Looking beyond COVID-19

Over the past few weeks, news from two vaccine developers dominated movements across international financial markets. On Monday 9 November, Pfizer and BioNTech announced that their COVID-19 vaccine was more than 90% effective in preventing the infectious disease. The following Monday, the biotech company Moderna revealed that in a late-stage clinical trial, its coronavirus vaccine was found to be 94.5% effective.

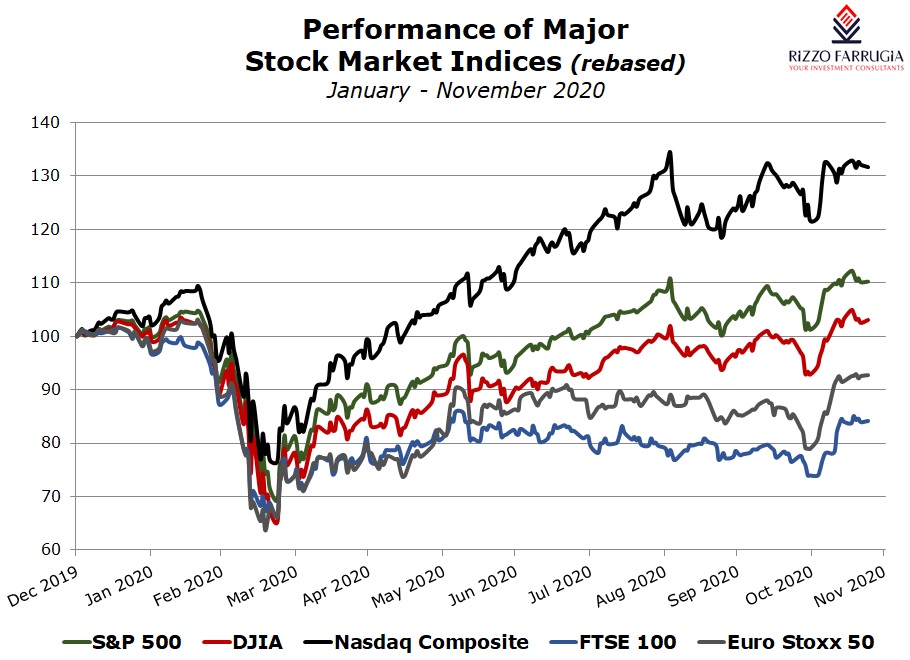

These two announcements fuelled optimism that the pandemic could come to an end sooner rather than later leading to sharp upward movements in the main international stock markets. In fact, the S&P 500 and the Dow Jones Industrial Average added 3.35% and 5.74% respectively in the weeks between Monday 9 November and Monday 16 November. In Europe, the gains were more remarkable as the FTSE 100 and the Euro Stoxx 50 both surged by more than 8%.

Interestingly to note that the tech-heavy Nasdaq Composite index in the US underperformed considerably during the same period as it ‘only’ advanced by 0.24%. The good news of the upcoming vaccines triggered a rotation away from companies that were beneficiaries during the pandemic (such as Zoom Video, Netflix and Peloton to name a few) towards those companies within economically sensitive sectors (cyclical) that stand to benefit the most once life returns to some form of normality once the pandemic is brought under control. The share prices of companies in sectors such as hospitality, airlines, restaurants dropped heavily earlier this year as the World Health Organisation declared COVID-19 as a pandemic and their revenue generation came to an almost abrupt halt.

Although many commentators pointed out the potential difficulties to ensure widespread distribution of the Pfizer/BioNTech vaccine due to the requirement for storage at very low temperatures, Moderna’s vaccine can be stored at much higher temperatures for up to 30 days raising hopes of achieving a more effective distribution globally.

Moderna reported last week that it intends to submit its vaccine for approval by the US Food and Drug Administration ‘in the coming weeks’ raising the prospect that at least two vaccines will be approved before the end of 2020. On 18 November, Pfizer confirmed that the final data analysis shows that its vaccine is 95% effective and on 20 November it submitted an application for emergency use authorisation to the Food and Drug Administration in the US.

It is thus clearly evident that both effective vaccines as well as successful treatments against COVID-19 (from the US companies Regeneron and Eli Lilly) will be available in the following months.

The vaccine developers also indicated a significant ramp-up in production through 2021 which will help achieve widespread distribution starting from mid-2021.

In the meantime, due to the significant spike in COVID-19 cases in most parts of the world and renewed lockdown measures in many countries across the EU and in several states across the US, the near-term economic performance will be very weak once again. However, most international commentators do not expect global economic performance to be as bleak as that experienced during the onset of COVID-19 in Q2 2020.

Financial analysts are claiming that a number of economic indicators (such as in manufacturing, housing and consumer spending) are pointing to the onset of a new upward cycle which is very encouraging and could lead to fresh economic vigour once conditions around the world normalise.

Uncertainty has clearly abated since early November following the outcome of the US Presidential election and the news from two of the many vaccine developers indicating that approval of a vaccine is imminent. Other vaccine candidates are also likely to edge closer to approval with one of the main contenders being AstraZeneca (in tandem with the University of Oxford) that had commenced stage 3 trials several weeks ago. In fact, last Monday, AstraZeneca announced that it achieved positive high-level results from an interim analysis of clinical trials which showed that the vaccine was highly effective in preventing COVID-19, the primary endpoint, and no hospitalisations or severe cases of the disease were reported in participants receiving the vaccine. Moreover, a new fiscal stimulus package in the US can also accelerate the economic recovery in 2021. As a result of all these factors, one of the large investment banks in Europe claimed that the S&P 500 is anticipated to climb by 13% in 2021.

Other commentators believe that the equity markets across the EU and the UK could outperform the S&P 500 due to the lower exposure of technology companies in the EU and UK stockmarkets compared to the S&P 500 which has a weighting of over 25% towards technology companies.

These technology companies saw their share prices rally for most of the year as many benefitted from the ‘stay at home’ trade with the result that most are trading on very high valuation multiples. For example, Apple’s share price rallied by 60% since the start of 2020 (and by 120% since the low for the year recorded on 23 March) pushing its price to earnings multiple to circa 36 times. Likewise, Amazon surged 68% whilst Microsoft climbed by more than 30%.

There were significant movements across international financial markets in recent months as investors digested the previously unimaginable change in circumstances and lifestyles as a result of COVID-19. To cite a few examples, the share price of BMW dropped from €74 in early January 2020 to a low of €36.60 in mid-March but has since doubled and recovered all of the losses incurred in Q1 2020. Likewise, the Spanish company Inditex, which is one of the largest retailers in the world and owner of the hugely popular Zara brand, saw its share price drop by over 30% within a few weeks in Q1 2020 but has since recovered by 35% and is now just 12% below the pre-COVID share price. There was a very similar trend in share prices of most companies within economically sensitive sectors.

Companies in other sectors such as oil and gas, energy, airlines and cruise liner operators have also recovered substantial ground and, in most cases, are well above their lows recorded earlier this year as markets started to anticipate a return to normality.

On the other hand, the share prices of companies that have benefited from people spending more time at home during the pandemic had a stellar performance for most of 2020 which led to a surge in the Nasdaq index in the US and also the S&P 500 due to its high weighting to technology leading to a false belief that most stock markets rallied during the pandemic. The share prices of these companies however are now retreating as investors are seeing light at the end of the tunnel and positioning themselves for a full reopening of the global economy following the encouraging news from the vaccine candidates.

As I had indicated in some previous articles, the mood of Mr Market fluctuates from one extreme to another and when confidence falls share prices generally drop heavily and likewise when sentiment is euphoric, share prices generally rally.

Investors should continue to look at investments in equities from a perspective of owners of businesses. For most companies with the exception of the ‘stay-at-home’ stocks, 2020 will undoubtedly be a bad year from a financial perspective but the pandemic will merely prove to be a temporary hit, albeit with some material repercussions. Over time, as conditions normalise, the profitability of many of these companies will start to recover and subsequently the ability to resume dividend payments to shareholders. The immediate reaction in recent weeks as uncertainty abated indicates that equity markets will continue to price in a gradual economic recovery possibly as from mid-2021. For example, Ryanair last week stated that it aims to deploy airline capacity of between 75% and 80% of its pre-crisis traffic during summer 2021. This could naturally have a strong positive impact across the EU hospitality industry and other sectors dependent on the resumption of air travel.

The stockmarket is a forward pricing mechanism and although the next few months will be very tough for people on a personal level due to the need for social distancing and also for companies whose revenues will be depleted due to continued lockdown measures, investors need to look beyond COVID-19 and position their portfolios accordingly.

As highlighted in the past by a UK financial journalist “perennial pessimism is the easiest way to simulate wisdom about the stock market, but it isn’t the way to make money”.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.