Composition of bond market

In my article published two weeks ago dealing with the role of the capital market and highlighting the growth in the Maltese corporate bond market over the years, I also published a chart showing the sectoral composition of the bonds listed on the Regulated Main Market of the Malta Stock Exchange.

Since 2007, the total amount of bonds in issue increased from €486 million to €1,909 million and this strong growth led to a marked change in the overall composition of the bond market.

As a result of the increased participation by numerous investors across the Regulated Main Market and the general need to maintain an adequate diversification of one’s portfolio, an analysis of the composition of the bond market and the largest issuers in Malta could provide interesting information to the general public.

The three most dominant sectors across the corporate bond market are hospitality (accounting for 27% of total bond issuance), real estate (accounting for 25% of total bond issuance) and financial services (accounting for 15% of total bond issuance). These three sectors account for close to 70% of the total bond issuance across the corporate bond market of almost €2 billion.

Within the hospitality sector, International Hotel Investments plc and Corinthia Finance plc (both forming part of the Corinthia Group) account for a total of €265 million of the overall bond issuance in the hospitality sector amounting to €522 million. The other large issuers across the hospitality segment are AX Group and SD Finance with €65 million each in issue, Tumas Investments plc at €50 million and Eden Finance plc at €40 million. The other issuers are Phoenicia Finance Company plc and SP Finance plc.

The overall issuance by the real estate sector at 25% can be sub-divided into two groups, namely those companies whose main business model revolves around property development activities and the commercial property companies whose main objective is to own property for long-term leasing. The commercial property sector is the larger of these two sub-groups with overall issuance at just under €261 million translating into 13.7% of the overall corporate bond market. Until recently, Mediterranean Investments Holding plc (also a member of the Corinthia Group) was the largest issuer with over €71 million in issue. This decreased mildly following the repayment of just under €12 million in bonds on 22 June 2021. The two other bonds of MIH are due to mature over the next two years with €40 million in July 2022 and €20 million in July 2023. Stivala Group Finance plc also has €60 million in issue across two bonds but these are due to mature in 2027 and 2029. The third largest issuer is Hili Properties plc which forms part of the Hili Ventures Group which also includes the other bond issuers 1923 Investments plc, Hili Finance plc and Premier Capital plc.

Within the property development sector which accounts for overall issuance of €204 million (10.7% of the overall bond market), the largest issuer is GAP Group plc with just over €70 million across three separate issues. The company has repeatedly been buying back some bonds from the market following the successful completion of a number of their projects and the sale of the large majority of residential units. Pendergardens Developments plc has a bond of just under €22 million which is due for redemption in just over 12 months and according to the latest information published by the company, it is expected that the sinking funds will amount to €10.6 million by the end of 2021. MIDI plc is another important issuer within the property development sector with a €50 million bond due for redemption in July 2026.

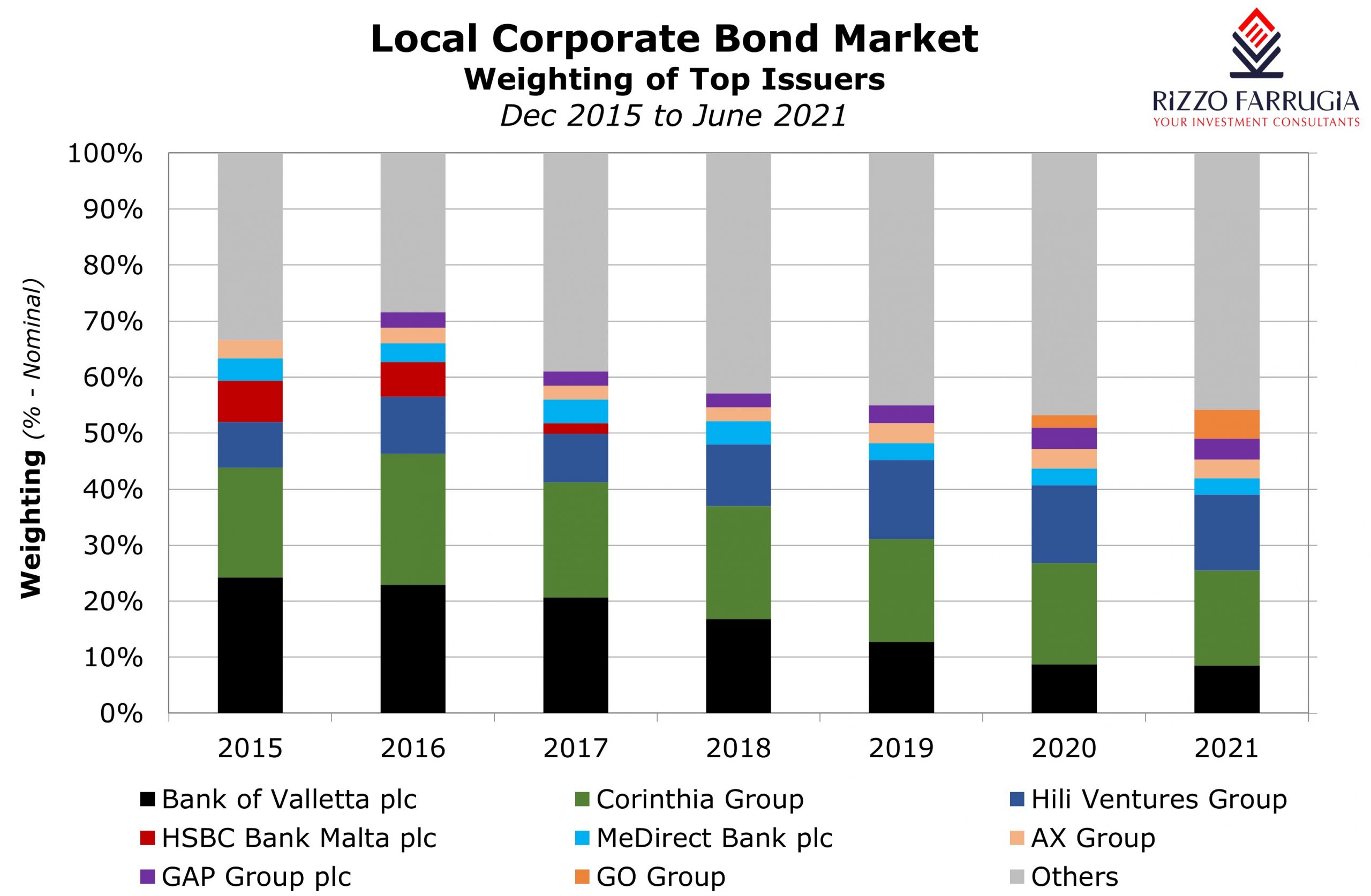

The financial services sector accounts for 15% of the overall bond market issuance with Bank of Valletta plc the largest issuer by far with a total of €161.6 million. APS Bank plc became the second largest issuer following last year’s €55 million subordinated bond issue. It is interesting to note that BOV’s share of overall bond issuance reduced from 24.2% in 2015 to 8.5% in 2021 as a result of the overall growth in the bond market.

Over the past 12 months, the telecommunications industry became a new sector represented across the bond market as Cablenet Communications Systems plc and its parent company GO plc issued a total of €100 million across two bonds.

The growth in the corporate bond market over the years which resulted in a broader selection of names and a reduced dependency on the largest issuers (as illustrated in the graph) should have assisted retail investors to achieve additional diversification across the bond component of their investment portfolio.

Conventional portfolio theory suggests that investors should hold a diversified portfolio of investments across different asset classes (bonds, shares, etc) and securities in order to minimize the overall risk of the portfolio. Moreover, when it comes to investing in bonds, an element of ‘bond laddering’ assists investors to spread their holdings across different maturities, thus mitigating an adverse movement in yields.

However, the overall composition or investment strategy of a portfolio should not be constant over time. As I indicated in last week’s article, I had written about the importance of ‘lifestyling’ of an investment portfolio in order to rebalance an investor’s overall appetite to risk against the investment time horizon. For example, investing too conservatively at a young age with an over-allocation to bonds could pose a risk that the growth rate of the portfolio will not keep pace with inflation. Conversely, if you invest too aggressively in equities at an older age, investors would be exposing their portfolio to excess market volatility which could erode the overall value at an age when you have fewer opportunities to recoup your losses. This was evident in the aftermath of the international financial crisis in 2008/09 and the start of the COVID-19 pandemic in early 2020.

With respect to the amount of diversification to achieve within the individual asset classes (namely in the bond component and also the share component), it is also natural for investors to hold a spread of securities across different sectors and different companies in order to reduce the overall risk and not be overly exposed to a specific sector or a company.

However, there is another school of thought which advocates that too much diversification may be detrimental since it would be harder to research numerous investments. In addition, too much diversification may limit the overall gains in companies or sectors that will be successful. This is most often referred to “diworsification” – a term that has also been used by legendary investors Peter Lynch and Warren Buffett, with the latter even describing diversification as “protection against ignorance”. In this context, certain investors and fund managers prefer to have a more concentrated portfolio with exposures to ‘high conviction’ companies which score highly in terms of financial indicators and prospects.

Placing this debate into the context of the Maltese corporate bond market, one may argue whether the various new bonds issued over the years helped investors diversify into new names and sectors or whether others preferred to maintain higher exposures to some of the larger companies.

In my view, the most important overriding objective should be one where investors take an approach of limiting excess exposure but only adding on to those companies that can demonstrate a strong level of financial soundness. As the pandemic has shown that certain industries can be materially impacted with significant pressures on the financial situation of a company, a proper assessment of the financial soundness of a company remains very important for retail investors.

Given the reportedly strong pipeline of new issuance, retail investors need to keep this firmly in mind. In essence, regardless of the amount of diversification achieved within a portfolio, risk can never be eliminated completely. Investors need to find the right balance between risk and return that achieves their financial goals while feeling comfortable with the strategy being adopted.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.