HSBC Malta share price worst performer in 2019

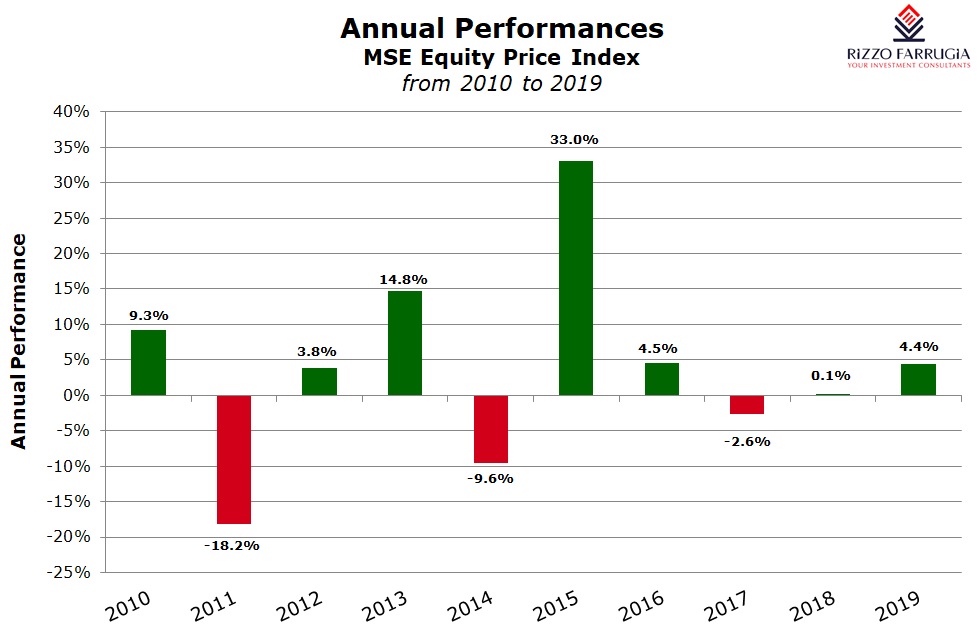

In last week’s article in which I reviewed those companies that registered the strongest returns in 2019, I mentioned that among the 24 equities listed on the Official List of the MSE, there were 12 equities that performed negatively with 7 companies registering declines in excess of 10%.

In this week’s article I will provide details on some of those companies that registered the weakest returns during the course of 2019.

HSBC Bank Malta plc ranks as the worst performing equity during 2019 with a share price decline of 29% to end the year at the €1.30 level after bouncing off its 16-year low of €1.15. The sharp decline in the share price resulted in a contraction in the bank’s market capitalisation of €191 million from €659.4 million at the start of the year to €468.4 million. As a result of this steep decline, HSBC slipped to 4th position in terms of the largest capitalisation companies in Malta and is now only slightly above GO plc at €431.6 million and RS2 Software plc at €412.9 million. Moreover, it is noteworthy to highlight that HSBC Bank Malta plc is the only local equity to have ever exceeded a market capitalisation of €2 billion when the bank’s share price had touched the equivalent of €5.64 in April 2006. Following the publication of the 2019 interim financial statements in August when HSBC Malta reported a net profit of €13.6 million during the first six months of 2019 compared to €14.3 million in H1 2018, the bank issued a further three company announcements in October and November. On 10 October, HSBC Malta announced a new strategic plan aimed at increasing its focus on digital banking services and modernising its branch network in order to mitigate the long-term impact of negative interest rates on its profitability. HSBC explained that this will entail the closure of a number of branches. Moreover, HSBC had also indicated that it will launch a voluntary retirement scheme and the costs attributed to this will be recognised in the 2019 financial results. On 18 November, HSBC confirmed that it was expecting its headcount to reduce by 180 employees as part of the retirement scheme at a cost of €16 million. A few days later, HSBC issued its Interim Directors Statement wherein the bank confirmed that its profitability is higher when compared to the same period in 2018. Another interesting observation is that as a result of the decline in the share price during the course of the year, the equity is now trading at a discount to the net asset value per share of €1.31. HSBC Malta’s share price had traded at a premium to its net asset value for a long number of years.

Although trading activity was very low at only €160,000 worth of shares, the share price of Grand Harbour Marina plc shed 21.4% to an all-time low of €0.55 compared to a record level of €1.15 in 2008. The double-digit decline in the share price materialised during the second half of the year after the company published its 2019 interim results on 30 August showing a 4.2% drop in revenue to €2.03 million (largely reflecting lower demand for super-yacht annual and visitor contracts as well as the corresponding decline in income from utilities) and a 44.3% drop in pre-tax profits to €0.33 million due to the impact of IFRS16 as well as the weaker performances of both marinas. In view of its obligations as a bond issuer, on 27 May 2019 Grand Harbour Marina published its financial projections for 2019 showing an anticipated drop of just over 5% in revenues to €4.48 million and a projected net profit of €0.39 million (-6.4%). The company was also anticipating to end the year with a cash balance of just over €10 million and total borrowings were expected to remain virtually unchanged at €14.7 million. As such, the net debt was anticipated to contract to €4.61 million resulting in a net debt to EBITDA multiple of 2.54 times (compared to 4 times in 2018) and an interest cover of 1.54 times (compared to 2.47 times in 2018).

After ranking as the best performer in 2018 with a share price appreciation of 91.4%, MIDI plc ranked as the third worst performer during 2019 with a decline of 19.4% to end the year at the €0.54 level after trading at a high of €0.72. Most of the decline took place in the final weeks of the year as the political crisis unfolded and after the company announced on 2 December that discussions with Tumas Group Company Limited in connection with the development of Manoel Island ceased by mutual agreement. MIDI had originally issued an announcement to the market on 21 June 2018 that it entered into preliminary discussions with Tumas Group Company Limited to explore the possibility of establishing a joint venture with respect to the development of Manoel Island. At the time of the publication of the 2018 financial statements in April 2019, MIDI had made reference to the approval by the Planning Authority of the revised Masterplan and the revised Outline Permit for the restoration and redevelopment of Manoel Island (which was the subject of an appeal by an NGO) and reiterated that discussions with Tumas Group Company Limited with respect to the development of Manoel Island were still ongoing. In the 2018 Annual Report published ahead of the Annual General Meeting held in June 2019, Chairman Dr Alec Mizzi stated that the parties were exploring a number of alternative opportunities. The Chairman had also remarked that following the approval of the revised Masterplan and Outline Permit for Manoel Island, the company was looking forward “to bring to fruition our vision for a world class development at Manoel Island”.In the Annual Report, CEO Mr Mark Portelli had commented that the development of Manoel Island “will serve as a springboard to unlocking significant shareholder value which we believe exists in this development over the coming years”.

Meanwhile, MIDI plc had also submitted a full development application to the Planning Authority for the final phase of Tigné Point comprising the construction of a residential block of 63 apartments and 4 levels of car parking, the development of a commercial block (circa 2,500 square metre) and the landscaping, paving and embellishment of the so-called Garden Battery and adjoining areas.

The US Dollar denominated equity of FIMBank plc shed 17.4% during the course of 2019 to end the year at the USD0.60 level. The share price was relatively unchanged at USD0.72 prior to the end of the first quarter of the year when the bank published its 2018 financial statements. Although the FIMBank group reported an improvement in its pre-tax profit to almost USD13 million, the share price slid to a low of USD0.59 at the beginning of July possibly as the market was disappointed at the increase in impairments registered during 2018. The share price rallied back up to the USD0.71 level by mid-August but dropped back down to USD0.62 within a few weeks. During the first half of 2019, the FIMBank group reported a pre-tax profit of USD9.65 million (almost 38% higher than the comparable figure of USD7 million) but the Directors stated that the results were below expectations as the bank re-aligned certain businesses towards a more diversified risk strategy.

For the second successive year, the share price of MaltaPost plc registered double-digit declines. In fact, following the drop of 25.5% during 2018 from the record level of €2.12 to €1.58, the share price of the postal operator shed a further 17.1% during 2019 to end the year at the €1.31 level. The company issued an important announcement in June 2019 in which it revealed that it entered into an agreement with APS Bank plc, Atlas Insurance PCC Ltd and GasanMamo Insurance Limited to form a limited liability company which, subject to the relevant regulatory approvals, would be registered as an insurance company to carry out the business of life insurance. MaltaPost said that each of the participating companies will hold 25% of the equity of the proposed new entity and the company also indicated that in due course this development is expected to have a significant positive impact on its prospects. Meanwhile, the 2018/19 annual financial statements to 30 September were published recently showing that MaltaPost registered a 12.9% growth in pre-tax profits to almost €3 million. The Directors recommended an unchanged final net dividend of €0.04 per share.

Bank of Valletta plc also posted double-digit declines for the second successive year. After ranking as the worst performer in 2018, BOV’s share price slipped by a further 12.3% during 2019 to end the year at the €1.06 level which is only marginally above the 10-year low of €1.015 reached on 9 December. Sentiment towards BOV had deteriorated markedly as from mid-2018 once the bank published its interim financial statements showing a €75 million provision for litigation and the suspension of its dividend payments. During the course of 2019, BOV issued numerous company announcements related to the issuance of a new subordinated bond issue of €50 million, the termination of its relationship with its USD correspondent bank and the intention to raise additional Tier 1 Capital by the end of the year which has since been delayed.

Following the declines in the banking equities in recent years, investors will be particularly attentive to upcoming announcements by the various banks to assess how the impact of the de-risking strategies and the negative interest rate environment will continue to impact shareholder returns in the future. Meanwhile, other noteworthy developments expected during 2020 include the upcoming launch of a takeover bid in Medserv plc and news on progress of the sale of the Corinthia Prague by International Hotel Investments plc. It would also be interesting to gauge whether the sudden political crisis that hit Malta since November would impact any primary market offerings. AX Group plc recently indicated that they plan a share offering subject to approval from the relevant authorities to undertake the development of the Verdala Site.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.