Bond focus: Commercial Property Companies

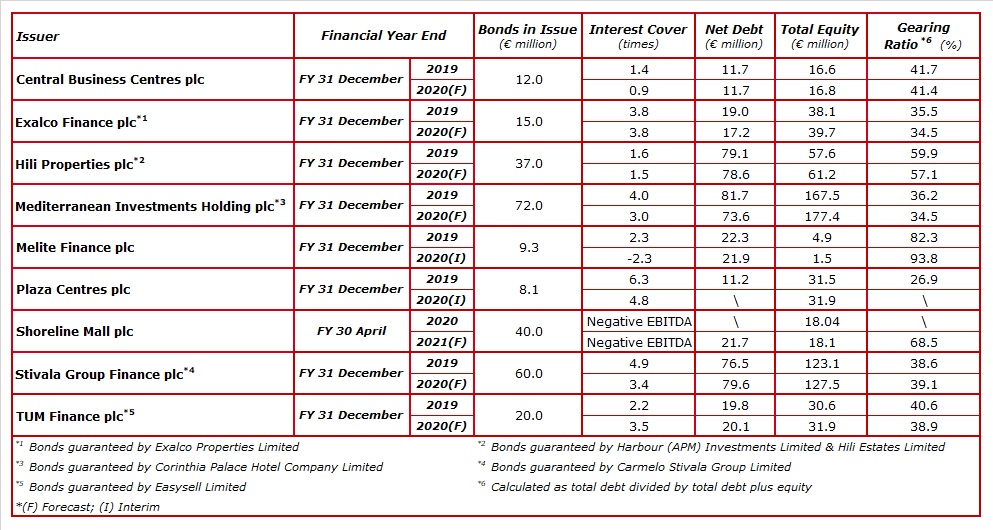

Among the companies whose bonds are listed on the Regulated Main Market of the Malta Stock Exchange, one can identify nine companies which are mainly focused on commercial property activities namely Central Business Centres plc, Exalco Finance plc, Hili Properties plc, Mediterranean Investments Holding plc, Melite Finance plc, Plaza Centres plc, Shoreline Mall plc, Stivala Group Finance plc and TUM Finance plc.

Although the main objective of all these companies is to hold a portfolio of properties for long-term rental income, there are many differences between them and therefore they are not strictly comparable. For example, the only asset of Mediterranean Investments Holding plc is in Libya while Hili Properties plc has a diverse portfolio of 23 properties in various countries including Malta. Moreover, Melite Finance plc does not actually own any properties but holds long-term leases over of a number of retail stores in Italy. Shoreline Mall plc is still in the development stage and the project is only expected to be completed in December 2021 while Stivala Group has an important hospitality segment within its operations.

Nonetheless, a review of some credit metrics is interesting to gauge the overall creditworthiness of this important set of companies within the overall bond market. Since it is generally the norm for commercial property companies to have long-term rental agreements in place, the interest cover is a key credit metric to follow showing the ability of a company to honour its annual interest obligations.

Central Business Centres plc has three separate bonds in issue totalling €12 million maturing in 2021, 2025 and 2027. The company has three business centres – one in Zebbug, one in Gudja and the St. Julian’s Business Centre which welcomed its first tenants in June 2019. The company also owns a large tract of land in Zebbug with the intention of developing it into a complex comprising retail, storage and office space. As at April 2020, the Zebbug business centre was 100% occupied while the occupancy rate of the Gudja business centre was 86%. Meanwhile, the St. Julian’s business centre had an occupancy of 56% in April 2020. The interest cover improved in 2019 to 1.4 times as a result of the income being derived from a related part on the tract of land in Zebbug pending the execution of the agreement with LIDL Immobiliare Malta Ltd. In view of the COVID-19 pandemic, the company assumed a decrease in revenue which would result in a decline in the interest cover to below 1 times. The gearing ratio is not expected to change materially from the level of 41%.

Exalco Properties Limited as guarantor to the €15 million bonds in issue by Exalco Finance plc has a portfolio of 6 business centres with a total of 15,600 sqm in lettable area. The financial performance of the company is expected to improve in 2020 mainly on account of the commencement of rental income from the remaining available space at the Phoenix building effective January 2020 but also due to the renewal of some agreements at higher rates also effective from the beginning of 2020 as well as annual rental increments as stipulated in existing lease agreements. The interest cover is expected to improve to 4.3 times in 2020 while the gearing ratio will be practically unchanged at 35%.

Hili Properties plc has a portfolio of 23 properties in Malta, Romania, Latvia, Estonia and Lithuania with rentable area of over 76,000 sqm spread across offices, restaurants and retail. Revenues are anticipated to drop by 8.3% in 2020 to €8.02 million reflecting the sale of the Tower Business Centre located in Swatar in late December 2019 for a total consideration of €7.1 million. As a result, the interest cover is expected to deteriorate slightly to 1.47 times compared to 1.65 times in 2019 while the gearing ratio is anticipated to improve marginally to 57.1%.

The only operating asset of Mediterranean Investments Holding plc is the Palm City Residences in Libya. The interest cover is expected to decline to 3 times in 2020 from 4 times in 2019 as the company is anticipating revenues to drop to €21.8 million in 2020 from over €27 million in 2019 on account of a reduction in some of the short term leases. Nonetheless, the company reported in August that it generated revenue of €12.5 million during the first half of the year. Despite the weaker financial performance anticipated in 2020, the gearing ratio is expected to improve to 34.5%. The three bonds listed on the MSE totalling €72 million mature over the next three years.

Melite Finance plc issued various announcements in recent months related to the difficulties it is encountering in its business operations and the resultant negative impact on its balance sheet which reduced the total equity of the company to only €1.45 million as at 30 June 2020. This is the first listed company that is seeking to restructure the terms of the bonds that had been issued in 2018. Although the company recently indicated that it managed to sub-lease a few of its outlets in recent weeks, the market will be very attentive to further announcements in due course including the terms of the restructuring.

Plaza Centres plc recently announced that it sold one of its two properties for a consideration of €14 million and following this transaction, the company is seeking to repurchase a number of its outstanding bonds of just over €8 million due in 2026. Since the original bond issue stipulated a minimum holding of €50,000 nominal, the company is not obliged to publish a Financial Analysis Summary on an annual basis providing financial forecasts. Although no financial forecasts are available for 2020, the interest cover of 6.3 times is expected to decline on account of the impact on the retail areas of the Plaza Shopping Complex from COVID-19 and also no revenue earned from the Tigné Place property during the final few months of the year following the sale of this asset in September. The company’s gearing ratio was 26.9% as at the end of 2019.

Shoreline Mall plc was only set up in December 2017 and conducted a €40 million bond issue earlier this year to fund the construction of a 25,000 sqm shopping mall and seven foreshore residential units. The gearing ratio as at the end of 2020 is anticipated to be 68.5%. The company is not anticipated to generate any meaningful revenue until the opening of the complex in January 2022 and therefore the interest cover is a poor metric to gauge in the coming years.

Stivala Group Finance plc issued two bonds in recent years totalling €60 million. The Stivala Group has a sizeable property portfolio valued at over €190 million as at the end of 2019. Both bonds are secured by a number of properties within this vast portfolio including a plot of land in Ta’ Xbiex which is earmarked for the development of a commercial property comprising over 7,000 sqm of rentable area. The Group has other major projects in the pipeline including a 225-room hostel in Gzira. The latest FAS indicates that both projects are delayed in view of the uncertainty resulting from COVID-19. The financial performance of the Group is naturally expected to be negatively impacted from the complete shutdown of the hospitality operations between mid-March and the end of June 2020 and the reduced business activity during the second half of 2020. In fact, the interest cover is expected to weaken to 3.4 times but the gearing ratio will remain largely unchanged at 39%.

TUM Finance plc launched a €20 million bond issue in 2019 and through its 100% owned subsidiary TUM Operations Ltd owns 75% of Centre Parc Holdings Limited and 100% of Easysell Ltd which also acts as a guarantor to the bonds in issue. The Centre Parc complex opened in October 2019 and was fully tenanted by the end of 2019 and remained 100% occupied by the end of August 2020. Meanwhile, the guarantor owns the Zentrum Business Centre in Qormi which is also held as security for the bond issue. A sizeable extension to this property was carried out recently and the building is also fully occupied. As a result of the additional rental income being generated in 2020, the financial performance is expected to improve materially leading to a strengthening of the interest cover to 3.5 times and a slight reduction in gearing to 38.9%.

Even prior to the sudden onset of COVID-19, there was a notable oversupply of commercial property coming to the market in Malta. As a result of recent political developments and the risk of Malta being grey-listed coupled with the possible impact on the demand for office space in view of potential changes in work patterns due to COVID-19, one needs to closely monitor developments in this sector. It is important to verify whether rental agreements will remain in place to provide the consistent income required by these various issuers to honour their obligations in a timely manner.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.