BOV set for a €150 million capital raise

The title of today’s article may be surprising to many readers of this weekly column given that my previous article on Bank of Valletta plc a few months ago was titled ‘BOV no longer in immediate need of equity injection’. In November 2016, after the publication of the 2015/16 financial statements, I had quoted the Chairman at the time Mr John Cassar White who had indicated in a meeting with financial analysts that a capital raising exercise was unlikely to take place in 2017 and may be postponed into the future. This conclusion may have been arrived at as the bank had registered good progress from a capital perspective with the Tier 1 ratio rising to 12.8% as at 30 September 2016.

However, in his final speech as Chairman of the bank at the Annual General Meeting on 16 December 2016, Mr Cassar White had acknowledged that the bank required a capital injection between €150 and €200 million over the next 3 years. During the last AGM, Mr Cassar White had also made reference to the announcement on 24 November 2016 that the international credit rating agency Fitch Ratings had downgraded BOV to ‘BBB’ from ‘BBB+’. The ex-Chairman had explained to shareholders that the rating downgrade reflected the fact that foreign banks with the same credit rating had better capitalisation ratios than BOV.

It is therefore possibly within this context that in last week’s company announcement in which it disclosed the financial results for the 6-month period to 31 March 2017, BOV confirmed that it is planning to issue €150 million in new share capital “over an approximate one year period”. During last week’s meeting with financial analysts, the new Chairman of BOV Mr Taddeo Scerri explained that this capital raising exercise may be conducted in more than one tranche.

A capital raising exercise is normally conducted via a rights issue which is a new issue of shares to existing shareholders generally at a discount to the market price prevailing at the time. Many banks across Europe have conducted sizeable rights issues over recent months including Unicredit, Deutsche Bank and Credit Suisse. The largest offer was of the Italian bank Unicredit who conducted a €13 billion rights issue earlier this year.

Incidentally, Unicredit is the second largest shareholder in BOV with a stake of 14.55%. Hopefully, Unicredit now have sufficient capital and also an appetite to subscribe to their rights issue entitlement in BOV over the next year. BOV’s largest shareholder is the Government of Malta with a holding of 25.23%. Given BOV’s shareholding structure with two shareholders holding just under 40% of the bank’s issued share capital, one of the key announcements ahead of the final details of the capital raising plans, would be whether these two shareholders would be subscribing to their rights entitlement. Hopefully the rights issue will be supported by the two largest shareholders thereby paving the way for a successful capital raising exercise.

Apart from the mention of the capital raising plans, the main purpose of last week’s announcement was the publication of the interim financial statements as at 31 March 2017. During the first six months of their 2016/17 financial year, BOV registered another record financial performance. Pre-tax profits increased by 8% to €74 million. However, the financial performance was hugely impacted by the reversal of impairments of €5.3 million (compared to a net charge of €8.1 million in the comparative period) and the significant uplift in the value of insurance associates to €8.9 million.

A closer look at the financials reveals that net interest income declined by 3% to €72.7 million as the negative interest rate environment is continuing to hurt those banks, including BOV, with high levels of liquidity. In fact, BOV reported that deposits grew by a further €487 million in the past 6 months to reach €9.7 billion while net lending only increased by €102 million to €4.1 billion. As such, the loan to deposit ratio continued to deteriorate to 42.4% which is very damaging in the current negative interest rate environment.

Profit on foreign exchange activities was relatively unchanged during the first half of the year. Furthermore, BOV generated only €6.3 million in fair value movements as well as net gains on investment securities in contrast to the €17.3 million generated in the comparable period ended 31 March 2016.

On the other hand, however, it is very positive to note that net fee and commission income advanced by 5.8% to €33.8 million. The increase in this line of business is very important for BOV in the current interest rate environment. BOV attributed this improvement to strong performances in the areas of fund management, fund services, stockbroking and bancassurance.

Some other positive indicators that emerged from last week’s financials were the continued improvement in the Tier 1 ratio to 13.1% and the consistent double digit return on equity which is not very common among other Maltese banks as well as institutions across the eurozone.

Apart from the final details of the upcoming rights issue, another important announcement that shareholders should look out for is the overall impact from the implementation of a new financial reporting standard (IFRS 9) dealing with the provisioning policy which was endorsed by the EU on 22 November 2016. I had made reference to this in my last article on BOV in November 2016 and in last week’s announcement it was stated that “the adoption of IFRS 9 may have a material impact on the Bank’s financial statements”. Additionally, BOV stated that “the implementation of this new standard is currently underway and the financial impact is to be determined and disclosed within the financial report ending 2017”. At the last AGM, BOV had announced that it is changing its financial year-end from September to December. As such, the next financial statements will cover a 15-month period to 31 December 2017 and we therefore expect BOV to publish their financials and make this important announcement on IFRS 9 during the first three months of 2018 – similar to the plans of HSBC Malta.

Meanwhile, shareholders will be pleased to note that the interim dividend improved by almost 24% to a net dividend of €0.0293 per share. This is the highest interim dividend distributed by BOV in the past 5 years. Many were surprised that BOV is distributing a dividend while over the next year it will be requesting its shareholders to take up an additional €150 million worth of shares in the Bank. However, in reply to questions from financial analysts, BOV’s CEO Mr Mario Mallia defended the Board’s decision and explained that these two situations may co-exist as it would indeed be very unlikely to see investors take up the new shares if dividends were stopped altogether.

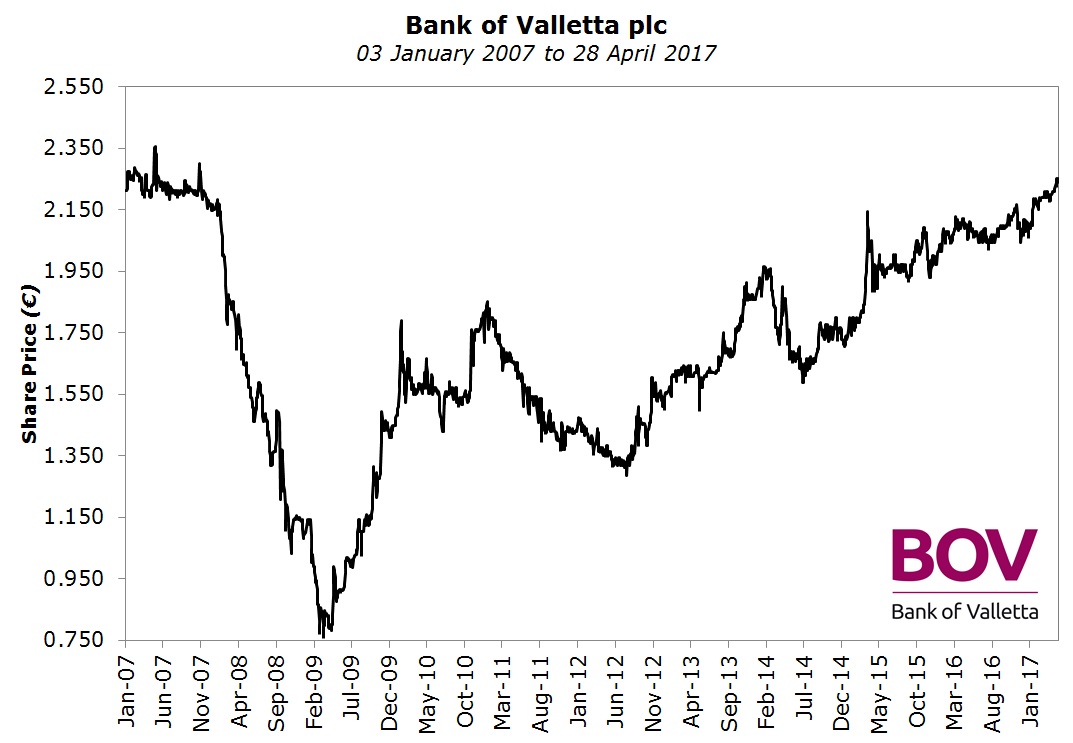

Shareholders should also be pleased with the continuing positive share price performance which touched a high of €2.27 last Friday afternoon following the publication of the financial statements and the declaration of the interim dividend. BOV’s equity is in fact trading at its highest level in over 9 years.

Since BOV is the largest company listed on the MSE, both in terms of market capitalisation at over €900 million and in terms of the number of shareholders at over 20,000, the capital raising plans are likely to be one of the most important highlights across the MSE over the next year.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.