An introduction to Berkshire Hathaway

In some of my articles over the past 12 years, I often made reference to Warren Buffett and his value investing philosophy.

Possibly, not many Maltese investors are aware of the history and the current set-up of Berkshire Hathaway Inc, the investment vehicle of Warren Buffett.

Berkshire Hathaway traces its history back to two textile firms (Berkshire Fine Spinning Associates and Hathaway Manufacturing Company) which merged in 1955. Warren Buffett first acquired a stake in Berkshire Hathaway in the early 1960’s and took full control of the company in 1965.

Berkshire Hathaway liquidated its textile operations in 1985, by which time it had become the holding company for Buffett’s other investments and corporate acquisitions as he used the cash flows of the original core business of the textile arm to acquire other businesses, the first being an insurance company called National Indemnity.

Warren Buffett began to acquire insurance companies to use the float or available reserve (the insurance premiums which are collected before payment of any claims) in order to purchase stakes in other companies. Berkshire acquired the Government Employees Insurance Company (GEICO) in 1996. GEICO originally only serviced employees of the federal government since it was the company’s belief that it would be less risky to insure government workers rather than the general public. However, following GEICO’s acquisition by Berkshire, it began to market its insurance products also to individuals outside of the public sector. Today, GEICO is the second largest auto insurance company as it insures more than 27 million vehicles in the US.

Over the years, Warren Buffett and Vice Chairman Charlie Munger transformed Berkshire into a widely diversified conglomerate of businesses together with an investment portfolio with a combined current market capitalization of more than USD500 billion. Berkshire Hathaway has more than 50 wholly-owned subsidiaries which, in turn, have an additional 200 subsidiaries. Apart from the insurance companies – GEICO, National Indemnity, Berkshire Reinsurance and others, Berkshire owns notable businesses in other sectors such as See’s Candies (which Berkshire acquired in 1972), Burlington Northern Santa Fe (one of the largest freight railroad network in the US with 8,000 trains and 48,000 employees), Dairy Queen (a fast-food chain with over 4,500 stores in the US and over 2,500 stores internationally), Benjamin Moore Paints, NetJets, Duracell and Fruit of the Loom.

Moreover, Berkshire Hathaway has an investment portfolio that has a current market value of over USD200 billion in many large well-known companies in the US apart from a cash balance of USD114 billion as at 31 March 2019 which includes investments in short-term U.S. Treasury Bills. Warren Buffett wishes to use this cash for ‘an elephant-sized acquisition’.

Berkshire’s investment portfolio is one of the most closely followed around the world as many investors seek to track those companies which, on a quarterly basis, Warren Buffett adds to the portfolio or in which he increases his stake, as well as those companies which fell out of his favour and he disposed of.

Although a large portion of the portfolio is focused on financial services and banks (with large stakes in Bank of America, Wells Fargo, American Express, US Bancorp, JP Morgan Chase, Moody’s Corporation and Bank of New York Mellon), Berkshire’s single largest holding is Apple Inc.

Berkshire Hathaway only began investing in technology companies in 2011 with an acquisition of USD10 billion worth of shares in IBM which had then been sold in 2018 (a baptism of fire for Berkshire in the tech sector as IBM had turned out to be a bad investment decision). The company started investing in Apple in 2016 and within a very short period of time it became its top position in the portfolio. As at the end of March 2019, Berkshire held 250 million shares of Apple valued at USD47 billion. Warren Buffett has publicly declared that he loves the “stickiness” of Apple’s ecosystem and believes that the company’s products provide tremendous value to customers. Also in the technology sector, earlier this month Warren Buffett announced that Berkshire Hathaway acquired some shares in Amazon.com despite the share price being close to its all-time high and having surged by over 500% over the past 5 years.

The second largest allocation in the investment portfolio of Berkshire is Bank of America which came about during the global financial crisis with an investment of USD5 billion worth of Bank of America preferred shares and warrants to buy 700 million shares for just USD7.14 each. The warrants were exercised in 2017. Those shares are today priced at USD28 per share thus representing a very successful investment for Berkshire Hathaway.

Berkshire Hathaway has had a sizeable shareholding in Coca Cola Company since 1989 when he invested USD1.3 billion which is currently valued at USD18.7 billion. Moreover, it is estimated that Berkshire receives over USD600 million per annum in dividends solely from its stake in Coca Cola.

However, not all investments made by Berkshire Hathaway were successful. Warren Buffett began purchasing shares in Tesco plc in 2006 and continued to add to this position in later years becoming the company’s third-largest shareholder. As Tesco’s financial situation started to deteriorate, Berkshire started selling its stake in 2013 and by the time Warren Buffett sold off the entire stake in Tesco, he suffered a loss of USD444 million – one of the biggest losses in his investment company’s history.

More recently, Warren Buffett admitted that Berkshire had “overpaid” for Kraft Food Group in early 2015 when it merged with Heinz (which was already 50% owned by Berkshire). Earlier this year, Kraft Heinz took a USD15.4 billion write-down for its Kraft and Oscar Mayer brands and other assets, slashed its dividend, and announced that the US Securities and Exchange Commission was probing its accounting leading to a sharp decline in its share price. Warren Buffett confirmed that despite the difficult situation at Kraft Heinz, he had no plans to dispose of Berkshire’s stake in the food and beverages company.

Warren Buffett believes in the value of compounding and as such, Berkshire Hathaway does not pay any dividends to shareholders. Since Warren Buffett obtained control of Berkshire Hathaway, it has only paid a dividend once (in 1967).

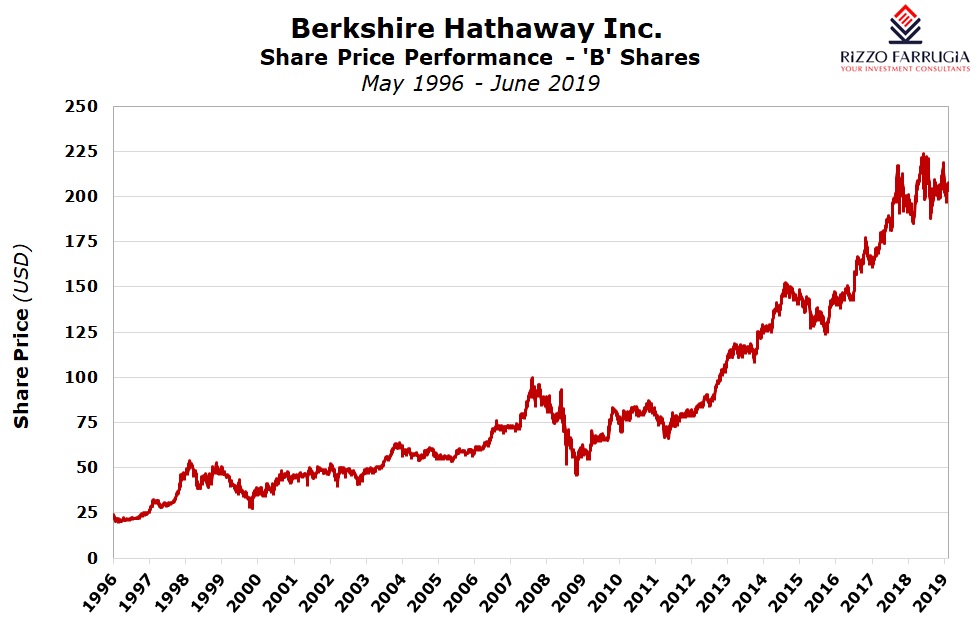

Berkshire trades in two classes of shares on the New York Stock Exchange. The “A” shares are priced at over USD300,000 (this is correct and not an error!) making it too costly for an average retail investor to invest in. On the other hand, the “B” shares, which were created in 1996, are currently priced at just over USD200.

Warren Buffett is regarded as one of the most successful investors of all times. He became renowned for buying stakes in companies at prices that would later turn out to be less than their true value and holding on to them for the long term.

Warren Buffett believes that instead of “buying fair companies at wonderful prices”, one should buy “wonderful companies at fair prices”. A company must not only have a lucrative position in the marketplace, but it should also have a “moat”. This is Mr Buffett’s reference for a company with a lasting competitive edge. In his view, such a company should have strong cash flow generation capabilities and attractive profitability secured for the long-term since other companies cannot easily replicate what it does. Warren Buffett compares this to a moat around a castle. Such a moat in business prohibits rival companies from competing. In his metaphor, the castle should be run by a knight who spends his riches on widening the moat, rather than blowing it all on banquets. In his view, the moat is the main factor to be considered.

Warren Buffett always argued against an overly-diversified portfolio of shares since he favours a handful of shares in companies that are well-known and run by skilful managers. Warren Buffett warns investors to never invest in a business that you cannot understand, and he claims that several investors obtain certain exposures merely for diversification purposes and end up with stakes in a portfolio that are not understood well.

Warren Buffett stays away from unprofitable companies, heavily indebted ones and also speculative punts.

One of Warren Buffett’s theories is to buy a shareholding in a company because you want to own it, not because you want the share price to go up. He views his stakes in companies as a part owner of the business and ignores the short-term price fluctuations caused by abrupt changes in investor sentiment, temporary shifts in the economic cycle or ‘market noise’.

Warren Buffett always argued that “opportunities come infrequently” so “when it rains gold, put out the bucket, not the thimble". This is the reason behind the large idle cash always held by Berkshire Hathaway. It certainly was put to good use at the time of the start of the global financial crisis in 2008 and 2009 when he invested sizeable amounts in Bank of America and Goldman Sachs.

Berkshire Hathaway has been described by some international analysts as the S&P 500 index ‘without the bad bits’. Other financial commentators believe that a stake in Berkshire provides “a very nice long-term way to own America”. However, replicating the historic performance in the future would be extremely hard given the overall percentage return of Berkshire Hathaway of over 2 million percent between 1965 and 2018!

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.