Malta’s dividend yielding equities

The earnings season for the companies with a December financial year-end came to a close two days ago and it has become customary practice to rank the companies listed on the Regulated Main Market of the Malta Stock Exchange in terms of various investment metrics. Today’s article will deal with the dividend yields of the various companies since it is a primary indicator taken into consideration by many investors.

Although the main objective when investing in equities should be long-term capital appreciation, many companies in Malta have a history of consistent dividend payments and some companies also have a declared dividend policy. This is important for the Maltese investing community given the preference of retail investors for a consistent income distribution from the various securities within their investment portfolios especially at a time of a prolonged very low interest rate environment.

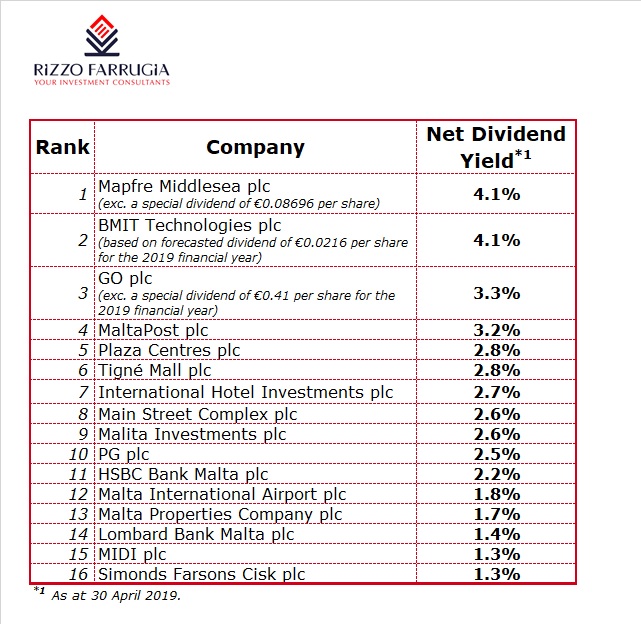

This year’s dividend league table excludes special dividends. By their nature, special dividends are generally one-off events although many would recall the series of annual special dividends distributed by HSBC Bank Malta plc between 2004 and 2007.

However, history did not repeat itself this year and HSBC Malta did not announce another special dividend in respect of the 2018 financial year following the special net dividend of €0.0555 per share declared in February 2018 in respect of the 2017 financial year. Apart from the lack of another special dividend, the ordinary dividend of HSBC Malta declined by 32%, resulting in a significant drop in the ranking in the dividend league table. HSBC Malta’s net dividend yield of 2.2% places it in 11th position among the companies listed on the MSE.

Another reason for excluding the special dividends from the updated league table is due to the fact that two companies (GO plc and Mapfre Middlesea plc) announced large special dividends this year which would distort the resultant yields and ranking and may incorrectly influence some investors in their deliberations.

Notwithstanding the exclusion of the special dividend of €0.08696 per share, Mapfre Middlesea ranks at the top of the league table with a net dividend yield of 4.1% based on the ordinary dividend of €0.0978 per share which is slightly lower than last year’s dividend of €0.1054 per share. It is worth noting again that the dividend cover is below 1 for the second successive year.

GO plc declared a special net dividend of €0.41 per share following the sale of their 49% shareholding in BMIT Technologies plc. Moreover, the telecoms operator also declared an ordinary net dividend of €0.14 per share and the yield of 3.3% in the league table is based on the ordinary dividend. Despite the sizeable special dividend, it is worth noting that the ordinary dividend increased by a further 7.7% for the 2018 financial year following the 18% increase the previous year which may be a signal to the market on the company’s intentions going forward from a dividend perspective despite the lack of a firm dividend policy. The net dividend league table also includes the expected upcoming dividend in the current financial year by the last company that conducted an IPO, namely BMIT Technologies plc. The company declared its dividend policy in the prospectus and gave a firm estimation of the anticipated dividends for 2019.

BMIT Technologies plc had stipulated that dividend distributions are expected to amount to a maximum of 90% of the company’s free cash flow but not exceeding 95% of distributable profits. The dividend is projected to amount to €0.0216 per share in respect of the 2019 financial year, representing a net dividend yield of 4.1% based on the current share price of €0.53 per share. Moreover, in view of the anticipated growth in profits in 2020, BMIT is projecting a net dividend of €0.024 per share (+11.1%) for the 2020 financial year.

Main Street Complex plc had repaid all its borrowings following its IPO in the first half of 2018 and as a result of this it had stated that it will distribute the entire annual net profit in the form of dividends to shareholders on a semi-annual basis. Main Street Complex paid its maiden interim dividend in September 2018 (€0.00628 per share) and a few weeks ago, the company recommended the payment of a final net dividend of €0.00981 per share for approval at the upcoming Annual General Meeting. The total net dividend for the 2018 financial year of €0.01609 per share translates into a net dividend yield of 2.6% based on the current share price of €0.63 per share. Main Street Complex also indicated in its Prospectus that the total net dividend covering the 2019 financial year (payable in October 2019 and May 2020) is anticipated to increase to €0.0218 per share giving a net dividend yield of 3.5%.

The other commercial property companies, Plaza Centres plc and Tigne Mall plc, have identical dividend yields of 2.8%. Both companies continue to report very high occupancy levels which should continue to translate into sustainable dividends to shareholders also in future years.

Many may be surprised at the ranking of MaltaPost plc. Although the company’s dividend has remained static at €0.04 per share since the IPO in 2008, the net dividend yield has improved to 3.2% on account of the sharp decline in the share price in recent months. Despite the difficulties in registering improved financial performances given the regulated nature of their core business, the company has virtually no borrowings which should sustain their dividend stream also in future years.

International Hotel Investments plc had declared an interim dividend of €0.02 per share in June 2018 as the company had indicated in their 2017 Annual Report that they are seeking to commence cash distributions to shareholders on an annual basis whenever permissible. Earlier this week, IHI published its 2018 financial statements and the company announced that it is recommending the payment of an additional net dividend of €0.02 per share translating into a yield of 2.7%.

Another addition to the dividend league table this year is Malta Properties Company plc as it declared its maiden dividend of €0.01 per share for approval by shareholders at the upcoming Annual General Meeting on 11 June. Since the spin-off from GO plc in November 2015, Malta Properties restructured its property portfolio by disposing of some properties and redeveloping others. The company is currently constructing the exchange and data centre in Zejtun which is expected to be completed by the end of 2019. In future years, Malta Properties is expected to redevelop their properties in Marsa and the old Birkirkara exchange. The company had also announced last week that it was in discussions with SmartCity (Dubai) FZ-LLC regarding the possible acquisition of 91% of the shares in SmartCity (Malta).

As I stated in some of my articles in the past, while it is important to rank the historic dividends paid by each of the companies, it is even more important to understand the sustainability of a company’s dividend. Indeed, some companies may be in a position to distribute higher dividends to shareholders in the future or may be required to slash the dividend. Circumstances may differ between the various companies based on regulatory obligations (mainly in the banking sector), capital expenditure plans as well as the extent of leverage on a company’s balance sheet. As such, it is important for investors to understand the different circumstances that may be faced by each of the companies in the future. While the dividend cover is a good indicator since it shows the number of times that profits exceed the dividend payment, other financial metrics may also help such as the net debt to EBITDA multiple. This is an important ratio for certain companies since it gauges the leverage of a company and may assist in understanding the possibility of future dividend hikes especially in the context of possible upcoming capital expenditure requirements.

While certain financial ratios in isolation may be important to track, the wider investment case needs to be considered by investors when contemplating whether it is worth investing additional funds into a specific company. Attending an Annual General Meeting of a company and questioning management on the company’s investment requirements and business strategy going forward would surely help an investor gain a deeper understanding on the wider investment case. With most Annual General Meetings taking place over the next eight weeks, shareholders are urged to attend and pose the right questions to gain a deeper understanding on the future direction of the company.

Print This Page DisclaimerThe article contains public information only and is published solely for informational purposes. It should not be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. No representation or warranty, either expressed or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in this article. Rizzo, Farrugia & Co. (Stockbrokers) Ltd (“Rizzo Farrugia”) is under no obligation to update or keep current the information contained herein. Since the buying and selling of securities by any person is dependent on that person’s financial situation and an assessment of the suitability and appropriateness of the proposed transaction, no person should act upon any recommendation in this article without first obtaining investment advice. Rizzo Farrugia, its directors, the author of this article, other employees or clients may have or have had interests in the securities referred to herein and may at any time make purchases and/or sales in them as principal or agent. Furthermore, Rizzo Farrugia may have or have had a relationship with or may provide or has provided other services of a corporate nature to companies herein mentioned. Stock markets are volatile and subject to fluctuations which cannot be reasonably foreseen. Past performance is not necessarily indicative of future results. Foreign currency rates of exchange may adversely affect the value, price or income of any security mentioned in this article. Neither Rizzo Farrugia, nor any of its directors or employees accepts any liability for any loss or damage arising out of the use of all or any part of this article. Additional information can be made available upon request from Rizzo, Farrugia & Co. (Stockbrokers) Ltd., Airways House, Fourth Floor, High Street, Sliema SLM 1551. Telephone: +356 2258 3000; Email: info@rizzofarrugia.com; Website: www.rizzofarrugia.com © 2021 Rizzo, Farrugia & Co. (Stockbrokers) Ltd. All rights reserved. This article may not be reproduced or redistributed, in whole or in part, without the written permission of Rizzo Farrugia. Moreover, Rizzo Farrugia accepts no liability whatsoever for the actions of third parties in this respect.

This article was produced by Edward Rizzo, Director at Rizzo Farrugia, which is a company licensed to undertake investment services in Malta by the MFSA under the Investment Services Act, Cap. 370 of the Laws of Malta and a member of the Malta Stock Exchange. The company’s registered address is at Airways House, Fourth Floor, High Street, Sliema SLM 1551, Malta.