ECB to begin monetary policy tightening

The European Central Bank announced last week that it will raise interest rates twice in the next four months (July and September) to counteract the bout of inflation which has been aggravated by the war in Ukraine. In fact, consumer price inflation across the euro area hit a fresh record high of 8.1% in May.

The ECB said that it is on course of increasing its main deposit rate by 25-basis points at its next meeting on 21 July, followed by a further uplift in September. Although the central bank noted that the scale of the rate hike in September is dependent on the evolving trajectory of the medium-term inflation outlook, many commentators are already anticipating this rate increase may amount to 50 basis points.

The upcoming intervention by the ECB starting next month would mark its first tightening of monetary policy in over a decade. During last week’s meeting, the ECB also confirmed that as from 1 July it will end its asset purchase programme which was introduced in 2014 to avert potential deflation. While the quantitative easing measures will cease, the central bank will continue to reinvest the proceeds of its €4.9 trillion portfolio of securities as they mature rather than actively sell them with a view of maintaining “ample liquidity conditions”. In essence this means that the ECB is not contemplating any quantitative tightening measures yet.

The ECB also published updated economic forecasts last week anticipating lower economic growth in the euro area of 2.8% in 2022 and 2.1% in 2023, compared to the March forecasts of 3.7% and 2.8% respectively. In contrast, inflation projections were revised upwards to 6.8% in 2022 and 3.5% in 2023, compared to the March forecasts of 5.1% and 2.1% respectively. Inflation is then expected to fall back to 2.1% only in 2024.

The President of the ECB Christine Lagarde explained that further rate rises beyond September 2022 would proceed on a “gradual” path to take the eurozone back into positive interest rates after 11 years of stimulus. The ECB’s deposit rate has stood at minus 0.5% since 2019 and below zero since mid-June 2014.

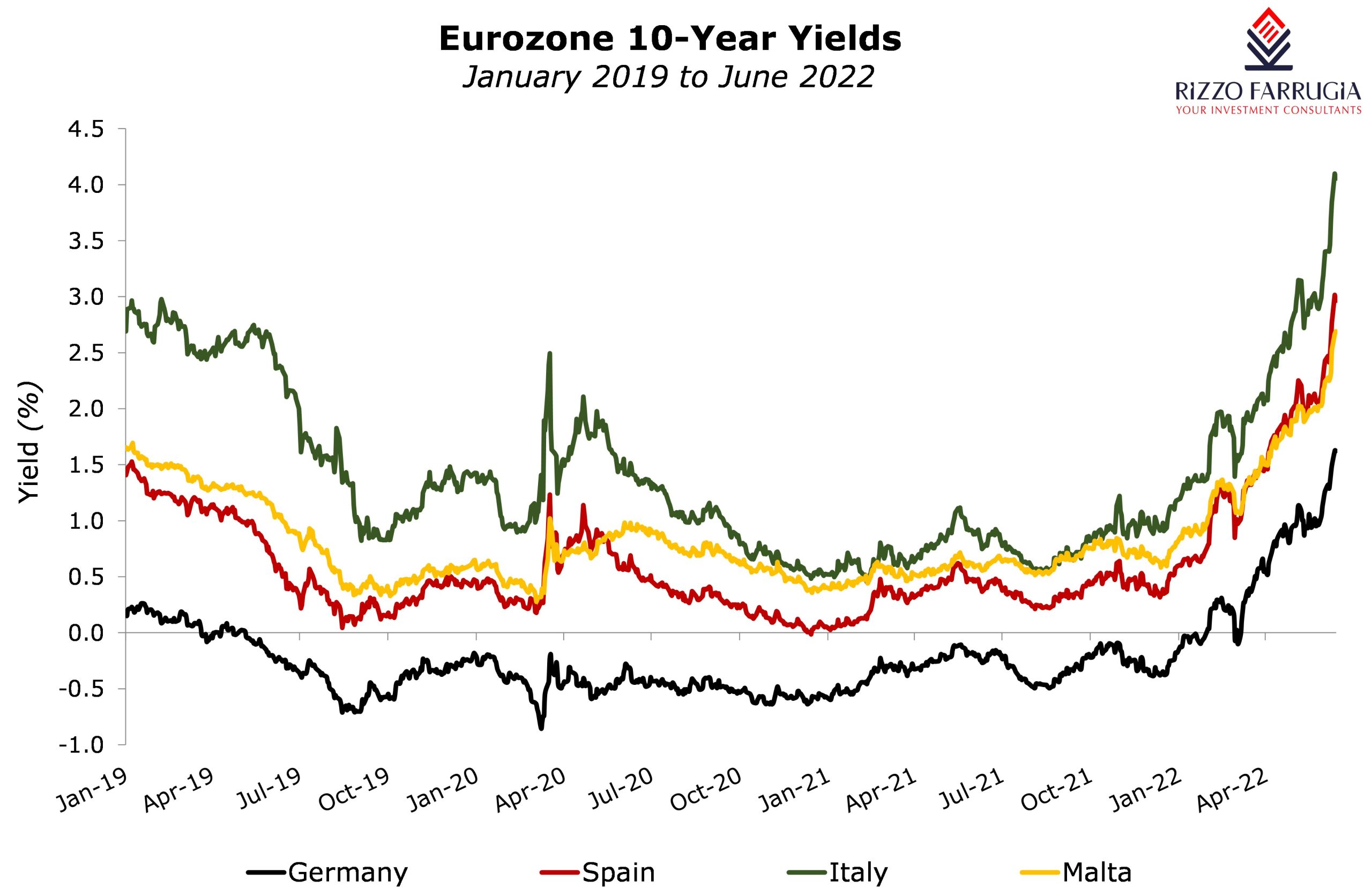

The international bond markets as well as equity markets continued to decline on the news of the persistently high levels of inflation in the eurozone as well as in the US. Germany’s 10-year Bund yield is now at above the 1.65% level (the highest since March 2014) and Italy’s 10-year bond yield surpassed the 4% level. The continued upward momentum in yields across the eurozone bond market led to further sharp declines in the prices of all Malta Government Stocks. All Malta Government Stocks have suffered deep double-digit losses since the start of the year.

The other major central banks have already implemented monetary policy tightening measures in recent months. The US Federal Reserve started raising rates in March 2022 followed by a 50-basis point hike in May, the sharpest uplift in 22 years, with indications of further aggressive increases in the weeks and months ahead.

The Bank of England has hiked rates at four consecutive meetings to take the base interest rate to a 13-year high.

Meanwhile, the already fragile investor sentiment was dented further last week as the World Bank warned that “several years of above-average inflation and below-average growth now seem likely”. The much-feared stagflation (a period of low growth and elevated inflation) is therefore increasingly becoming a plausible outcome.

In view of these very challenging conditions, many investors may be tempted to maintain higher levels of idle cash within their portfolios. However, the recent inflation readings imply negative real returns for idle cash balances.

The performance of equity and bond markets will continue to be mainly dependent on inflation readings in the weeks and months ahead as these will dictate the future direction of the interest rate policies that need to be deployed by the major central banks.

While it is very likely that the world economy is entering a period of lower economic growth and higher inflation, some investment professionals are of the view that inflation may be peaking and more moderate levels of inflation will become evident later on this year. Most of the world’s renowned value investors have regularly remarked that it is almost impossible to accurately predict macro-economic conditions. As such, they encourage investors to build portfolios that can perform well over the long-term. This implies obtaining exposure to profitable companies with healthy balance sheets which are trading at reasonable valuations and also have strong pricing power with the ability of passing on higher costs to consumers.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.