Bond focus: Retail Companies

The retail industry featured among the most impacted economic sectors during COVID-19 due to the restrictions imposed by the health authorities via a temporary closure of all retail areas from 23 March to 3 May 2020.

Even prior to the onset of COVID-19, there was a growing trend in recent years for more customers to opt for online shopping. The lockdowns imposed during the first wave of the pandemic resulted in a surge in online shopping creating further pressures on retailers who were not well geared for online orders. A recent article in the Financial Times stated that Moody’s Investors Service expects online shopping to account for 15% of retail sales in continental Europe in the future, compared with 10% before the pandemic.

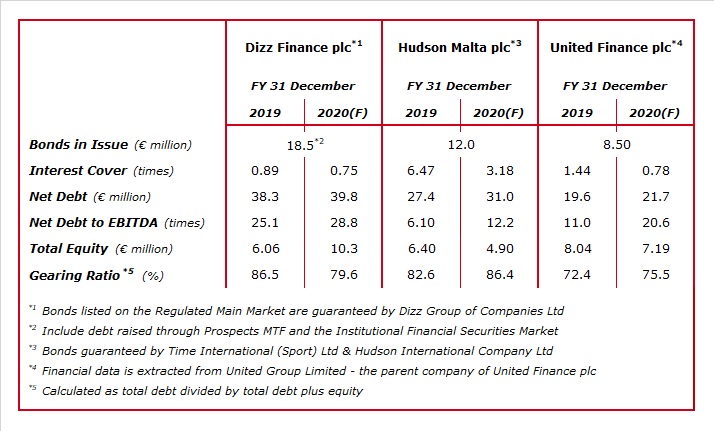

Among the companies whose bonds are listed on the Regulated Main Market of the Malta Stock Exchange, only two companies can be identified as being focused on the retail industry, namely Dizz Finance plc and Hudson Malta plc. However, I also included United Finance plc in the table of retail companies in view of the important contribution to the overall performance of United Group Limited by their retailing segment (mainly Debenhams).

Dizz Finance plc issued a bond of €8 million in September 2016 at a coupon of 5% on the Regulated Main Market guaranteed by Dizz Group of Companies Limited – the ultimate parent and holding company of the Dizz Group. Since then, other issuers forming part of the Group issued additional debt instruments on other venues. On 1 October 2018, D Shopping Malls Finance plc issued a €7.5 million bond at 5.35% via Prospects MTF, while earlier on this year D Foods Finance Ltd raised €3 million as part of a €10 million secured Convertible Notes Programme listed on the Institutional Financial Securities Market. Overall revenue of Dizz Group during 2020 is expected to drop by 9.5% to €13 million as the sharp drop in sales from fashion retail (-26% to €9.4 million) is expected to be partly compensated by improved turnover from food and beverage outlets as well as rental income. In fact, EBITDA is only anticipated to ease by €0.1 million to €1.4 million. Despite this, the interest cover is expected to remain below 1 for the second consecutive year implying that the Group is not generating sufficient cash earnings to honour its finance costs. The issued share capital of the Guarantor increased to €7.7 million during 2020 following the acquisition of DCaffe Holdings Limited and D Kitchen Lab Limited in exchange for an issue of ordinary shares to the ultimate beneficial owners of the Group. This is anticipated to help the overall gearing ratio to improve slightly to 79.6% compared to 86.5% as at the end of 2019. However, the net debt to EBITDA multiple will continue to rise to over 28 times in 2020. Moreover, it is noteworthy that the author of their Financial Analysis Summary stated that “the current situation of accumulated losses, together with minimal cash balances and increasing debt levels is unsustainable, and as such, the Group requires a drastic improvement in profitability or a fresh injection of cash as equity or both”.

Hudson Malta plc is one of the main subsidiaries of the Hudson Group which, in turn, is involved in the retail and distribution of branded fashion and sportswear in Malta, Europe and Africa. Hudson Malta plc is the holding company for the group’s operations in Malta. The portfolio of brands managed by Hudson Malta plc include NIKE, Converse, Timberland, Crocs, Eastpak, New Era, Intersport, Kiabi, New Look, Ted Baker, Alcott and River Island. In early August, Hudson Malta plc announced that Hudson Holdings Limited (the ultimate parent company of the Hudson Group) is in advanced negotiations in connection with the acquisition of Trilogy Limited, a premium fashion retail company operating in Malta with brands such as Calvin Klein, Armani Exchange, Mango, Tommy Hilfiger and Tommy Jeans, through a share-for-share exchange process.

Hudson Malta issued its maiden bond in Q1 2018. The Financial Analysis Summary presents historical financials of Hudson Holdings Limited since the issuer had advanced €4.5 million of the bond proceeds (totalling €11.8 million) to its parent company, whilst the 2020 projections for Hudson Malta reflect the expected performance of the issuer of the bonds. The forecasts for Hudson Malta take into account the actual trading results for the first half of 2020 and the projections for the remaining 6 months to 31 December 2020. The projections for the second half of the year assume that the Malta retail establishments will remain operational during the entire period.

Revenue in 2020 is projected to decrease by 29% (or €12.4 million) to €30.3 million mainly due to the complete shutdown of the retail sector between 23 March and 3 May 2020 and the expected curtailment of operations in fashion retail between June and December 2020 despite retail outlets still being operational. EBITDA is expected to drop by 43% (equivalent to €2.0 million) to €2.5 million resulting in a weaker forecasted interest cover of 3.2 times. The report however highlighted that the Hudson Group has taken measures to safeguard its cashflow position (including moratoria on repayment of loan facilities with its bankers) and to ensure it can meet its obligations despite the downturn in revenues. The forecasts for 2020 also indicate that Hudson Malta will obtain a new bank loan facility of €2.7 million. As a result of the increase in borrowings, the gearing ratio of the issuer is expected to increase to 86%. Likewise, the additional borrowings coupled with the projected reduction in EBITDA, will weaken the net debt to EBITDA to 12.2 times.

United Finance plc tapped the bond market for the third time in October 2014 with a bond issue of €8.5 million maturing in 2024. Although the bonds are not guaranteed by United Group Limited, the figures quoted in the table refer to United Group which operates in the retail, automotive and property sectors. The retail segment accounted for almost 70% of total revenue of the United Group during 2019. However, it is worth highlighting that the consolidated revenue and EBITDA of the United Group does not reflect the contribution from two important investments of the Group, namely a 33.33% shareholding of Motors Inc. Limited and 19.23% of Pender Ville Limited. The results of these companies are accounted for as ‘share of results of associates and jointly controlled entities’ below the operating profit line item. Revenues of United Group Limited are anticipated to drop by 42.5% to €7.43 million largely due to the significant disruptions to the ‘Fashion Retail’ (-43.5% to €4.98 million) and ‘Automotive’ (-43.7% to €1.76 million) operations brought about by the COVID-19 pandemic. EBITDA is expected to decline to €1.06 million compared to €1.78 million in the 2019 financial year which will result in the interest cover dropping to only 0.8 times from 1.4 times in 2019. Total borrowings are expected to increase by 5.1% to €22.2 million whilst the gearing ratio is anticipated to increase to 75.5% and the net debt to EBITDA multiple is forecasted to deteriorate to 20.6 times compared to 11 times for the 2019 financial year. The contribution from associates and jointly-controlled entities is only anticipated to amount to €0.35 million compared to €0.9 million in 2019 and €2.2 million in 2018. Two of the major assets of the United Group are commercial properties with a combined value of €12.5 million. GB Buildings in Ta’ Xbiex is a six-storey building valued at €6 million with a net floor area of 2,510 sqm. GB Buildings is fully leased to third parties, except for one floor which is occupied by the Group. The Pinto Business Centre in Qormi is in the final stages of completion comprising circa 3,400 sqm of office space valued at €6.5 million as at December 2019. The ground and first floors have been leased as from 1 September 2020 for a period of 5 years. The financial forecasts anticipate an uplift of €1.4 million in the value of Pinto Business Centre as at the end of 2020.

The resurgence of COVID-19 cases in recent weeks could lead to fears of renewed disruptions ahead of the important Christmas season for the retail industry. Given the evident impact from the pandemic on these bond issuers, it would be advisable if trading updates are provided to the market in early 2021 to assist investors to gauge how these companies fared during the Christmas season.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.