Another record performance from MIA

Malta International Airport was the second company to publish its interim financial statements last week following Mapfre Middlesea plc on 12 July which kicked-off the interim reporting season.

The financial newsflow will reach a climax in mid-August as several companies already confirmed the dates of the publication of their June 2019 financial statements. Companies having a December year-end are obliged to publish their interim financial statements by the end of August. Moreover, since PG plc’s financial year ends on 30 April, it must publish its annual financial statements also by the end of August.

The next few weeks will therefore be an important period for the Maltese equity market with financial analysts and investors in a position to gauge the health of most of the companies listed on the Regulated Main Market. Hopefully, companies will present an update on their business strategy apart from providing a review of their financial performance. Some companies also organise briefings for financial analysts which are very helpful in order to question management on the progress of their business initiatives.

For the active followers of the local equity market, it should not come as a surprise that Malta International Airport registered another record financial performance during the first half of 2019. MIA publishes its traffic results on a monthly basis and since the aviation segment accounts for circa 70% of the company’s overall revenue generation, the increased passenger flow filtered into the financial performance of the company.

On 9 July MIA published its H1 traffic results and it announced that it generated a 5.9% increase in passenger movements during the first half of the year to 3.25 million (H1 2018: 3.07 million). This translated into a 9.1% increase in revenues to €44.6 million – a record at the interim stage. It may be worth highlighting that over the past 5 years, the company’s revenue in the first half of their financial year increased by an average of almost 10% per annum reflecting the strong upward movement in passenger traffic.

The half-year results published last week reveal that revenue from the ‘Airport’ segment increased by 7.1% to just over €31 million while revenue from the ‘Retail & Property’ segment increased by 13.2% to €13.3 million.

During the press conference held on 9 July when MIA published its traffic results, CEO Mr Alan Borg explained that the growth in passenger numbers came about from a 5.8% increase in seat capacity as well as a 5.9% increase in aircraft movements. The CEO also highlighted that despite the substantial increase in seat capacity and aircraft movements, the seat load factor remained in line with the previous year and stood at 79.8% which is a very strong metric. Mr Borg also mentioned that the growth in passenger movements mainly materialised from Ryanair which continued to reinforce its position as the largest carrier operating to Malta. Ryanair registered a 13.3% increase in passenger movements to Malta during the first half of 2019 to a total of 1.3 million passengers followed by AirMalta with a rise of 2.8% to 919,000 passenger movements. Mr Borg also provided some statistics of the increased connectivity in recent years showing MIA’s increased connectivity by over 200% since 2009. This is the largest growth achieved when compared to peer airports.

As I explained in last week’s article regarding IFRS 16, MIA was one of the companies which was very much impacted by the adoption of this new accounting standard as from 1 January 2019. In fact, the interim financial report published last week provided a very detailed description of the overall impact on the airport operator. The company explained that it is recognising the value of its lease liabilities of €45.7 million and the ‘right-of-use’ of the temporary emphyteuses as an asset on its balance sheet in relation to the leasehold land and buildings, as well as other assets mainly motor vehicles.

MIA reported that staff costs increased by 12.9% and other operating costs rose by a mere 0.8% to a total amount of €17.6 million (+3.95%). The increase in other operating costs does not take into account the lease expenses as these are now partly included under the ‘Depreciation’ line item and partly under the ‘Finance Cost’ line item. In fact, the airport operator explained that on a like-for-like basis, operating expenses would have increased by a further €1.1 million in H1 2019 when compared to the corresponding period last year.

Moreover, the earnings before interest, tax, depreciation and amortisation of €27 million cannot be compared with the previous year’s figure of €23.9 million due to the adoption of IFRS 16. However, on an adjusted basis, EBITDA still exceeded last year’s figure by 8.1%.

The impact of IFRS 16 is mostly evident from the depreciation and finance costs. The depreciation charge incurred by MIA during the first half of 2019 surged by nearly 20% to €4.35 million (H1 2018: €3.63 million) whilst net finance costs increased to €1.02 million compared to just €0.18 million in H1 2018 notwithstanding the fact that MIA remained entirely debt free (except for lease liabilities which are now recognised on balance sheet against a ‘right-of-use’ asset). On a like-for-like basis, the depreciation charge would have only increased by 6% to €3.85 million in H1 2019, whilst net finance costs would have been much lower amounting to only €0.02 million.

Although the treatment of IFRS 16 may trouble some investors when interpreting a company’s financial performance, the profitability figures are not impacted whatsoever. MIA reported a 7.3% increase in profitability during the first half of 2019 to €21.7 million before tax and €13.95 million after tax.

As it has become customary over the past several years, the company declared a net interim dividend of €0.03 per share. MIA distributes a dividend semi-annually and the company then recommends the payment of a final dividend for approval by shareholders at the Annual General Meeting. While the interim dividend has remained unchanged for a long number of years, the final dividend has fluctuated in recent years. Earlier this year, a net dividend of €0.09 per share was declared in respect of the final dividend for the 2018 financial year which was paid on 29 May 2019. This represented an increase of 28.6% over the final dividend in the previous 3 years. Despite the increase in MIA’s dividend in respect of the 2018 financial year, the dividend payout ratio eased slightly to 53.6%. In an article published earlier this year I had revealed that Flughafen Wien AG (the operator of Vienna Airport and the largest shareholder of MIA) had proposed a 30% increase in its 2018 dividend (corresponding to a 55% dividend payout ratio). I had also highlighted that Flughafen Wien AG had stated that their dividend payout ratio will rise to 60% in 2019. Shareholders of MIA will need to await the publication of the 2019 annual financial statements in February 2020 to see whether MIA will also alter its dividend payout ratio in tandem with that of its parent company.

The amount of future dividends by MIA must be seen in the light of the company’s financial structure and also its sizeable investment programme. MIA’s executive management has declared in the past that the company aims to fund most of its capital expenditure for core operations from internal cash flow while other investments such as the SkyParks II development will take place via debt funding. MIA is currently undertaking a €20 million investment in a new multi-storey car park. Upon completion, the company will then proceed with the terminal extension project and SkyParks II. With respect to the terminal extension project, MIA’s CEO confirmed at the recent press conference that the final plans are expected to be presented in the coming months.

Although the company is in the midst of a significant capital expenditure programme, it continues to generate significant cash from its operations which amounted to €36.8 million in 2018 and €42.7 million in 2017. Meanwhile, during the first half of 2019, MIA generated €25.1 million in cash from operations. The high cash generation enabled the company to repay all bank borrowings of €33 million during the first half of 2018 and yet as at 30 June 2019, the company had a cash balance of €25.8 million.

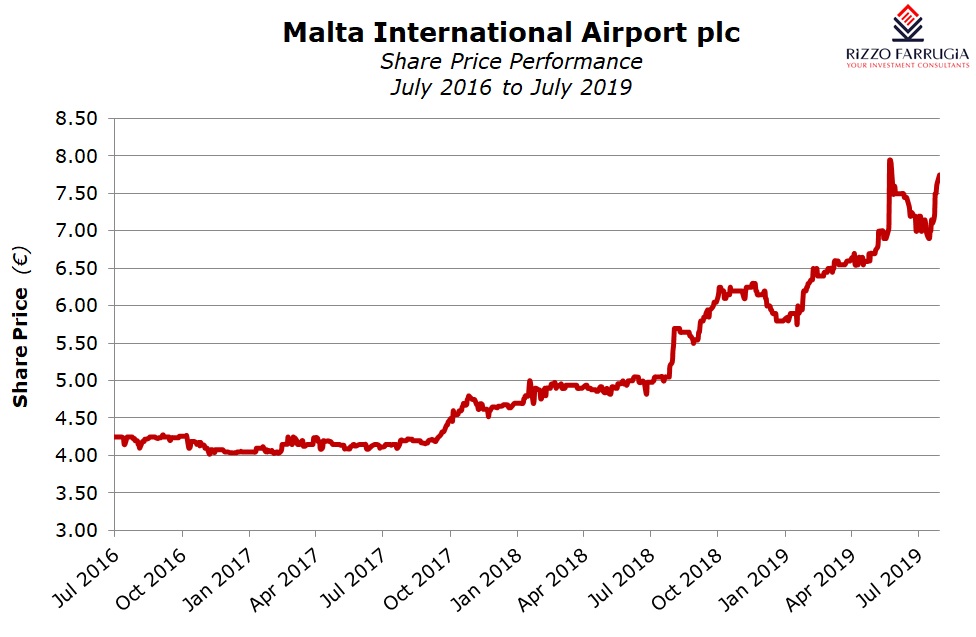

The share price of MIA had traded up to a record of €7.95 on 22 May 2019 before dropping back to the €6.90 level earlier this month. It has since regained the €7.75 level helping the company’s market capitalisation surpass the €1 billion level. This helped MIA continue to strength its position as the largest company listed on the MSE as the market cap of BOV has drifted towards the €650 million level.

Although MIA did not upgrade its 2019 passenger growth forecast of +5.8% to 7.2 million passengers, it would be interesting to understand the future route development programme of Ryanair following the announcement of the setting up of Malta Air and ongoing discussions with the Government of Malta on which routes will be expanded further.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.