diligence and regulatory approvals.

There were several other noteworthy developments in 2018 that are worth highlighting since they could well characterise equity market movements and trading activity also during the course of 2019. Due to space limitations, these will be dealt with in a separate article next week. One of the most interesting developments in the New Year will be the upcoming Initial Public Offering of BMIT Technologies plc. Meanwhile, as was evident again in recent weeks, company announcements very often generate increased trading activity which in turn leads to a more liquid market in a company’s shares. As such, companies whose shares are listed on the regulated main market should ensure regular communications to the market. A more liquid equity market is beneficial to both retail as well as institutional investors and could also well encourage additional companies to obtain a listing.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.