Investing during a bear market environment

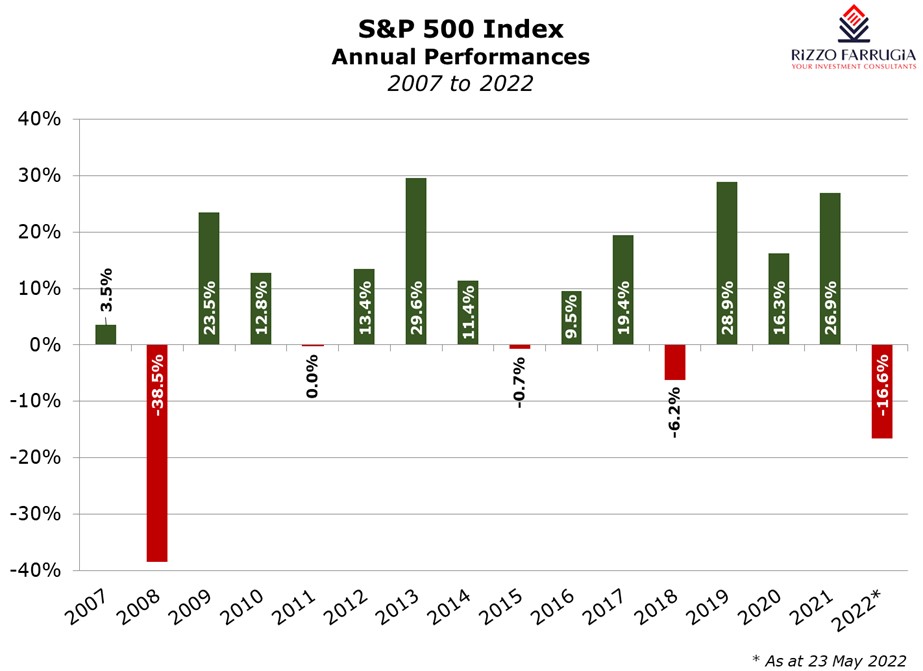

Renewed worries that a recession is imminent triggered another sharp sell-off across major international equity markets last week. The benchmark S&P 500 share index in the US slumped briefly into bear market territory on Friday as it dropped by more than 20% from the record high in January 2022. The S&P 500 index has now registered seven consecutive weeks of declines – a stretch not seen since the dotcom bubble burst in 2001. The Dow Jones Industrial Average has also been on a remarkable downturn in recent weeks as it registered its eighth consecutive week of declines – its longest losing streak since 1932.

The technology-focused NASDAQ index has long been in a bear market as it has now dropped by almost 30% since its high in November 2021. The combined decline in the market cap of the NASDAQ constituents amounted to a total of USD 2.8 trillion.

The decline in equity markets in recent months came about as central banks have started to raise interest rates in order to dampen the soaring inflation levels seen across the world also at a time when governments are also unwinding their COVID-era support measures. Moreover, the war in Ukraine has exacerbated the inflationary environment as this led to a disruption of supply chains and a further hike in commodity prices and agricultural products.

The Chairman of the US Federal Reserve Jerome Powell recently remarked that it will be “challenging” to cut inflation without forcing the US economy into a recession. The Federal Reserve has already implemented two interest rate hikes this year, and the central bank has promised two more hikes of 0.5 percentage points each over the next few months possibly also followed by two to three 0.25 percentage point increases before the end of the year.

This challenging economic environment has led to a remarkable change in investor sentiment which worsened last week following the profit warnings from the large retailers Walmart and Target which are companies that typically do well during periods of economic weakness. Although both firms reported an improvement in revenue levels, their profitability declined as a result of increasing costs and tightening margins reflecting the adverse impact of inflation on operations.

While the equity market downturn earlier this year started mainly in the most speculative assets including cryptocurrencies, last week this became much more broad-based as it also spread to the more profitable and established companies including the mega cap stocks.

To date, some of the most remarkable downturns were evident in most of the high-flying start-ups that went public in recent years such as Robinhood (a decline of 80% from the level at which the retail-trading app went public in July 2021) and Peloton Interactive (a decline of over 90% from the record level in July 2021) which are referred to at times as the ‘COVID-19 darling stocks’ together with Zoom, GameStop and several others.

The prospect of higher interest rates by the world’s major central banks had originally mainly negatively impacted those technology companies and growth stocks whose valuations rely on large profits materialising in the very distant future. Essentially, higher interest rates reduce the present value of a company’s cash flows and profits. The additional risk for investors now is that given the current environment, if inflation does not moderate, central banks are prepared to continue to raise interest rates which in turn places further pressure on the valuation multiples especially of the higher risk technology stocks. This will inevitably result in many investors shunning the more speculative growth stocks and focusing on the quality companies that generate more stable and visible returns.

In view of the extent of the declines across the equity markets this year, some commentators are comparing recent events to the bursting of the dotcom bubble in 2001. However, it may be wrong to compare the current slump across the technology sector to that experienced two decades ago. At the time, most companies did not have healthy balance sheets or sound business models. Although the COVID-19 darling stocks such as Peloton, Zoom, etc may be a good comparison to what happened in 2001, the mega cap technology companies are all cash-rich companies with recurring revenue streams and very profitable indeed.

Nonetheless, the combined market value of the tech titans (namely Alphabet, Amazon, Apple, Meta and Microsoft) still dropped by over 25% since November 2021 despite registering quarterly revenue of USD 359 billion in the first three months of 2022 and USD 69 billion in net profits. Alphabet, Amazon and Microsoft are the three largest providers of cloud computing globally, registering USD43 billion in revenue from cloud computing in the first three months of 2022 representing a growth of 33% from the first quarter last year showing resilience and growth across a core business line.

As the legendary investor Benjamin Graham once said: “Abnormally good or abnormally bad conditions do not last forever”. Indeed, the very loose monetary policy conditions and COVID-19 support that led to the huge upturn in company valuations shortly after the start of the pandemic in the first half of 2020 may have led some investors to stop considering whether a company was profitable or otherwise as one of the main factors had become revenue growth.

Likewise, the current environment where declines in share prices are taking place at times indiscriminately and irrespective of the company’s fundamentals, may not last forever and could present good opportunities for long-term investors.

Companies that are well-established, profitable and have a competitive advantage such as the tech titans are bound to perform substantially better in this current environment than the more speculative ones that are loss-making.

The short-term movements across the equity market are dependent on whether the US economy falls into a recession. A number of market commentators believe that inflation may be peaking and will moderate towards the end of the year which will enable the Federal Reserve to hold back from raising interest rates too fast in order to quell the inflationary pressures. If inflation does indeed moderate, equity markets are bound to start a recovery phase.

In the meantime, the headlines of the market sell-off may be very concerning to many investors. However, long-term investors should remain unfazed by the short-term performance across financial markets and do their best to ride out the volatility by controlling abrupt emotions. The key remains to build a portfolio of companies with a strong competitive advantage that should be able to pass through the inflation and pass on the increased cost for their products to their customers because of their pricing power.

Most renowned investors agree that the best way to deal with inflation remains that of investing in the best quality and best-positioned companies since, as Warren Buffett recently reiterated during the Berkshire Hathaway AGM, it is virtually impossible for anyone to accurately predict the overall macro-economic environment. Essentially, high quality companies are always a good investment since fundamentals never go out of fashion.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.