Economic boom ahead?

This time last year most articles from financial commentators understandably delved into the extraordinary circumstances that were unfolding as virtually all economies around the world had grounded to a halt due to the severe restrictions imposed to limit the spread of COVID-19.

Although at the time it was extremely hard to predict the damage to the economy since the duration of the lockdown and the pandemic was unknown, it was evident that some sectors such as tourism and related industries were inevitably the sectors impacted the most. On the other hand, companies operating in ecommerce, digital transformation, automation, online working, and technology were experiencing a surge in demand.

Global economies ended the year suffering one of their worst declines in recent history. The eurozone suffered a decline of 6.6% in GDP, the UK fared worse with a drop of 9.9% while the US economy shrunk by 3.5% after posting a sharp recovery in the later part of the year from the sizeable contraction in GDP in Q2 2020.

Following the doom and gloom amid the surreal and unprecedented circumstances last year, it may be surprising to many that I am writing an article about the possibility of a global economic boom ahead.

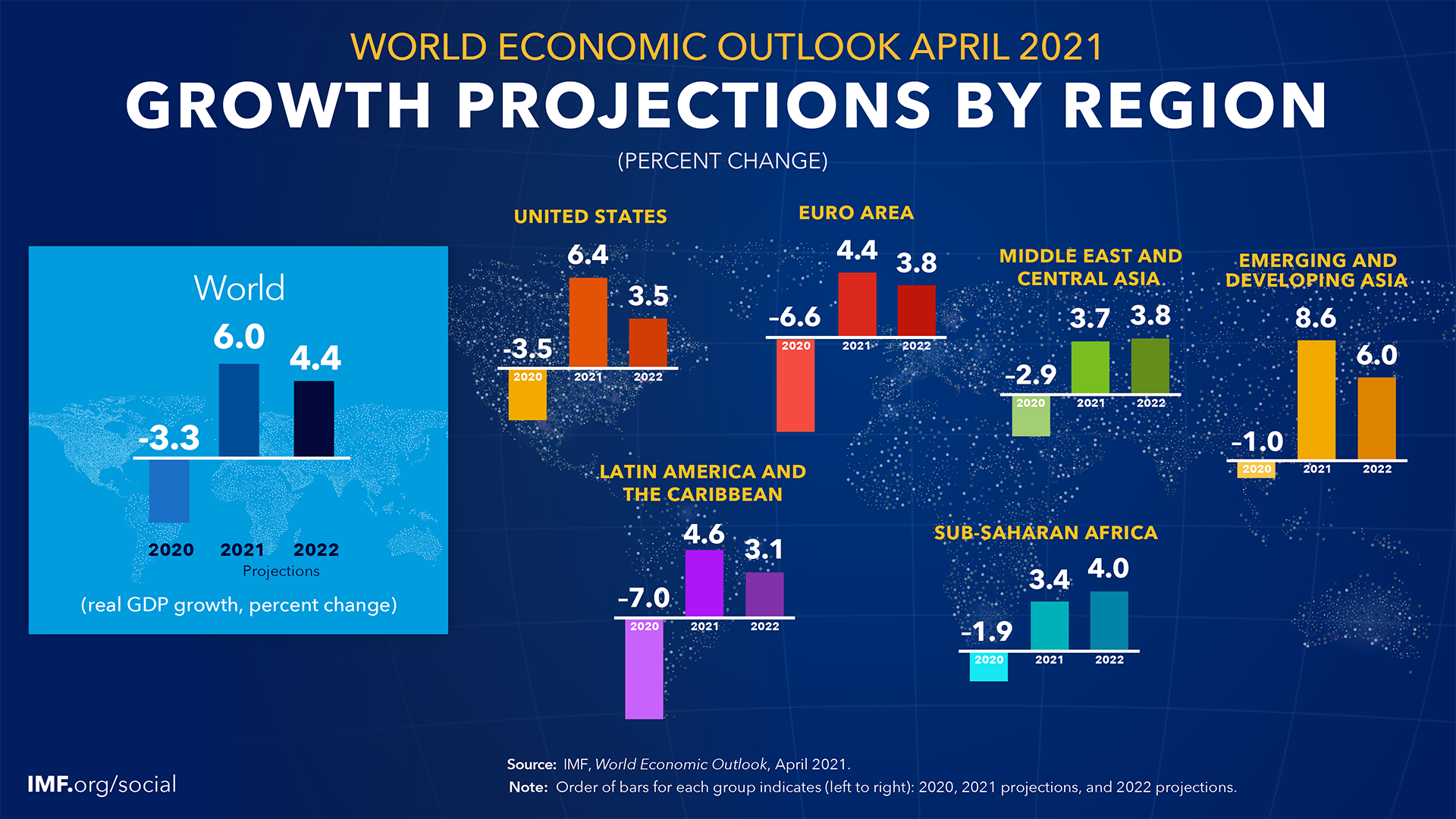

Last week, the International Monetary Fund (IMF) published upgraded economic forecasts for the second time in three months. The IMF is expecting a stronger economic recovery in 2021 than originally anticipated as COVID-19 vaccine rollouts continue to gather momentum. The IMF expects the world economy to grow by 6% in 2021 compared to its January 2021 forecast of 5.5%. This is a remarkable upgrade in such a short period of time.

The IMF also predicted that most advanced countries will emerge largely unscathed from the pandemic from an economic output perspective and in fact it expects the world economy to continue recovering strongly also in 2022 as Gross Domestic Product (“GDP”) is estimated to increase by 4.4% which is marginally higher than an earlier estimate of 4.2%.

This sudden change in the global economic outlook may surprise many analysts and economists. In fact, it is worth recalling that as COVID-19 began spreading around the world in early 2020, the IMF warned of a global economic downturn at par with the Great Depression of the 1930’s. Moreover, only a few months ago (in October 2020), the IMF was warning that the coronavirus pandemic will cause “lasting damage” to living standards across the world with any recovery likely to be “long, uneven and uncertain”.

Instead, the IMF now expects the US economy to grow by 6.4% in 2021. The IMF also indicated that by 2024, the US economy is likely to be bigger than it was before the pandemic. The US Federal Reserve also hiked its GDP forecast for the rest of 2021 in its most recent policy meeting. The central bank now expects US GDP to grow by 6.5% in 2021, compared with its 4.2% forecast during its December meeting. US economic growth forecasts for 2021 and 2022 were revised higher after Congress approved USD1.9 trillion in fiscal spending over and above the USD900 billion package late last year.

Last week’s revised forecasts by the IMF were followed by equally bullish comments by one of the most respected bankers in the US, the Chairman and CEO of JP Morgan Chase & Co. In his very lengthy letter to the bank’s shareholders, Jamie Dimon claimed that he sees strong growth for the world’s biggest economy in the near term, thanks to the government’s strong response to the coronavirus pandemic that has left many consumers flush with savings. Mr Dimon also indicated that the upcoming economic boom “could easily run into 2023”. The Chairman and CEO of JP Morgan also made reference to the valuations across the equity market in his letter to shareholders. Although he acknowledged there was “some froth and speculation” in parts of the market, he then explained that the economic boom predicted for the coming years “may justify current valuations, because markets are pricing in economic growth and excess savings that make their way into equities”.

With respect to the Eurozone which suffered a sharp decline in economic activity in 2020 (-6.6%), the IMF predicts that GDP growth across the single currency area will be 4.4% in 2021 and 3.8% in 2022. Malta is expected to outperform the eurozone. Following the 7% contraction in GDP in 2020 (compared to the previous forecast of a decline of 7.9%), the IMF is now predicting that Malta’s GDP will grow by 4.7% in 2021 and by a further 5.6% in 2022 with the unemployment rate expected to remain at 4.3% in 2021 and to improve to 4.1% in 2022.

As I had explained in my article published towards the end of November 2020 titled ‘Looking beyond COVID-19’, the stockmarket is a forward pricing mechanism and often anticipates the future much earlier than when economic data is published. In fact, the optimistic economic outlook released last week propelled equity markets across the US and some parts in Europe (such as in Germany, the Netherlands and Switzerland) to reach new record highs. The S&P500 index in the US surpassed the 4,000-point level for the first time ever and has now gained 10% since the start of the year. Similarly, the Euro Stoxx 50 added 12% so far in 2021 propelled by the incredible performance of Volkswagen which rallied by more than 50%, as well as the strong uplifts in Daimler (+32%), ASML (+34%) and ING Groep (+35%).

I had concluded the article in November 2020 by stating that “although the next few months will be very tough for people on a personal level due to the need for social distancing and also for companies whose revenues will be depleted due to continued lockdown measures, investors need to look beyond COVID-19 and position their portfolios accordingly”.

While the economic outlook looks surprisingly strong compared to the downbeat assessments last year, one must also highlight the potential risks to such a strong economic recovery. One of the major risks is undoubtedly the spread of variants of COVID-19 and the possibility that existing vaccines do not protect against the new mutations.

Another risk to the recovery could be the potential monetary policy tightening by the major central banks as they would need to respond to the likelihood of higher levels of inflation which would place upward pressure on interest rates across markets. Share prices are generally very sensitive to interest rate levels.

While it is very difficult to predict the way stock markets could perform even with such a strong economic boom ahead, the key takeaway for equity investors remains that of always investing in high quality companies and having a long-term and disciplined approach to investing.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.