Farsons’ vision of a regional beverage player

Simonds Farsons Cisk plc presented its 2018/19 Annual Report to financial analysts on 3 June. Chairman Louis Farrugia, CEO Normal Aquilina and CFO Annemarie Tabone spoke about the factors behind the record financial performance once again, as well as the two key pillars of the Group’s strategy to grow its business further, namely exports and innovation.

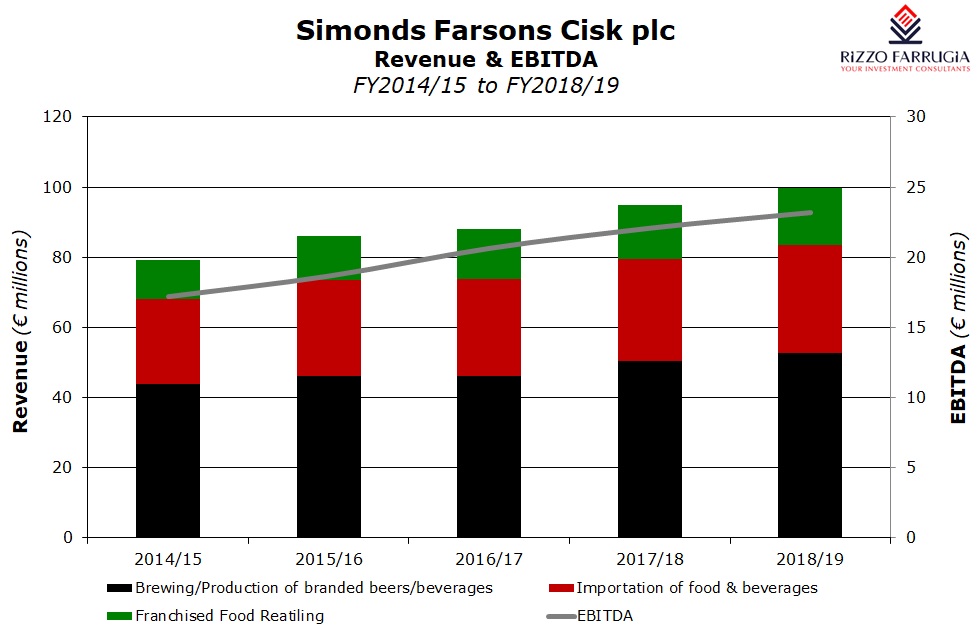

Farsons had published its 2018/19 financial statements on 15 May showing a 5% increase in revenue to just under €100 million, a 5% growth in earnings before interest, tax, depreciation and amortisation (EBITDA) to €23.2 million and a 10% increase in net profits to a fresh record level of €15.1 million. Meanwhile, overall Group net borrowings decreased by €6 million to €33.1 million, resulting in an improved gearing ratio of 23.4% (2017/18: 28.8%) and a net debt to EBITDA multiple of 1.43 times.

For the fourth successive year, Simonds Farsons Cisk generated a return on equity in excess of 10%. The ROE improved to 14.8% during the last financial year compared to 12.5% in the previous year.

The Directors of Farsons are recommending a final net dividend (paid out of tax-exempt profits) of €0.10 per share, representing a 15.4% increase over the final net dividend paid out in respect of the previous financial year (€0.0867 per share). Coupled with the unchanged interim dividend of €0.0333 per share paid out in October 2018, the total net dividend declared in respect of the 2018/19 financial year amounts to €0.1333 per share, representing an 11.1% increase over the total net dividend distributed in the previous comparable period (€0.12 per share) with the dividend payout ratio at 26.4%.

In the presentation to financial analysts, CEO Norman Aquilina hailed the consistency in the Group’s financial performance in recent years and in the Annual Report he explained that “our continued strategic focus on improving our overall operational efficiency together with the ongoing capital investments have allowed the Group to improve its competitive standing”. Various initiatives were undertaken by the Group in recent years to improve its operational processes which led to remarkable efficiency gains. In fact, while Group turnover increased by 26% over the past 5 years, EBITDA grew by 35% showing the benefits of the heavy investments undertaken.

The CEO also mentioned other areas of potential improvement to the manufacturing process which were identified potentially helping to register further growth in profits in future years. Mr Aquilina cited “performance improvements on a number of packaging lines; improved procurement and stock management processes; an improved distribution/customer process; and improved rates of return on 25 and 50 centilitre returnable glass bottles”. Moreover, Mr Aquilina indicated two other fairly significant investments that will be implemented during the current financial year (2019/20) in steam generation boilers and a refrigeration compressor. The CEO is hopeful that these should “achieve additional savings in fuel and electricity consumption”.

Although all companies within the Farsons Group reported an improved performance, the Annual Report confirms that the Cisk portfolio (led by Cisk Lager but including other variants such as Cisk Excel, Cisk Pilsner and Cisk Chill), remains a key determinant to the Group’s overall performance. Mr Aquilina reported that the Cisk product range delivered “another strong set of results”. During the current year, Farsons is celebrating the 90th anniversary since the launch of Cisk in 1929. Within the beer segment, the CEO also highlighted the increasing sales on the local market of the Farsons Classic Brews range (Blue Label, Farsons Double Red, Farsons India Pale Ale and Farsons Gold Label) notwithstanding the ever-increasing competition from craft and specialty beers from all over the world. Mr Aquilina states that “the underlying drivers of the growing craft sector – small scale, local, exclusive, artisanal, flavourful, innovative – suggest that growth is likely to be sustained in the immediate future”.

The vision of the Farsons Group is to grow its business, both domestically and internationally, with the aim to achieve a greater regional presence in the food and beverage sectors. During last week’s presentation, CEO Normal Aquilina highlighted the aim of becoming a “regional beverage player”. The CEO mentioned that although the internationalization strategy of Farsons is centred around their two flagship brands, Cisk and Kinnie, the opportunity is also evident given the long-standing relationships with its principals. In fact, Mr Aquilina announced that Farsons reached an agreement with PepsiCo to export to certain identified markets since PepsiCo is seeking to utilize the space capacity of certain key partners to increase its presence in certain regions. Although the CEO said that this agreement is still in its infancy, “the potential is there”.

With respect to the current export drive, the Annual Report provides a good overview of the progress being achieved. According to the Annual Report, Italy is the largest market and it is therefore “a key area of management focus”. The report also notes “stable beer volume and re-orders” being registered in South Korea and Israel and the entry into Bahrain with Cisk Excel and Blue Label. The CEO reported that following a positive response, “discussions and new product development plans are underway to widen Farsons’ presence in the Middle East, which has a sizeable expat community and lucrative beer market”.

Farsons also exports Kinnie and Mr Aquilina indicated that the franchise operation in Australia registered “another year of profitable growth”. Moreover, Kinnie was reportedly gaining market share in Poland and this market “is expected to show accelerated growth in 2019”. The CEO also mentioned that additional opportunities for Kinnie are being assessed in other countries namely the United Kingdom, Germany, Belgium and Holland.

Meanwhile, Chairman Louis Farrugia explained in the Annual Report that although there are a “growing number of countries to which we export our own brands, this part of our business requires patience and tenacity. There is no quick road to success in exporting to new markets. We are, however, making small but significant in-roads in some markets, which make us all the more motivated to succeed”.

On his part, CEO Norman Aquilina reported that “the export business is fraught with numerous challenges, and our efforts are not always immediately successful. Nevertheless, we persevere in line with our Group’s over-riding growth objectives, encouraged by the progress we have registered thus far”.

Given the Group’s dominant position in the local beer market with a share exceeding 50%, the potential for growing the food importation arm as well as the franchised food business was also mentioned during last week’s meeting. In both areas, Farsons’ market share is very small and the CEO indicated that despite the challenging conditions and intense competition, areas for growth in the food importation arm and the franchised food business are being identified in order to command a better market share.

In view of its obligations as a bond issuer, Farsons will be publishing its updated Financial Analysis Summary by mid-July, i.e. within two months from the publication of its annual financial statements. With respect to the last financial year, Farsons failed to achieve its revenue forecast by €0.9 million but it then surpassed its projections from a profitability aspect. The actual operating profit amounted to €15.3 million compared to the forecast of €14 million. The Annual Report provides an explanation of this by stating that there was a lower depreciation charge to that envisaged due to timing differences in the capital expenditure spend, and a favourable movement in the impairment allowance recognised in the income statement arising from enhanced processes in the management of trade receivables which resulted in a better performance than that achieved in past years.

The share price of Farsons has performed very positively in recent years as investor sentiment towards the company improved following the strong growth in profitability since the 2013/14 financial year. The market capitalisation of the company recently surpassed €300 million despite the spin-off of Trident Estates plc in early 2018 which shows the extent of the added shareholder value generated in recent years. As the share price recently surpassed the absolute price of €10.00, the tick size regime dictates that the minimum tick size for future trades must be of €0.10 as opposed to €0.05 when the equity stood below €9.00. The increase in the tick size could restrict the liquidity in the equity of Farsons even further and as such, the directors of the company should consider a share split to reduce the absolute share price to one which would be considered as being more ‘affordable’ while also leading to a lower tick size.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.