Changes to Property Portfolios

In recent weeks, the market was informed of two transactions with respect to changes in the property portfolios of two commercial property companies whose equities are listed on the Malta Stock Exchange.

On the one hand, Malta Properties Company plc announced that it successfully concluded the purchase of the HSBC Contact Centre in Swatar while Plaza Centres plc confirmed that it sold its property called Tigné Place in Sliema.

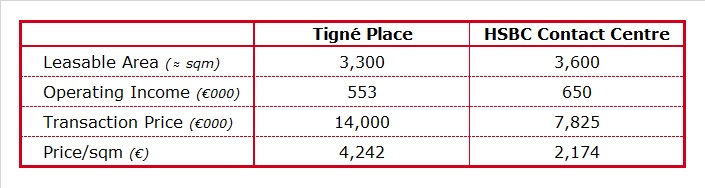

Although both these deals were initially entered into prior to the onset of COVID-19, a comparison of some metrics of these two properties produces some interesting observations and helps investors gain a better understanding of the current status of the commercial property market and also gauge how beneficial these transactions were for each of the two companies.

Malta Properties Company acquired the HSBC Contact Centre in Swatar from HSBC Bank Malta plc for €7.825 million. The acquisition was primarily financed by a bank facility of €6.5 million. The property is subject to a lease agreement in favour of HSBC Global Services (UK) Limited for a remaining fixed term of 3.6 years with an option of renewing the lease for a further two fixed terms of 5 years each. The agreement also stipulates that HSBC UK is committed to invest €1 million to refurbish the property which could indicate that the intention of the tenant is to retain the lease for well-beyond the current agreement which expires in just over three and a half years. This would provide Malta Properties Company with good visibility of the revenue stream arising from the Swatar property from another very high-quality tenant. In fact, it has long been the objective of MPC to reduce the concentration of its overall exposure to its main tenant which is GO plc and this recent acquisition perfectly fits this objective.

In a recent virtual meeting with financial analysts, the CEO of MPC Mr Mohsin Majid indicated that the rental income from the Swatar property acquisition amounts to over €0.65 million per annum with annual increments based on the rate of inflation. Given the indicated rental income to be generated and the acquisition price of €7.825 million disclosed in the recent announcement which excludes taxes and other expenses, one would arrive at an annual rental yield of more than 8%. The rentable area of Swatar amounts to circa 3,600 sqm so the acquisition equates to a value of €2,174 per sqm. The company’s CEO described the Swatar property acquisition as one which was conducted at an attractive valuation with very good financing terms providing a handsome and immediate contribution to cash flows whilst enabling the company to gain exposure to a high-quality tenant.

The CEO of MPC also provided additional details of some other initiatives being undertaken given the status of some of the other properties within the company’s portfolio. The Zejtun exchange is being delivered to its tenant GO plc in mid-2021 and this will represent the start of another new and important long-term revenue stream for MPC. Meanwhile, with respect to the property in Spencer Hill, Marsa, the CEO indicated that the planning application is at an advanced stage. The company is reportedly deliberating whether to proceed with the original intention of a major development subject to finding an anchor tenant beforehand and possibly customising the development to suit the requirements of the tenant, or to seek a lease of the building in its present form subject to a light refurbishment. MPC’s CEO hinted that some discussions for an immediate lease are ongoing with prospective tenants who view the property’s excellent location in very close proximity to Valletta as an important attraction.

Another significant property development project that will be possible to commence as from early 2022 relates to a sizeable plot of land in B’Kara. The CEO explained that this may possibly be mainly designed as a residential project given its location. MPC intends to keep growing its portfolio of properties and it is therefore seeking to conduct further property acquisitions possibly in other sub-sectors of the real estate market and not solely focused on commercial property assets.

While MPC acquired another property to add to its sizeable portfolio, Plaza concluded the sale of one of its two properties for €14 million. Plaza had acquired Tigné Place in Sliema in September 2016 for €9.5 million. A calculation of the rental income that was generated by Tigné Place as well as an indication of the metrics of the recent disposal is possible by reviewing the financial statements published by Plaza Centres plc over recent years. Such a review indicates that in 2019, Tigné Place generated rental income of €0.79 million which translates into a yield of 5.6% based on the transaction price of €14 million. The property has a rentable area of circa 3,300 sqm which equates to a price of €4,242 per sqm.

Plaza booked a handsome profit on this property in a very short period of time following its acquisition in 2016. This helped the company’s net asset value to grow from €0.873 per share in 2015 to €1.129 per share as at 30 June 2020.

Although many investors would be anxious to learn how Plaza will deploy the significant cash now available at its disposal, the company already provided an indication last week as to how it will employ some of these funds. In fact, early last week, Plaza issued its agenda for the upcoming Annual General Meeting due to take place on 14 October 2020 and included an extraordinary resolution related to a share buy-back of a maximum of 10% of the issued share capital (equivalent to 2,824,200 shares) at a price not lower than €0.74 per share and not higher than €1.12 per share. Should the entire share buy-back programme materialise within the stipulated 18-month period, it would represent an outlay of a maximum of €3.16 million at the maximum price of €1.12.

Moreover, in another company announcement also published last week, Plaza explained that following the repurchase of €250,000 of its 3.9% bonds due in 2026, it intends to stand in the secondary market between 25 September and 24 October 2020 with a view of repurchasing up to a further €2 million of its €8.25 million 3.9% bonds at a fixed price of 103.50%. Should both the share buy-back and the bond buy-back be executed in full, the total outlay of the company would just exceed €5.4 million from the overall sale proceeds of €14 million.

The financial metrics of these two recent property deals by MPC and Plaza are also helpful for analysts and investors when reviewing both the financial statements as well as any changes that may take place to the property portfolios of other companies which have bonds listed on the Malta Stock Exchange, such as Exalco Finance plc, whose guarantor Exalco Holdings Ltd, has a portfolio of 6 properties. Meanwhile, Hili Properties plc has a large property portfolio and one which is more diversified both geographically and also across the real estate sector. In fact, only 25.5% of the portfolio of Hili Properties are situated in Malta by value, with the majority located in Latvia (36.3%) and Romania (32.7%). Moreover, a large percentage of the overall portfolio of Hili Properties consists of the various restaurants which are leased to Premier Capital plc, the franchisee of McDonalds. Similar to Hili Properties, Premier Capital is also a subsidiary of Hili Ventures Limited.

COVID-19 had a sharp and immediate negative impact on many sectors of the global as well as the local economy, and it is expected to have a longer-term impact on other sectors including the commercial property sector. It was a widely held view even before the onset of the coronavirus that there was an excess supply of commercial properties being developed in Malta. It will be interesting to monitor any future property transactions as well as trends in rental rates to understand the extent of the impact on the commercial property sector. Industry reports on the subject by the authorities or other associations would help a great deal in providing the necessary data for more detailed assessments on company fundamentals to be carried out by the investing community.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.