Brighter skies ahead for MIA

Malta International Airport recently published its traffic statistics for the month of May. Passenger movements increased by 8% from the previous month to 554,820. This is the second consecutive month since October 2019 (i.e. four months prior to the outbreak of the COVID-19 pandemic in Europe) that passenger volumes exceeded 500,000. Moreover, the number of passenger movements recorded in May 2022 is only 17.7% below the amount of 674,101 passengers welcomed in the same period in 2019 prior to the onset of the pandemic. Also worth noting is that the seat load factor (representing the occupancy on the planes) of 81.4% during May 2022 was also the highest since October 2019 and even superior to the level of 80.3% recorded in May 2019.

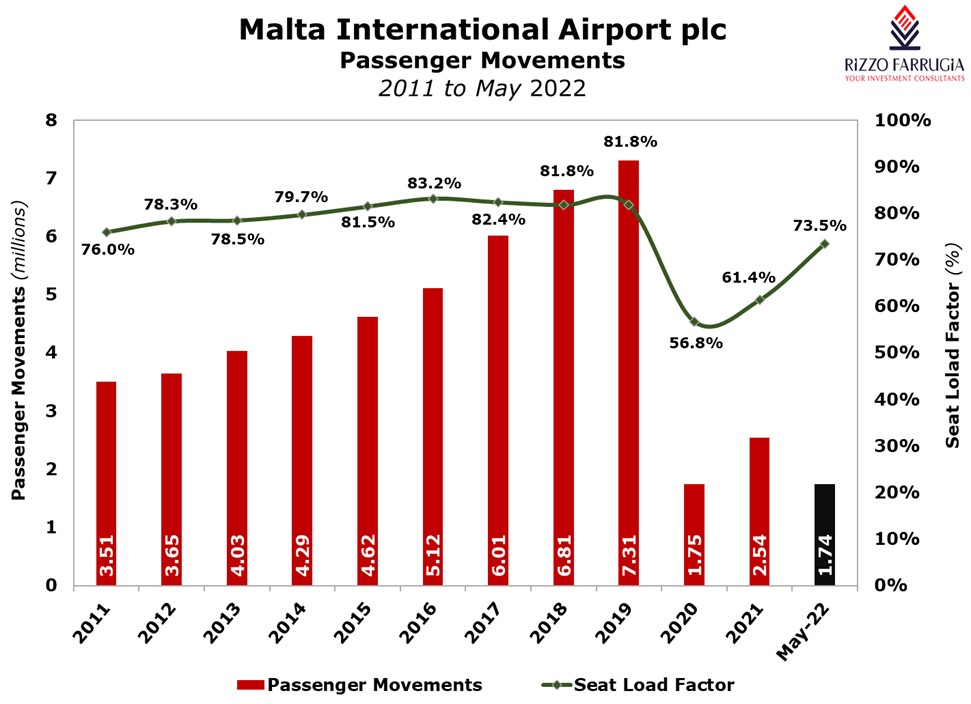

Since the start of 2022, the total number of passenger movements at 1.74 million has now virtually reached the level of traffic recorded in all of 2020. When compared to last year with passenger movements of 2.54 million, the actual traffic during the first 5 months of 2022 accounts for almost 70% of the total traffic registered in 2021.

Despite the very challenging macro-economic conditions and intensifying inflationary pressures, it is very evident that a strong recovery is taking place across the tourism sector as a result of the pent-up demand for travel and the removal of pandemic-related restrictions. This is also evidenced by recent statements from MIA’s two largest carriers, namely Ryanair and AirMalta.

Last week, Ryanair’s Chief Executive revealed that bookings are strengthening with a seat load factor of around 94% in June and continued strong demand and high seat load factors also in the next three months.

Moreover, in a post on social media, AirMalta’s Executive Chairman disclosed that following two very strong months in April and May, the national carrier is expected to register a better performance in June with a seat load factor well-above 90%.

This augurs well for MIA on the assumption that no more pandemic-related lockdowns or major traffic restrictions will recur.

In fact, on 13 June, MIA’s parent company – Flughafen Wien AG (Vienna Airport) – issued a press release to update its traffic and financial forecasts for this year. The Flughafen Wien Group now expects a total of 28 million passengers for the group which includes 22 million at Vienna Airport and the balance of 6 million passenger movements among its two strategic investments – namely Malta Airport and Kosice Airport. This represents a significant upgrade from the forecasts at the start of the year which amounted to 17 million for Vienna Airport and 4 million for their two strategic investments.

On the basis of the updated guidance, one can understand that Flughafen Wien AG are expecting MIA to register overall traffic volumes of above 5 million passenger movements in 2022 which would represent more than twice the traffic registered in 2021.

Given the strong indications provided by MIA’s two largest carriers for the summer months, the airport operator should emulate the recent announcement by its parent company and issue its 2022 traffic and financial guidance similar to what used to be published at the start of each year prior to the pandemic.

This could also coincide with the upcoming publication of the half-year financial report which normally takes place by the end of July.

Prior to the pandemic, MIA had issued regular semi-annual dividends to shareholders ever since its Initial Public Offering in 2002. Following the suspension of dividends over the past two years due to the devastating impact from the pandemic on both the travel industry and the company’s financial performance, MIA took the right measures aimed at preserving its liquidity and maintain financial stability. However, in view of the consistent trend over recent months and clear indications for a strong summer coupled with the continued strength of the company’s financial position with cash balances of €36.5 million as at 31 March 2022, the airport operator should recommence dividend payments to shareholders by declaring an interim dividend for 2022.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.