Malita Investments – analysing the COVID-19 impact

Malita Investments plc published its 2019 Annual Report and Financial Statements on 12 March 2020 and held a video conference call with analysts on 27 April.

During 2019, Malita Investments plc generated record aggregated revenues of €8.33 million, representing an increase of 4% over the previous corresponding figure. The increase in revenue was driven by additional ground rent amounting to just under €165,000 from the Valletta Cruise Port (“VCP”) and the project management fees being derived from the Affordable Housing Project with the Housing Authority which are classified as service concession income and costs in accordance with IFRS 12.

The additional ground rent receivable from VCP reflects the increased business at the cruise liner terminal which resulted in a higher percentage of rent payable to Malita than the pre-set minimum annual ground rent. During the video conference call, Chairman Mr Kenneth Farrugia explained that this premium reflected the performance figures of VCP for 2018 and therefore given the record passenger throughput at the cruise liner terminal in 2019, another similar amount is anticipated to be recognised in the 2020 financial statements. Meanwhile, given that passenger traffic has ground to a halt due to the closure of the terminal as a result of COVID-19, no additional premium will be reflected in Malita’s financial statements in 2021.

In essence, Malita Investments has four key assets, namely ownership of the sites of Malta International Airport and Valletta Cruise Port as well as a temporary emphyteusis over the Parliament Building and Open-Air Theatre in Valletta referred to as the City Gate project. In addition, the company is currently undergoing a major project as it is constructing 717 apartments, 574 garages and 146 car spaces across 16 sites in 10 localities as part of the Affordable Housing Project. Mr Farrugia explained that construction works were not particularly impacted by the COVID-19 pandemic but had been halted in early March for a brief period following the tragic collapse of a building which brought all construction works across Malta to an abrupt halt.

The Chairman also indicated that revenue from the Affordable Housing Project will start to be recognised as from 2021 since a total of 157 units are due for completion by end of next year followed by 458 units in 2022 and the balance of 102 units in 2023. Upon completion, Mr Farrugia explained that the Affordable Housing Project will represent a “major revenue stream for Malita”. The company will be entering into commercial agreements with each of the tenants for an initial period of 7 years which can be renewed at the end of the term should the tenants still qualify for affordable housing. When questioned on the credit risk to the company with respect to possible defaults on the payment of leases by tenants, the Chairman clarified that Malita has lots of comfort on its future revenue streams from this project since the subvention from the Government of Malta (ranging from a minimum of 75% of the rent due) to each of the tenants is being transferred directly to the company. As such, Malita will then only be due the remaining balance from each of the tenants which translates into a maximum credit risk exposure of only 25%. Mr Farrugia also argued that the weakening economic dynamics as a result of the pandemic is not a major concern in respect of this project since the persons in need of affordable housing are still very numerous and market dynamics indicate a shortage of supply of residences.

The financial performance of Malita is generally heavily impacted on an annual basis as a result of the recognition of fair value movements on its investment properties. During 2019, the positive fair value movements amounted to €34.6 million compared to €7.7 million in the previous year as the MIA and VCP properties experienced fair value gains of 29.4% to a combined value of €104.1 million whilst the fair value of the Parliament Building and the Open Air Theatre rose by 10.2% to €119.3 million. The fair value of investment properties is calculated with reference to the cash flows receivable by Malita discounted to present value. The discount rate is based on the yield to maturity on the longest dated available Malta Government Stock in issue together with additional premiums reflecting the risks inherent in the underlying cash flows.

The significant downward trend in interest rates since the 2008/09 financial crisis resulted in lower discount rates being applied by Malita which naturally boosted the value of its investment properties. Accordingly, a sustained reversal in interest rates to more ‘normal’ levels in the future will lead to the erosion of these gains which, as at the end of 2019, amounted to €74.5 million net of applicable deferred tax liabilities.

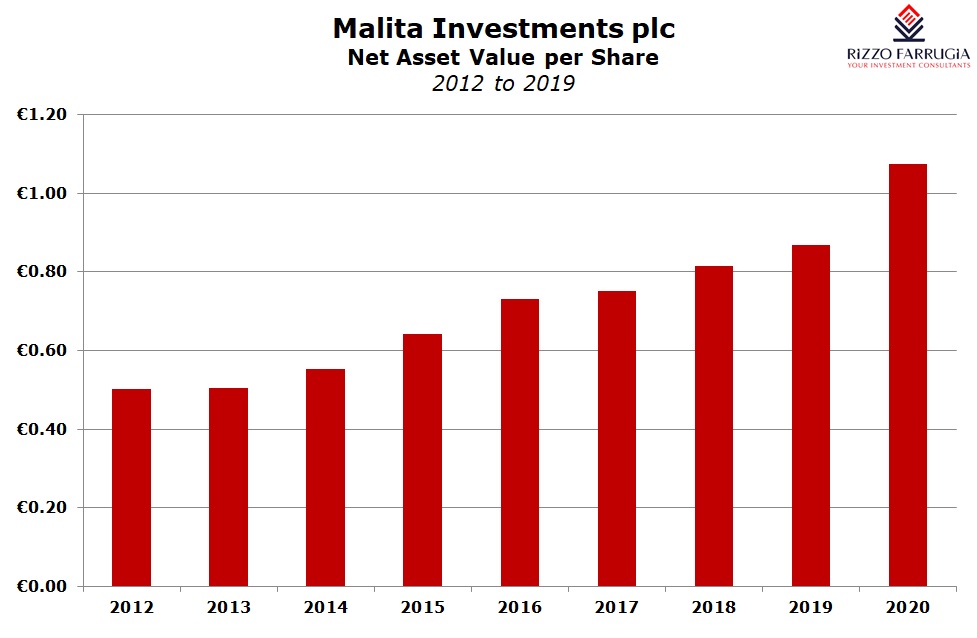

The large fair value movements hugely impact the profitability and also the calculation of the net asset value per share which is a key metric when analysing this investment proposition although the fair value gains accumulated over the years are non-distributable reserves. Total shareholders’ funds including the fair value gains jumped by 23.8% in 2019 to €159 million translating into a net asset value per share of €1.0734 compared to €0.867 per share as at 31 December 2018. Meanwhile, the net asset value per share excluding any fair value gains generated over the years would amount to €0.57. It would be interesting to gauge the impact on the net asset value of the company once the Affordable Housing Project is complete in 2023.

Malita had recommended the payment of a final net dividend of €0.01853 per share when it had published its financial statements on 12 March. In view of the certainty of the cash flows from the rental income streams due from its three tenants, the company further announced on 20 March that it is proceeding with the distribution of the dividend (which was paid earlier this week) notwithstanding the postponement of the Annual General Meeting.

In essence, there is no immediate negative impact of COVID-19 on the revenue generation of Malita. The company will continue to receive ground rent due from its tenants and in 2020 it will also recognise the additional rent from VCP as a result of the record number of passengers in 2019 at the cruise liner terminal. While this largely immaterial figure will not appear in the 2021 financials, Malita will then start to generate additional revenue from the Affordable Housing Project following the completion of the first 157 units. In fact in the same announcement on 20 March, Malita stated that it is constantly monitoring the impact of COVID-19 on its operations, “particularly in relation to how the various measures being implemented by the Government to contain the spread of the virus will impact the progress on the various construction sites forming part of the Housing Project”.

Malita can be classified as a defensive equity. The characteristics of such an equity should be appreciated even more following the very unexpected developments that took place a few months ago which left a marked impact on the revenue generation of most companies. The Maltese capital market needs additional companies with such defensive characteristics to be admitted to the Regulated Main Market to allow investors the ability to continue to diversify their portfolios especially in areas which provide consistent dividend and stable earnings regardless of the state of the overall market or the economy.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.